Alternative Minimum Tax: AMT Planning and Avoidance

Imagine navigating the complex world of taxes, only to discover there's another layer of calculations you need to consider. This hidden tax system can unexpectedly increase your tax bill, leaving you scratching your head and wondering how to avoid it.

Many taxpayers find themselves blindsided by unexpected tax liabilities. The rules can seem opaque, the calculations complicated, and the potential for errors high. This can lead to significant financial stress and a feeling of being unfairly targeted by the tax system.

This article aims to demystify the Alternative Minimum Tax (AMT), providing you with the knowledge and strategies you need to plan for it and potentially minimize its impact. We'll explore what triggers the AMT, common misconceptions, and effective planning techniques to help you navigate this complex area of taxation.

In this article, we've covered the essentials of the Alternative Minimum Tax (AMT), including its purpose, triggers, common misconceptions, and effective planning strategies. We've discussed deductions, credits, and investment strategies that can help you minimize your AMT liability. By understanding the AMT and implementing proactive planning techniques, you can potentially reduce your tax burden and avoid surprises. Key terms include: Alternative Minimum Tax, AMT exemption, AMT planning, tax deductions, tax credits, investment strategies, tax liability, tax planning.

Navigating AMT Triggers and Exemptions

The Alternative Minimum Tax (AMT) is triggered when your adjusted gross income (AGI) exceeds a certain level and you have certain deductions or credits that reduce your regular tax liability. The goal of understanding AMT triggers and exemptions is to minimize your chances of being subject to it in the first place.

I remember a time when a client came to me completely bewildered. They had always meticulously managed their finances, but they were hit with a substantial AMT bill after exercising stock options. The AMT had essentially clawed back a significant portion of their gains. It was a wake-up call for them, and for me, it underscored the importance of proactively planning for the AMT, especially when dealing with events like stock options, large capital gains, or significant state and local tax deductions.

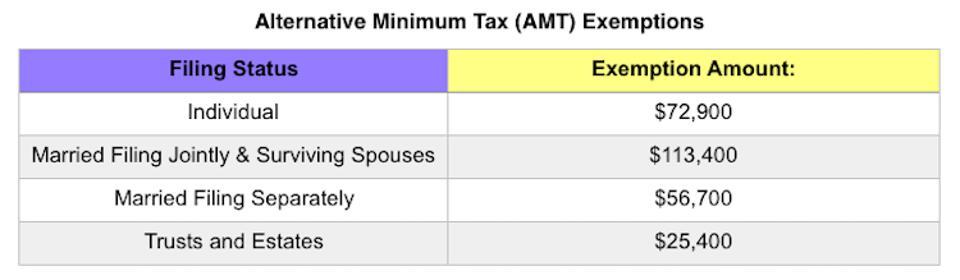

AMT exemptions exist and can shield a portion of your income from the AMT. These exemptions vary based on your filing status and are adjusted annually for inflation. However, the exemption amount phases out as your Alternative Minimum Taxable Income (AMTI) increases. Factors that trigger AMT include high state and local taxes, certain itemized deductions, and incentive stock options. It's important to review your tax situation annually to determine if you are at risk of being subject to the AMT. Understanding the nuances of these triggers and exemptions is the first step toward effective AMT planning. Strategies include maximizing above-the-line deductions, deferring income, and accelerating deductions when appropriate.

Understanding the Alternative Minimum Tax (AMT)

The Alternative Minimum Tax (AMT) is a parallel tax system designed to ensure that high-income earners pay at least a minimum amount of tax, even if they have significant deductions and credits. The purpose of the AMT is to limit the ability of taxpayers to use deductions and credits to eliminate their tax liability.

The AMT calculation involves starting with your regular taxable income and adding back certain deductions and exemptions. This results in your Alternative Minimum Taxable Income (AMTI). You then subtract an exemption amount, which varies based on your filing status, to arrive at your AMT base. This base is then taxed at AMT rates, which are generally lower than regular income tax rates. If your AMT liability exceeds your regular tax liability, you will pay the AMT. Some common items that trigger the AMT include high state and local taxes, private activity bond interest, accelerated depreciation, and incentive stock options. Understanding these items and their impact on your AMTI is essential for effective AMT planning. Strategies include minimizing AMT preference items, deferring income, and accelerating deductions when beneficial.

History and Myths of the Alternative Minimum Tax (AMT)

The Alternative Minimum Tax (AMT) was originally introduced in 1969 to prevent a small number of wealthy individuals from completely avoiding income tax. However, over time, due to inflation and a lack of adjustments, it began to affect more and more middle-class taxpayers.

One common myth is that the AMT only affects the wealthy. While it was initially intended for high-income earners, the lack of inflation adjustments caused it to impact a wider range of taxpayers. Another myth is that AMT planning is too complex to understand. While the calculations can be intricate, understanding the basic principles and working with a qualified tax advisor can make it manageable. The AMT has undergone several revisions throughout its history, with changes to exemption amounts and tax rates. These changes have been aimed at reducing the number of taxpayers subject to the AMT and simplifying the calculation process. The AMT remains a complex area of taxation, and understanding its history and dispelling common myths can help taxpayers better prepare for its potential impact. Strategies include minimizing AMT preference items, deferring income, and accelerating deductions when beneficial.

Hidden Secrets of the Alternative Minimum Tax (AMT)

One of the hidden secrets of the AMT is that it can impact your state tax liability. Because the AMT disallows deductions for state and local taxes, it can increase your federal tax liability, which in turn can increase your state tax liability.

Another hidden secret is that the AMT can affect your investment decisions. Certain investments, such as private activity bonds, can trigger the AMT. Understanding the AMT implications of different investment options is crucial for effective tax planning. Also, the AMT can also create tax credits that can be used in future years. The Minimum Tax Credit (MTC) allows taxpayers to recover some of the AMT they paid in previous years when their regular tax liability exceeds their AMT liability. This credit can be carried forward indefinitely and can provide significant tax savings over time. Understanding these hidden secrets can help taxpayers make informed decisions and minimize their AMT liability. Strategies include minimizing AMT preference items, deferring income, and accelerating deductions when beneficial.

Recommendations for Alternative Minimum Tax (AMT) Planning

One of the most important recommendations for Alternative Minimum Tax (AMT) planning is to start early. Don't wait until the end of the year to assess your AMT situation. By planning proactively throughout the year, you can make informed decisions that minimize your AMT liability.

Another key recommendation is to work with a qualified tax advisor. A tax professional can help you navigate the complex AMT rules and identify opportunities for tax savings. They can also help you develop a customized tax plan that addresses your specific financial situation. It's also important to keep accurate records of your income, deductions, and credits. This will help you prepare your tax return accurately and ensure that you are taking advantage of all available deductions and credits. Finally, it's crucial to stay informed about changes to the tax laws. The AMT rules are subject to change, and staying up-to-date on the latest developments can help you avoid surprises. Strategies include minimizing AMT preference items, deferring income, and accelerating deductions when beneficial.

Common AMT Planning Strategies

One common AMT planning strategy is to minimize your AMT preference items. AMT preference items are deductions and exemptions that are allowed for regular tax purposes but are not allowed for AMT purposes. By minimizing these items, you can reduce your AMTI and potentially avoid the AMT.

Another common strategy is to defer income. By deferring income to future years, you can reduce your current year's AMTI and potentially avoid the AMT. This can be done through strategies such as contributing to retirement accounts or deferring bonuses. It is also possible to accelerate deductions. If you anticipate being subject to the AMT in the current year but not in future years, you may want to accelerate deductions into the current year. This can be done by prepaying expenses or making charitable contributions. Another strategy is to consider the impact of investment decisions on the AMT. Certain investments, such as private activity bonds, can trigger the AMT. Be sure to consider the AMT implications of different investment options when making investment decisions. By implementing these strategies, you can potentially reduce your AMT liability and minimize your overall tax burden.

Tips for Alternative Minimum Tax (AMT) Avoidance

One of the best tips for Alternative Minimum Tax (AMT) avoidance is to maximize your above-the-line deductions. Above-the-line deductions are deductions that you can take before calculating your adjusted gross income (AGI). By maximizing these deductions, you can reduce your AGI and potentially avoid the AMT.

Another tip is to consider the timing of your income and deductions. If you anticipate being subject to the AMT in one year but not in another, you may want to shift income and deductions between years to minimize your overall tax liability. Review your investment portfolio for potential AMT triggers. Certain investments, such as private activity bonds, can trigger the AMT. Be sure to consider the AMT implications of different investment options when making investment decisions. Finally, don't hesitate to seek professional advice. A qualified tax advisor can help you navigate the complex AMT rules and identify opportunities for tax savings. By following these tips, you can potentially avoid the AMT and minimize your overall tax burden.

Understanding AMT Credits and Deductions

One of the key aspects of AMT planning is understanding which credits and deductions are allowed for AMT purposes. Some credits and deductions that are allowed for regular tax purposes may not be allowed for AMT purposes. This can significantly impact your AMT liability.

For example, the standard deduction and personal exemptions are not allowed for AMT purposes. This means that if you take the standard deduction or claim personal exemptions, your AMTI will be higher than your regular taxable income. In addition, certain itemized deductions, such as state and local taxes, are limited or disallowed for AMT purposes. It's important to carefully review the rules for AMT credits and deductions to ensure that you are taking advantage of all available tax savings. You should also factor the impact of certain credits like the child tax credit, the dependent care credit, or education credits can impact your AMT. Failing to account for them can lead to unexpected tax liabilities.

Fun Facts About the Alternative Minimum Tax (AMT)

Did you know that the Alternative Minimum Tax (AMT) was originally intended to affect only a handful of wealthy individuals? However, due to inflation and a lack of adjustments, it began to impact a much larger number of taxpayers.

Another fun fact is that the AMT calculation is actually more complex than the regular income tax calculation. It involves starting with your regular taxable income and adding back certain deductions and exemptions. The AMT has its own set of tax rates and exemption amounts. These rates and amounts are different from the regular income tax rates and amounts. The AMT can create a tax credit that can be used in future years. This credit, known as the Minimum Tax Credit (MTC), allows taxpayers to recover some of the AMT they paid in previous years. The AMT has been the subject of much debate and criticism over the years. Many people argue that it is too complex and unfair. Despite these criticisms, the AMT remains a part of the U.S. tax system. Strategies include minimizing AMT preference items, deferring income, and accelerating deductions when beneficial.

How to Plan for the Alternative Minimum Tax (AMT)

Planning for the Alternative Minimum Tax (AMT) requires a proactive approach. The first step is to estimate your potential AMT liability. This can be done by completing Form 6251, Alternative Minimum Tax – Individuals. This form will help you determine if you are likely to be subject to the AMT.

Once you have estimated your potential AMT liability, you can begin to explore strategies for minimizing its impact. One strategy is to minimize your AMT preference items. These are deductions and exemptions that are allowed for regular tax purposes but are not allowed for AMT purposes. Another strategy is to defer income to future years. This can reduce your current year's AMTI and potentially avoid the AMT. You can also accelerate deductions into the current year if you anticipate being subject to the AMT. A good strategy is to monitor your tax situation throughout the year and make adjustments as needed. This will help you avoid surprises at tax time and ensure that you are taking advantage of all available tax savings. Strategies include minimizing AMT preference items, deferring income, and accelerating deductions when beneficial.

What If You Owe the Alternative Minimum Tax (AMT)?

If you owe the Alternative Minimum Tax (AMT), it's important to understand your options. The first step is to pay the AMT liability in full by the tax filing deadline. Failure to pay on time can result in penalties and interest.

You may be able to reduce your AMT liability in future years by implementing AMT planning strategies. These strategies may include minimizing AMT preference items, deferring income, and accelerating deductions. As mentioned before, you may be able to claim the Minimum Tax Credit (MTC) in future years. The MTC allows you to recover some of the AMT you paid in previous years when your regular tax liability exceeds your AMT liability. If you are unable to pay the AMT liability in full, you may be able to set up a payment plan with the IRS. A payment plan allows you to pay the AMT liability in installments over a period of time. It's important to seek professional advice from a qualified tax advisor if you owe the AMT. A tax advisor can help you understand your options and develop a plan to minimize your AMT liability in future years. Strategies include minimizing AMT preference items, deferring income, and accelerating deductions when beneficial.

Listicle of Alternative Minimum Tax (AMT) Strategies

Here is a list of key strategies for managing the Alternative Minimum Tax (AMT):

1. Minimize AMT preference items: Reduce deductions and exemptions that trigger the AMT.

- Defer income: Postpone income to lower your current AMTI.

- Accelerate deductions: Claim deductions in years you expect to be subject to the AMT.

- Maximize above-the-line deductions: Reduce your AGI to potentially avoid the AMT.

- Time income and deductions strategically: Shift income and deductions between years to minimize your tax liability.

- Review investment portfolio: Assess AMT implications of different investment options.

- Seek professional advice: Consult a tax advisor for personalized guidance.

- Understand AMT credits and deductions: Know which credits and deductions are allowed for AMT purposes.

- Keep accurate records: Maintain detailed records of your income, deductions, and credits.

- Stay informed: Keep up-to-date on changes to the tax laws.

By implementing these strategies, you can potentially reduce your AMT liability and minimize your overall tax burden.

Question and Answer on Alternative Minimum Tax: AMT Planning and Avoidance

Q: What is the Alternative Minimum Tax (AMT)?

A: The Alternative Minimum Tax (AMT) is a parallel tax system designed to ensure that high-income earners pay at least a minimum amount of tax, even if they have significant deductions and credits.

Q: Who is affected by the AMT?

A: The AMT can affect taxpayers with high incomes and certain deductions and credits, such as high state and local taxes, private activity bond interest, and incentive stock options.

Q: How can I plan for the AMT?

A: You can plan for the AMT by estimating your potential AMT liability, minimizing AMT preference items, deferring income, accelerating deductions, and seeking professional advice.

Q: What if I owe the AMT?

A: If you owe the AMT, you should pay the liability in full by the tax filing deadline. You may be able to reduce your AMT liability in future years by implementing AMT planning strategies and claiming the Minimum Tax Credit (MTC).

Conclusion of Alternative Minimum Tax: AMT Planning and Avoidance

Navigating the Alternative Minimum Tax (AMT) can seem daunting, but with a solid understanding of its intricacies and proactive planning, you can minimize its impact on your finances. By staying informed, seeking professional guidance, and implementing effective strategies, you can take control of your tax situation and avoid unnecessary financial burdens. The key is to be proactive, seek expert advice when needed, and stay informed about the ever-changing tax landscape.

Post a Comment