Charitable Remainder Trust: Advanced Tax Planning Strategy

Imagine a way to support your favorite charity, secure a stream of income for yourself or your loved ones, and significantly reduce your tax burden all at once. Sound too good to be true? It's not. A Charitable Remainder Trust (CRT) might be the key to unlocking these benefits and achieving your philanthropic and financial goals.

Many individuals face a challenging dilemma: they want to contribute to causes they believe in, but they also need to ensure their own financial security and plan for the future. Selling appreciated assets can trigger hefty capital gains taxes, diminishing the amount available for both charitable giving and personal financial goals. Navigating the complexities of tax laws and estate planning can also feel overwhelming, leading to missed opportunities and unnecessary financial burdens.

This blog post aims to demystify the Charitable Remainder Trust, explaining how it works, who it benefits, and why it's a powerful tool for advanced tax planning. We'll explore the different types of CRTs, discuss their advantages and disadvantages, and provide practical examples to help you determine if a CRT is right for you.

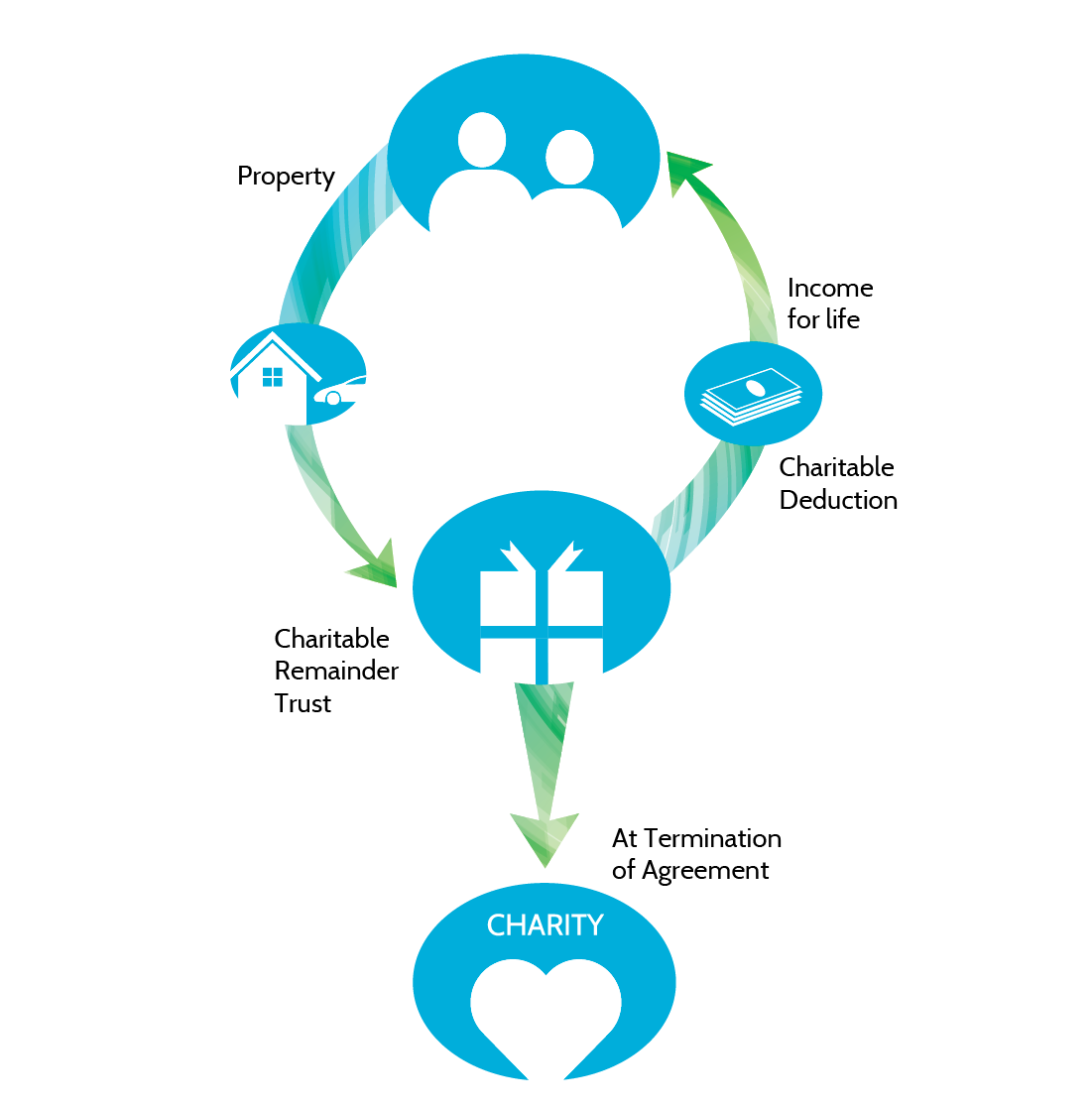

A Charitable Remainder Trust offers a unique blend of philanthropy and financial planning. It allows you to donate assets to a trust, receive income from those assets during your lifetime or a specified term, and ultimately benefit a designated charity. This strategy can provide tax deductions, defer capital gains taxes, and create a lasting legacy. This article explores these aspects, covering topics like CRT types, benefits, potential drawbacks, historical context, and practical tips for implementation.

Understanding the Basics of Charitable Remainder Trusts

My grandfather, a lifelong philanthropist, always struggled with the timing of his donations. He wanted to give generously but was concerned about outliving his savings. He eventually discovered the power of CRTs. A Charitable Remainder Trust is, at its core, an irrevocable trust that allows you to donate assets—such as stocks, bonds, or real estate—while retaining an income stream for yourself or other beneficiaries for a set period or for life. Upon the trust's termination, the remaining assets are transferred to the charity or charities of your choice. The primary motivation for establishing a CRT often revolves around the significant tax advantages it provides. When you contribute assets to a CRT, you are generally entitled to an immediate income tax deduction based on the present value of the charitable remainder interest. This deduction can significantly lower your current tax liability. Furthermore, if you donate appreciated assets, you can avoid paying capital gains taxes on the appreciation at the time of the transfer. This can be particularly beneficial if you have assets that have grown substantially in value. The trust itself is generally tax-exempt, meaning that any income earned by the trust is not subject to current income tax. This allows the assets within the trust to grow more quickly, potentially providing a larger income stream for you or your beneficiaries. The income from a CRT can be structured in a variety of ways, depending on your needs and preferences. You can choose to receive a fixed annual payment (a Charitable Remainder Annuity Trust, or CRAT) or a variable payment based on a percentage of the trust's assets (a Charitable Remainder Unitrust, or CRUT). This flexibility allows you to tailor the CRT to your specific financial situation. Overall, CRTs are a powerful tool for individuals who are both charitably inclined and seeking to optimize their tax planning.

Types of Charitable Remainder Trusts

There are primarily two main types of Charitable Remainder Trusts: the Charitable Remainder Annuity Trust (CRAT) and the Charitable Remainder Unitrust (CRUT). Understanding the differences between these two is crucial for determining which type best suits your individual needs and financial goals. A Charitable Remainder Annuity Trust (CRAT) provides a fixed annual payment to the beneficiary or beneficiaries. This payment remains constant throughout the term of the trust, regardless of the trust's performance. Because the payment is fixed, CRATs offer predictability and stability. This makes them a good choice for individuals who need a reliable income stream. However, CRATs have some limitations. Additional contributions to the trust are not permitted after the initial funding. This means that you cannot add more assets to the trust later on if your financial situation changes. The payout rate of a CRAT must be at least 5% but no more than 50% of the initial fair market value of the assets contributed to the trust. This payout rate is determined when the trust is established and cannot be changed. In contrast, a Charitable Remainder Unitrust (CRUT) provides a variable annual payment to the beneficiary or beneficiaries. This payment is calculated as a fixed percentage of the trust's assets, revalued annually. Because the payment is based on the trust's performance, CRUTs offer the potential for growth. If the trust's assets increase in value, the annual payment will also increase. This makes them a good choice for individuals who are comfortable with some level of risk and who want to potentially receive a higher income stream over time. CRUTs also offer more flexibility than CRATs. Additional contributions to the trust are permitted after the initial funding. This means that you can add more assets to the trust later on if your financial situation changes. There are also several variations of the CRUT, such as the Net Income CRUT (NICRUT) and the Net Income with Makeup CRUT (NIMCRUT). These variations allow for even greater flexibility in structuring the income stream.

The History and Myths Surrounding CRTs

The concept of Charitable Remainder Trusts dates back several decades, evolving alongside tax laws and philanthropic trends. While the basic principles have remained consistent, the specific regulations and applications of CRTs have adapted over time. It's important to understand the historical context to appreciate the current landscape and avoid common misconceptions. CRTs gained significant traction in the mid-20th century as a way for individuals to support charities while also addressing their own financial needs. The establishment of formal tax laws governing CRTs provided a framework for their use and helped to legitimize them as a viable estate planning tool. Over the years, CRTs have become increasingly sophisticated, with various strategies and techniques developed to maximize their benefits. However, this complexity has also led to some misunderstandings. One common myth is that CRTs are only for the wealthy. While CRTs can be particularly advantageous for high-net-worth individuals, they can also be beneficial for those with more modest assets who are looking to make a significant charitable impact. Another myth is that CRTs are complicated and difficult to set up. While it's true that establishing a CRT requires careful planning and attention to detail, working with an experienced attorney or financial advisor can make the process much smoother. Additionally, some people believe that CRTs are primarily tax shelters with little genuine charitable intent. While tax benefits are certainly a key consideration, the underlying purpose of a CRT is to support a charitable cause. In fact, the IRS closely scrutinizes CRTs to ensure that they are structured and operated in accordance with the law. Overall, by understanding the history and debunking the myths surrounding CRTs, individuals can make informed decisions about whether this strategy is right for them.

Unveiling the Hidden Secrets of CRTs

While the basic mechanics of Charitable Remainder Trusts are relatively straightforward, there are several lesser-known strategies and considerations that can significantly enhance their effectiveness. These "hidden secrets" can help you maximize the benefits of a CRT and achieve your philanthropic and financial goals more efficiently. One often overlooked aspect is the selection of the right assets to contribute to the trust. Appreciated assets, such as stocks or real estate that have increased in value, are particularly well-suited for CRTs. By donating these assets, you can avoid paying capital gains taxes on the appreciation, which can free up more funds for both charitable giving and personal income. Another key consideration is the choice of the trustee. The trustee is responsible for managing the trust assets and making distributions to the beneficiaries. It's important to select a trustee who is both knowledgeable and trustworthy. This could be an individual, such as a family member or friend, or a professional trustee, such as a bank or trust company. Furthermore, the timing of the donation can also have a significant impact on the tax benefits of a CRT. Donating assets during a year when you have a high income can help to offset your tax liability. Additionally, you can use a CRT to smooth out your income over time. For example, if you anticipate receiving a large lump sum payment in the future, you can use a CRT to defer some of that income to later years. Finally, it's important to remember that CRTs are irrevocable trusts. This means that once the trust is established, it cannot be changed or terminated. Therefore, it's crucial to carefully consider your goals and objectives before creating a CRT. By understanding these hidden secrets, you can unlock the full potential of a CRT and make a lasting impact on both your own financial well-being and the charitable causes you support.

Expert Recommendations for CRTs

Navigating the world of Charitable Remainder Trusts can feel overwhelming, which is why seeking expert guidance is crucial. Financial advisors, estate planning attorneys, and tax professionals can provide valuable insights and help you make informed decisions about whether a CRT is right for you. One of the most important recommendations is to consult with an experienced attorney who specializes in estate planning and charitable giving. An attorney can help you draft the trust document, ensure that it complies with all applicable laws and regulations, and advise you on the tax implications of creating a CRT. Financial advisors can also play a key role in helping you determine the appropriate assets to contribute to the trust and in managing the trust assets to maximize their growth potential. They can also help you assess your financial needs and determine the optimal payout rate for the trust. Tax professionals can provide guidance on the tax benefits of a CRT and help you plan your donations to minimize your tax liability. They can also help you navigate the complex rules and regulations governing CRTs. In addition to seeking professional advice, it's also important to do your own research and learn as much as you can about CRTs. There are many resources available online and in libraries that can help you understand the basics of CRTs and the various strategies that can be used to enhance their effectiveness. Ultimately, the decision of whether or not to create a CRT is a personal one that should be based on your individual circumstances and goals. However, by seeking expert guidance and doing your own research, you can make an informed decision and ensure that you are using a CRT in the most effective way possible.

Choosing the Right Assets for Your CRT

Selecting the right assets to fund your Charitable Remainder Trust is a critical step that can significantly impact its performance and tax benefits. The ideal assets are typically those that have appreciated substantially in value, such as stocks, bonds, or real estate. When you donate these assets to a CRT, you can avoid paying capital gains taxes on the appreciation, which can free up more funds for both charitable giving and personal income. In addition to avoiding capital gains taxes, donating appreciated assets can also provide a larger income tax deduction. The amount of the deduction is based on the fair market value of the assets at the time of the donation, not the original cost basis. This means that you can deduct the full value of the assets, even though you never paid taxes on the appreciation. However, it's important to note that there are limitations on the amount of the deduction you can take in any given year. The deduction is generally limited to 50% of your adjusted gross income (AGI) for contributions of cash and ordinary income property, and 30% of your AGI for contributions of capital gain property. Any excess deduction can be carried forward for up to five years. While appreciated assets are generally the best choice for funding a CRT, there are some situations where other types of assets may be more appropriate. For example, if you have assets that are generating a low rate of return, such as cash or money market funds, you may want to consider donating those assets to a CRT. The CRT can then reinvest those assets in higher-yielding investments, which can potentially increase the income stream for you or your beneficiaries. Ultimately, the best assets to fund your CRT will depend on your individual circumstances and goals. However, by carefully considering your options and seeking expert advice, you can make informed decisions that will maximize the benefits of your CRT.

Practical Tips for Implementing a CRT

Successfully implementing a Charitable Remainder Trust requires careful planning and attention to detail. Here are some practical tips to help you navigate the process and ensure that your CRT achieves its intended goals. First, start by clearly defining your charitable goals and financial objectives. What charities do you want to support, and what level of income do you need from the trust? Answering these questions will help you determine the appropriate type of CRT and the optimal payout rate. Next, work with an experienced attorney to draft the trust document. The trust document is the legal foundation of your CRT, so it's essential to ensure that it is properly drafted and complies with all applicable laws and regulations. Your attorney can also advise you on the tax implications of creating a CRT and help you structure the trust in a way that minimizes your tax liability. Once the trust document is drafted, you'll need to select a trustee. The trustee is responsible for managing the trust assets and making distributions to the beneficiaries. You can choose an individual, such as a family member or friend, or a professional trustee, such as a bank or trust company. When selecting a trustee, it's important to consider their experience, knowledge, and trustworthiness. After the trustee is selected, you'll need to transfer the assets to the trust. This may involve retitling ownership of the assets or executing other legal documents. Be sure to follow all the necessary steps to ensure that the transfer is properly documented and legally valid. Finally, it's important to monitor the performance of the trust and make adjustments as needed. The trustee should provide you with regular reports on the trust's assets, income, and expenses. You should also review the trust document periodically to ensure that it still meets your needs and objectives. By following these practical tips, you can successfully implement a CRT and achieve your philanthropic and financial goals.

Common Mistakes to Avoid with CRTs

While Charitable Remainder Trusts offer numerous benefits, they also come with potential pitfalls. Avoiding these common mistakes is crucial for ensuring that your CRT operates smoothly and achieves its intended goals. One of the most common mistakes is failing to properly value the assets contributed to the trust. The value of the assets is used to calculate the income tax deduction and the annual payout amount, so it's essential to get it right. If the assets are overvalued, the IRS may disallow the deduction or impose penalties. Another common mistake is failing to comply with the rules and regulations governing CRTs. The IRS closely scrutinizes CRTs to ensure that they are structured and operated in accordance with the law. Failure to comply with the rules can result in the loss of tax benefits or even the termination of the trust. Another mistake is choosing the wrong type of CRT for your needs. As mentioned earlier, there are two main types of CRTs: CRATs and CRUTs. Each type has its own advantages and disadvantages, and the best choice will depend on your individual circumstances and goals. Another common mistake is failing to properly manage the trust assets. The trustee is responsible for managing the trust assets in a prudent and responsible manner. This includes making appropriate investments, diversifying the portfolio, and monitoring the performance of the assets. Finally, another mistake is failing to review the trust document periodically. The trust document is the legal foundation of your CRT, so it's essential to ensure that it still meets your needs and objectives. As your financial situation or charitable goals change, you may need to amend the trust document to reflect those changes. By avoiding these common mistakes, you can ensure that your CRT operates smoothly and achieves its intended goals.

Fun Facts About Charitable Remainder Trusts

Did you know that Charitable Remainder Trusts have been used by some of the world's most famous philanthropists? These sophisticated estate planning tools aren't just for the ultra-wealthy, but they certainly have a track record of success in the hands of those who understand their potential. One fun fact is that CRTs can be used to support a wide variety of charitable causes, from education and healthcare to environmental protection and animal welfare. You're not limited to a specific type of charity; you can choose any organization that is recognized by the IRS as a 501(c)(3) public charity. Another interesting fact is that CRTs can be structured to provide income to multiple beneficiaries. This can be a valuable tool for providing for your spouse, children, or other loved ones while also supporting your favorite charities. For example, you could set up a CRT that provides income to your spouse for their lifetime, and then distributes the remaining assets to your chosen charity upon their death. It's also worth noting that CRTs can be used to diversify your investment portfolio. By donating appreciated assets to a CRT, you can avoid paying capital gains taxes and then reinvest the proceeds in a more diversified portfolio. This can help to reduce your overall risk and potentially increase your long-term returns. Finally, one of the most fascinating aspects of CRTs is their ability to create a lasting legacy. By supporting your favorite charities through a CRT, you can ensure that your values and beliefs continue to make a difference in the world long after you're gone. This can be a powerful way to leave a lasting impact and make a meaningful contribution to society.

How to Establish a Charitable Remainder Trust

Setting up a Charitable Remainder Trust involves several key steps. First, you'll need to determine your charitable goals and financial objectives. Which charities do you want to support, and what level of income do you need from the trust? Answering these questions will help you determine the appropriate type of CRT and the optimal payout rate. Next, you'll need to work with an experienced attorney to draft the trust document. The trust document is the legal foundation of your CRT, so it's essential to ensure that it is properly drafted and complies with all applicable laws and regulations. Your attorney can also advise you on the tax implications of creating a CRT and help you structure the trust in a way that minimizes your tax liability. Once the trust document is drafted, you'll need to select a trustee. The trustee is responsible for managing the trust assets and making distributions to the beneficiaries. You can choose an individual, such as a family member or friend, or a professional trustee, such as a bank or trust company. When selecting a trustee, it's important to consider their experience, knowledge, and trustworthiness. After the trustee is selected, you'll need to transfer the assets to the trust. This may involve retitling ownership of the assets or executing other legal documents. Be sure to follow all the necessary steps to ensure that the transfer is properly documented and legally valid. Finally, you'll need to obtain a tax identification number for the trust from the IRS. This number will be used to report the trust's income and expenses to the IRS. By following these steps, you can successfully establish a CRT and begin enjoying its many benefits.

What If Scenarios with Charitable Remainder Trusts

Let's consider some "what if" scenarios to further illustrate the flexibility and potential impact of Charitable Remainder Trusts. What if you have a large, illiquid asset, such as real estate, that you want to donate to charity but don't want to sell and incur capital gains taxes? A CRT can be an ideal solution. You can donate the real estate to the trust, avoid the capital gains taxes, and receive an income stream based on the value of the property. The trustee can then sell the property and reinvest the proceeds in other assets. What if you need a higher income stream in the short term but are willing to accept a lower income stream in the future? You could use a NIMCRUT (Net Income with Makeup CRUT). With a NIMCRUT, the trust only pays out its net income each year, but if the income is less than the stated percentage, the shortfall can be made up in future years when the income is higher. This can be a useful strategy if you anticipate a period of lower income followed by a period of higher income. What if you want to change the charitable beneficiary of your CRT? While CRTs are irrevocable, you can generally change the charitable beneficiary as long as the new beneficiary is a qualified 501(c)(3) public charity. However, it's important to consult with your attorney before making any changes to ensure that they are done properly and do not violate any tax laws. What if the value of the assets in your CRT declines significantly? In the case of a CRUT, the income stream will also decline, as the payout is based on a percentage of the trust's assets. However, in the case of a CRAT, the income stream will remain fixed, regardless of the value of the assets. This is one of the key differences between CRATs and CRUTs. By considering these "what if" scenarios, you can gain a better understanding of the flexibility and potential impact of CRTs.

Top 5 Benefits of Charitable Remainder Trusts: A Listicle

Let's break down the advantages of using a Charitable Remainder Trust into a concise list:

- Tax Deduction: Receive an immediate income tax deduction for the present value of the charitable remainder interest.

- Capital Gains Tax Avoidance: Avoid paying capital gains taxes on appreciated assets when they are transferred to the trust.

- Income Stream: Receive a steady stream of income for yourself or your beneficiaries for a set period or for life.

- Estate Tax Reduction: Reduce your taxable estate, potentially lowering estate taxes for your heirs.

- Charitable Giving: Support your favorite charities and create a lasting legacy of philanthropy.

These five benefits highlight the powerful combination of financial planning and charitable giving that CRTs offer. From reducing your tax burden to providing a secure income stream and supporting worthy causes, CRTs can be a valuable tool for individuals seeking to optimize their financial and philanthropic goals.

Question and Answer about Charitable Remainder Trust

Q: What types of assets can be used to fund a Charitable Remainder Trust?

A: You can use a variety of assets to fund a CRT, including stocks, bonds, real estate, and other appreciated property. However, it's generally best to use assets that have appreciated in value, as this will allow you to avoid paying capital gains taxes.

Q: How is the income stream from a Charitable Remainder Trust taxed?

A: The income stream from a CRT is taxed as ordinary income. The character of the income (e.g., dividends, interest, capital gains) is passed through to the beneficiary.

Q: Can I change the charitable beneficiary of a Charitable Remainder Trust?

A: In most cases, yes. While CRTs are irrevocable, you can usually change the charitable beneficiary as long as the new beneficiary is a qualified 501(c)(3) public charity.

Q: What are the potential drawbacks of using a Charitable Remainder Trust?

A: One of the main drawbacks of using a CRT is that it is an irrevocable trust. This means that once the trust is established, you cannot change or terminate it. Additionally, the assets in the trust are no longer available to you or your heirs.

Conclusion of Charitable Remainder Trust

Charitable Remainder Trusts stand out as a sophisticated strategy that harmonizes charitable giving with personal financial planning. By understanding the nuances of CRTs, individuals can unlock significant tax advantages, secure a reliable income stream, and leave a lasting legacy by supporting the causes they care about most. While the complexities of CRTs warrant careful consideration and expert guidance, the potential benefits make them a powerful tool for those seeking to optimize their philanthropic and financial goals.

Post a Comment