Albanian Tax Optimization: Albania Tax Planning

Imagine keeping more of what you earn, reinvesting in your business, and securing a brighter financial future. In a world where tax regulations are constantly evolving, navigating the complexities can feel like traversing a labyrinth. But what if there was a guide, a strategy, a way to confidently manage your financial obligations while maximizing your potential?

Many businesses and individuals grapple with the intricacies of the Albanian tax system. They find themselves burdened by high tax rates, struggling to understand complex regulations, and missing out on valuable opportunities to minimize their tax liabilities. The frustration of overpaying taxes and the fear of non-compliance can be overwhelming, hindering growth and financial stability.

Albanian Tax Optimization, or Albanian Tax Planning, is about strategically structuring your financial affairs to legally minimize your tax burden in Albania. It's not about evasion, but about intelligently leveraging available deductions, credits, and incentives within the framework of Albanian tax laws. The aim is to improve your financial bottom line by reducing tax liabilities, freeing up capital for investment, and ensuring compliance with all relevant regulations.

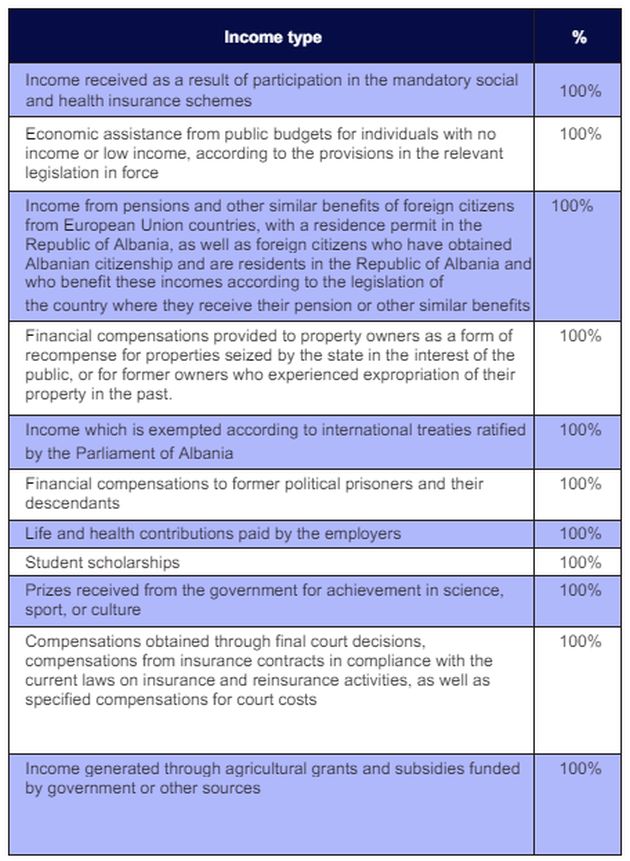

This exploration of Albanian Tax Optimization will cover key aspects of tax planning in Albania, from understanding the current tax landscape to implementing effective strategies for reducing your tax burden. We will delve into specific tax laws, explore available incentives, and uncover practical tips for maximizing your financial well-being while remaining fully compliant. This includes exploring topics such as corporate tax, personal income tax, VAT, and various deductions and exemptions available to businesses and individuals operating in Albania.

The Landscape of Albanian Taxation

The current tax landscape in Albania is constantly evolving. I remember when I first started advising businesses in Albania, the regulations were much less transparent. Finding the right information felt like searching for a needle in a haystack. Now, while there's still room for improvement, there's been a significant push towards greater clarity and accessibility. One of the biggest changes I've seen is the increased focus on digitalization and online filing, which has made the process a bit easier for both businesses and individuals. However, the complexity of the tax code remains a challenge. For instance, understanding the nuances of VAT on different types of transactions can be quite tricky, even for seasoned professionals. Successfully navigating this complexity requires a thorough understanding of Albanian tax laws, along with a keen awareness of how these laws apply to your specific circumstances. Tax optimization in Albania is all about taking advantage of the incentives and deductions that are available to you. For businesses, this might mean strategically structuring your operations to minimize your corporate income tax liability, or taking advantage of investment incentives. For individuals, it could involve maximizing deductions for personal expenses or making smart investments to reduce your tax bill. It's about being proactive and taking a holistic approach to your finances.

What is Albanian Tax Optimization?

Albanian Tax Optimization is not about illegal tax evasion. It's about strategically planning your financial affairs to minimize your tax liability in a way that is both legal and ethical. It involves understanding the intricacies of the Albanian tax code and using that knowledge to your advantage. Think of it like a puzzle: all the pieces (your income, expenses, investments, etc.) are there, and the goal is to arrange them in a way that minimizes the amount of tax you owe. Albanian Tax Optimization involves a multi-faceted approach, starting with a thorough assessment of your current financial situation. This includes analyzing your income streams, expenses, assets, and liabilities to identify potential areas for tax savings. It also involves staying up-to-date on the latest changes to Albanian tax laws and regulations. The Albanian government regularly updates its tax laws, so it's important to stay informed to ensure that you're taking advantage of all available opportunities. Furthermore, tax optimization in Albania isn't a one-size-fits-all solution. What works for one business or individual may not work for another. That's why it's essential to tailor your tax planning strategies to your specific needs and circumstances. This is why it is very important to work with a qualified tax advisor who can help you understand your options and develop a customized plan.

The History and Myths of Albanian Tax Optimization

The concept of tax optimization, while not always called by that name, has likely existed for as long as taxes themselves. In Albania, the modern tax system has evolved considerably since the fall of communism. In the early years of transition, tax laws were often inconsistent and enforcement was weak. This led to widespread tax evasion and a general lack of trust in the system. Over time, however, the Albanian government has made significant strides in strengthening its tax laws and improving enforcement. This has made tax optimization a more legitimate and viable strategy. One common myth about tax optimization is that it's only for the wealthy. While it's true that high-net-worth individuals often have more complex financial affairs that require sophisticated tax planning, tax optimization can benefit anyone who pays taxes in Albania. Another myth is that tax optimization is a risky or unethical activity. As mentioned earlier, tax optimization is perfectly legal and ethical as long as it's done within the bounds of the law. It's about using the tax code to your advantage, not breaking it. It's also important to dispel the myth that tax optimization is a one-time activity. Effective tax planning requires ongoing monitoring and adjustments to reflect changes in your financial situation and changes in the tax laws. It's a continuous process, not a one-off event.

The Hidden Secrets of Albanian Tax Optimization

The "hidden secrets" of Albanian Tax Optimization aren't really secrets at all, but rather overlooked or underutilized strategies. One key area often overlooked is the strategic use of business expenses. Many businesses fail to track and claim all eligible expenses, which can significantly reduce their taxable income. This includes expenses such as travel, entertainment, and home office expenses, provided they meet certain criteria. Another often-overlooked aspect is the strategic use of tax credits and incentives. The Albanian government offers various tax credits and incentives to encourage investment in specific sectors, such as renewable energy, tourism, and agriculture. Businesses that operate in these sectors should carefully review the available incentives to see if they qualify. Additionally, understanding the nuances of transfer pricing is crucial for multinational companies operating in Albania. Transfer pricing refers to the prices charged for transactions between related entities, such as subsidiaries of the same parent company. Setting transfer prices correctly can have a significant impact on a company's overall tax liability. Also, proper record-keeping is the foundation of any successful tax optimization strategy. Maintaining accurate and complete records of all income, expenses, assets, and liabilities is essential for substantiating your tax claims and avoiding potential penalties. Another crucial element is to anticipate future tax liabilities. Proactive tax planning involves forecasting your income and expenses for the coming year and estimating your tax liability. This allows you to make informed decisions about your finances and take steps to minimize your tax bill in advance.

Recommendations for Albanian Tax Optimization

If you're serious about optimizing your taxes in Albania, I highly recommend seeking professional advice from a qualified tax advisor. A good tax advisor can help you understand your specific tax situation, identify potential areas for tax savings, and develop a customized tax plan that meets your needs. They can also help you stay up-to-date on the latest changes to Albanian tax laws and regulations. Another important recommendation is to start planning early. Don't wait until the last minute to think about taxes. The earlier you start planning, the more opportunities you'll have to minimize your tax liability. This includes making sure you have a clear understanding of your income, expenses, assets, and liabilities. In addition to seeking professional advice and starting early, I also recommend educating yourself about Albanian tax laws and regulations. There are many resources available online, including government websites and tax publications. While these resources can be helpful, they should not be used as a substitute for professional advice. In addition, if you own a business, consider incorporating it. Incorporating your business can provide several tax advantages, such as the ability to deduct business expenses and the potential to defer income taxes. However, it's important to carefully consider the pros and cons of incorporation before making a decision. Always be ethical and transparent with your tax planning. Attempting to evade taxes or engaging in illegal activities can have serious consequences, including fines, penalties, and even imprisonment.

The Importance of Staying Compliant

It's vital to remember that tax optimization is about minimizing your tax liability within the boundaries of the law, never crossing the line into tax evasion. Staying compliant with Albanian tax laws is paramount, and any strategy that involves concealing income, falsifying documents, or engaging in other illegal activities is not only unethical but also carries significant legal risks. The Albanian tax authorities are increasingly vigilant in their enforcement efforts, and the penalties for tax evasion can be severe. These penalties can include hefty fines, interest charges, and even criminal prosecution in certain cases. Moreover, tax evasion can damage your reputation and erode trust with customers, suppliers, and other stakeholders. In contrast, tax optimization, when done properly, is a legitimate and ethical way to manage your tax obligations. It involves taking advantage of all available deductions, credits, and incentives to reduce your tax bill while remaining fully compliant with the law. This requires a thorough understanding of Albanian tax laws and regulations, as well as careful planning and execution. In order to do this, it is beneficial to have a trusted financial advisor. They can help you navigate the complexities of the tax system and ensure that you're taking advantage of all available opportunities while remaining fully compliant. Furthermore, staying compliant also involves maintaining accurate and complete records of all your financial transactions. This includes income, expenses, assets, and liabilities. Proper record-keeping is essential for substantiating your tax claims and avoiding potential penalties.

Tips for Effective Albanian Tax Optimization

One of the most effective tips for Albanian Tax Optimization is to keep meticulous records of all your income and expenses. Accurate records are essential for substantiating your tax claims and avoiding potential audits. This includes keeping receipts, invoices, bank statements, and other relevant documents. Another important tip is to take advantage of all available deductions and credits. The Albanian tax code offers a variety of deductions and credits that can help reduce your taxable income. These deductions and credits vary depending on your circumstances, so it's important to carefully review the tax laws to see what you're eligible for. Furthermore, if you're self-employed, consider setting up a retirement plan. Contributions to a retirement plan are often tax-deductible, which can help reduce your tax liability. There are various types of retirement plans available, such as individual retirement accounts (IRAs) and self-employed pension plans (SEPPs). Another tip for effective tax optimization is to manage your investments wisely. The way you invest your money can have a significant impact on your tax liability. Consider investing in tax-advantaged investments, such as municipal bonds, which are often exempt from state and local taxes. Also, be mindful of the tax implications of selling assets, such as stocks or real estate. Finally, consider tax-loss harvesting, which involves selling investments that have lost value to offset capital gains.

Understanding Tax Residency in Albania

Determining your tax residency status is crucial for accurately calculating your tax obligations in Albania. Generally, you are considered a tax resident of Albania if you meet one or more of the following criteria: your permanent home is in Albania, your center of vital interests (economic and personal ties) is in Albania, or you spend more than 183 days in Albania during a calendar year. Tax residents are typically taxed on their worldwide income, while non-residents are only taxed on income sourced from Albania. This distinction can have a significant impact on your tax liability, so it's important to determine your residency status correctly. The concept of "center of vital interests" can be somewhat subjective, but it generally refers to the place where you have the strongest economic and personal connections. This may include your family, your employment, your business, your property, and your social connections. If you have ties to multiple countries, it may be necessary to consider all relevant factors to determine which country is your center of vital interests. In addition, if you move to Albania, be sure to register with the tax authorities and obtain a tax identification number (NIPT). This number is required for filing tax returns and conducting other financial transactions. Furthermore, understand the tax treaties. Albania has tax treaties with many countries, which can help prevent double taxation. These treaties typically specify which country has the right to tax certain types of income, such as dividends, interest, and royalties. If you are a resident of a country that has a tax treaty with Albania, be sure to consult the treaty to see how it affects your tax obligations.

Fun Facts About Albanian Tax Optimization

Did you know that Albania has one of the lowest corporate income tax rates in the region? The standard rate is currently 15%, which can be quite attractive to businesses looking to invest in the country. Also, Albania has a relatively simple VAT system, with a standard rate of 20%. However, there are some exemptions and reduced rates for certain goods and services. Did you know that Albania offers tax incentives for investments in specific sectors, such as tourism, renewable energy, and agriculture? These incentives can include tax holidays, reduced tax rates, and other benefits. And, Albania has a growing network of free economic zones, which offer businesses a range of tax and customs incentives. These zones are designed to attract foreign investment and promote economic development. Also, the Albanian government is working to improve the efficiency and transparency of its tax system. This includes simplifying tax procedures, improving online services, and strengthening enforcement efforts. In addition to all of this, Albania has a relatively young and well-educated workforce, which can be an asset for businesses looking to expand their operations. Finally, Albania is a beautiful country with a rich culture and history, which can make it an attractive place to live and work.

How to Start with Albanian Tax Optimization

Starting with Albanian Tax Optimization doesn't have to be overwhelming. The first step is to gather all your financial documents, including income statements, expense reports, bank statements, and investment records. This will give you a clear picture of your current financial situation. Next, familiarize yourself with the basics of Albanian tax law. You can find information on the Albanian tax authorities' website or in various tax publications. Also, identify potential deductions and credits that you may be eligible for. This will require a thorough review of the tax laws and regulations. Furthermore, consider using tax software or hiring a tax advisor to help you with the process. Tax software can automate many of the calculations and help you identify potential tax savings. A tax advisor can provide personalized advice and guidance based on your specific circumstances. In addition to this, develop a tax plan. This plan should outline your tax goals, strategies, and timelines. It should also be reviewed and updated regularly to reflect changes in your financial situation and changes in the tax laws. Also, keep accurate records of all your financial transactions. This is essential for substantiating your tax claims and avoiding potential audits. Also, be proactive in managing your taxes. Don't wait until the last minute to think about taxes. The earlier you start planning, the more opportunities you'll have to minimize your tax liability.

What If I Don't Do Albanian Tax Optimization?

If you don't engage in Albanian Tax Optimization, you risk overpaying your taxes. This means you're essentially giving away money that could be used for other purposes, such as investing in your business, saving for retirement, or simply improving your quality of life. Another risk of not optimizing your taxes is missing out on valuable deductions and credits. The Albanian tax code offers a variety of deductions and credits that can significantly reduce your tax liability. If you're not aware of these opportunities, you're leaving money on the table. Furthermore, without proper tax planning, you may be more likely to make mistakes on your tax return. This can lead to penalties, interest charges, and even audits. In addition to these risks, failing to optimize your taxes can also limit your financial flexibility. By reducing your tax liability, you free up more capital that can be used for other purposes. This can give you more control over your finances and help you achieve your financial goals. Also, by not planning your taxes, you might be facing increased stress and anxiety about your financial situation. Tax optimization is not just about saving money, it's about gaining control and peace of mind.

Listicle of Albanian Tax Optimization

Here's a listicle of key strategies for Albanian Tax Optimization:

1. Keep meticulous records of all income and expenses.

2. Take advantage of all available deductions and credits.

3. Consider setting up a retirement plan if you're self-employed.

4. Manage your investments wisely.

5. Hire a tax advisor to help you with the process.

6. Develop a tax plan and review it regularly.

7. Be proactive in managing your taxes.

8. Stay up-to-date on the latest changes to Albanian tax laws and regulations.

9. Consider incorporating your business.

10. Be ethical and transparent with your tax planning.

Question and Answer about Albanian Tax Optimization

Q: Is Albanian Tax Optimization the same as tax evasion?

A: No, Albanian Tax Optimization is about legally minimizing your tax liability by taking advantage of available deductions, credits, and incentives. Tax evasion, on the other hand, is illegal and involves concealing income or falsifying documents.

Q: Who can benefit from Albanian Tax Optimization?

A: Anyone who pays taxes in Albania can benefit from tax optimization, including individuals, businesses, and self-employed individuals.

Q: How often should I review my tax plan?

A: You should review your tax plan at least once a year, or more often if there are significant changes in your financial situation or changes in the tax laws.

Q: Do I need a tax advisor to optimize my taxes?

A: While it's possible to optimize your taxes on your own, it's often beneficial to hire a tax advisor. A tax advisor can provide personalized advice and guidance based on your specific circumstances.

Conclusion of Albanian Tax Optimization

Albanian Tax Optimization is not merely about reducing your tax bill; it's about gaining control over your financial future. By understanding the Albanian tax system, utilizing available incentives, and planning strategically, you can maximize your financial resources and achieve your long-term goals. Whether you are a business owner, an investor, or an individual seeking to improve your financial well-being, taking the time to understand and implement effective tax optimization strategies is an investment that will pay dividends for years to come. Remember to prioritize compliance, seek professional guidance when needed, and stay informed about changes in the Albanian tax landscape. By doing so, you can confidently navigate the complexities of taxation and build a more secure and prosperous future.

Post a Comment