Consultant Tax Optimization: Independent Contractor Guide

So, you're a consultant, blazing your own trail as an independent contractor. Freedom is great, right? Setting your own hours, choosing your projects... but then comes tax time, and suddenly that freedom feels a bit more like a tangled web of deductions and self-employment taxes.

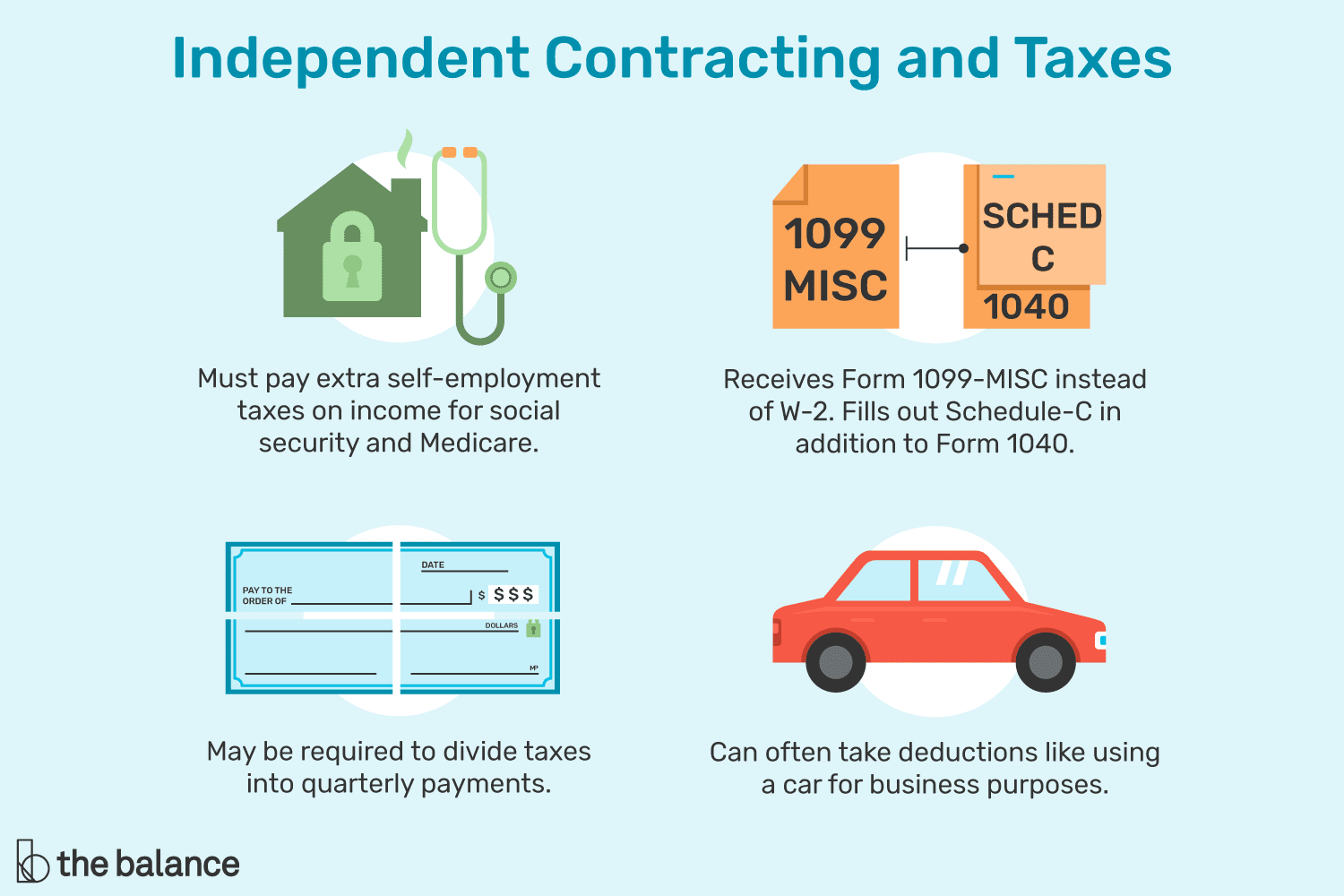

Navigating the world of self-employment taxes can be daunting. Many independent consultants struggle with understanding what expenses are deductible, how to accurately track income, and how to plan for quarterly tax payments. The fear of audits and the complexity of tax laws can add significant stress to an already demanding career.

This guide aims to be your go-to resource for navigating the world of consultant tax optimization as an independent contractor. We’ll break down the key strategies and insights you need to minimize your tax burden while staying compliant. It’s about empowering you to keep more of what you earn.

In this guide, we’ll explore deductible expenses, self-employment tax, estimated taxes, retirement planning, and record-keeping best practices. We will equip you with the knowledge you need to confidently manage your taxes and optimize your financial situation as a consultant.

Understanding Deductible Business Expenses

The heart of tax optimization for consultants lies in understanding deductible business expenses. I remember when I first started freelancing, I was so focused on securing clients and delivering projects that I completely neglected tracking my expenses. Big mistake! I ended up paying significantly more in taxes than I needed to because I didn't realize how much I could deduct.

So, what exactly qualifies as a deductible business expense? Think about anything that is "ordinary and necessary" for your business. This includes things like home office expenses (if you have a dedicated workspace), software subscriptions, travel costs for client meetings, professional development, and even marketing expenses like website hosting or business cards.

Keep detailed records of all your expenses, including receipts and invoices. Consider using accounting software to track income and expenses efficiently. The key is to be organized and proactive, so you can easily identify and claim all eligible deductions when it's time to file your taxes. Overlooking these deductions is like leaving money on the table, and as a consultant, every dollar counts.

Self-Employment Tax: What You Need to Know

Self-employment tax is essentially Social Security and Medicare taxes for those who work for themselves. Unlike employees, who have these taxes withheld from their paychecks, independent contractors are responsible for paying both the employer and employee portions.

This can be a significant financial burden, especially when starting. The self-employment tax rate is currently 15.3% (12.4% for Social Security and

2.9% for Medicare) on the first $160,200 of net earnings.

However, there's good news! You can deduct one-half of your self-employment tax from your gross income. This deduction helps to reduce your overall tax liability.

Planning for self-employment tax is crucial. Set aside a portion of your income regularly to cover these taxes, and consider making estimated tax payments quarterly to avoid penalties. Understanding self-employment tax is a cornerstone of effective tax planning for consultants.

The Myth of Unlimited Deductions

There's a common misconception that as an independent contractor, you can deduct anything and everything. This is far from the truth. While there are many legitimate deductions available, it's essential to understand the rules and regulations surrounding them.

Claiming deductions you're not entitled to can lead to audits and penalties. The IRS has specific guidelines for what constitutes a deductible business expense, and it's crucial to adhere to these guidelines.

One area where this myth often surfaces is with home office deductions. While you can deduct expenses related to your home office, it must be used exclusively and regularly for business purposes. Simply using your dining room table as a workspace doesn't qualify.

Be honest and accurate when claiming deductions, and consult with a tax professional if you have any doubts. Remember, it's better to be safe than sorry when it comes to taxes.

Secret Strategies for Maximizing Deductions

One lesser-known strategy for maximizing deductions is the qualified business income (QBI) deduction. This deduction allows eligible self-employed individuals and small business owners to deduct up to 20% of their qualified business income.

Another hidden gem is the deduction for health insurance premiums. If you're self-employed and pay for your health insurance, you can deduct the premiums from your gross income.

Don't forget about deductions for retirement contributions. Contributing to a SEP IRA or Solo 401(k) not only helps you save for retirement but also reduces your taxable income.

The key is to explore all available deductions and credits and take advantage of those that apply to your situation. Consulting with a tax professional can help you uncover these hidden strategies and ensure you're not leaving any money on the table.

Recommended Tax Planning Strategies for Consultants

Implementing a proactive tax planning strategy is essential for consultants. This involves more than just tracking expenses; it requires a holistic approach to managing your finances.

First, establish a separate business bank account to keep your personal and business finances separate. This makes it easier to track income and expenses and simplifies your tax preparation.

Second, create a budget and stick to it. This helps you monitor your cash flow and identify areas where you can reduce expenses.

Third, regularly review your tax situation with a tax professional. They can provide personalized advice and help you optimize your tax strategy based on your specific circumstances.

By implementing these strategies, you can take control of your taxes and ensure you're minimizing your tax burden while staying compliant.

Estimated Taxes: Avoiding Penalties

Estimated taxes are quarterly tax payments that independent contractors and self-employed individuals are required to make to the IRS. Because taxes aren't automatically withheld from your income like they are with a W-2 employee, it's your responsibility to pay taxes throughout the year.

Failing to pay estimated taxes can result in penalties and interest charges. The IRS assesses penalties if you don't pay enough taxes throughout the year or if you pay them late.

To avoid penalties, you need to estimate your income and tax liability for the year and make quarterly payments accordingly. The due dates for estimated taxes are typically April 15, June 15, September 15, and January 15.

There are several methods for calculating estimated taxes, including using the prior year's tax liability as a safe harbor. If your income is relatively consistent from year to year, you can use your prior year's tax liability to determine your estimated tax payments.

Alternatively, you can use the IRS's estimated tax worksheet to calculate your estimated tax liability based on your current income and deductions.

Regularly review your income and expenses throughout the year and adjust your estimated tax payments accordingly. This ensures you're paying enough taxes to avoid penalties and that you're not overpaying.

Practical Tips for Keeping Accurate Records

Maintaining accurate records is crucial for tax optimization and compliance. Without proper records, you won't be able to substantiate your deductions or accurately report your income.

Use accounting software to track your income and expenses. There are many affordable options available, such as Quick Books Self-Employed or Fresh Books, that are specifically designed for freelancers and independent contractors.

Scan and save all receipts and invoices electronically. This makes it easy to access your records and reduces the risk of losing important documents.

Keep a detailed log of your business activities, including client meetings, travel, and other expenses. This log can serve as documentation to support your deductions.

Regularly reconcile your bank statements with your accounting records to ensure everything is accurate. This helps you identify any errors or discrepancies and correct them promptly.

Back up your data regularly to protect against data loss. Consider using cloud storage or an external hard drive to store your records securely. By following these tips, you can ensure you have the records you need to accurately file your taxes and minimize your tax burden.

Setting Up a Retirement Plan for Consultants

As an independent consultant, you're responsible for funding your own retirement. Fortunately, there are several retirement plans available that offer tax advantages.

A SEP IRA (Simplified Employee Pension plan) is a popular option for self-employed individuals. It's easy to set up and allows you to contribute up to 20% of your net self-employment income, with a maximum contribution limit of $66,000 for 2023.

A Solo 401(k) is another option that allows you to contribute both as an employee and as an employer. This can result in higher contribution limits compared to a SEP IRA.

A SIMPLE IRA (Savings Incentive Match Plan for Employees) is a retirement plan that allows both you and your employees (if you have any) to contribute.

Contributing to a retirement plan not only helps you save for the future but also reduces your taxable income. The contributions are typically tax-deductible, which can lower your overall tax liability.

Consider consulting with a financial advisor to determine which retirement plan is best suited to your needs and financial goals. They can help you navigate the options and make informed decisions about your retirement savings.

Fun Facts About Taxes and Consultants

Did you know that the first income tax in the United States was introduced during the Civil War to fund the war effort? Or that the IRS was originally called the Bureau of Internal Revenue?

Here's a fun fact for consultants: you can deduct the cost of continuing education that helps you maintain or improve your skills in your current profession. This includes courses, workshops, and seminars.

Another fun fact: you can deduct the cost of business-related meals and entertainment, subject to certain limitations. Generally, you can deduct 50% of the cost of meals and entertainment that are directly related to your business.

Taxes may not be the most exciting topic, but understanding the rules and regulations can help you save money and optimize your financial situation.

How to Get Professional Tax Advice

Navigating the complexities of tax laws can be challenging, especially for independent consultants. That's why it's often beneficial to seek professional tax advice from a qualified accountant or tax advisor.

A tax professional can provide personalized guidance based on your specific circumstances and help you identify deductions and credits you may be eligible for.

They can also help you with tax planning, ensuring you're minimizing your tax burden while staying compliant with the law.

When choosing a tax advisor, look for someone who specializes in working with self-employed individuals and small business owners. They should have a thorough understanding of the tax laws that apply to consultants and be able to provide tailored advice.

Don't hesitate to ask questions and seek clarification on any tax-related matters. A good tax advisor will be patient and explain things in a way that you can understand.

The cost of professional tax advice is often well worth it, as it can help you save money on taxes and avoid costly mistakes.

What If You Get Audited?

The thought of being audited by the IRS can be daunting, but it's important to stay calm and prepared. If you receive a notice of audit, don't panic.

The first step is to gather all your relevant records, including income statements, expense receipts, and any other documentation that supports your tax return.

Review your tax return and make sure you understand the items that are being audited. If you're unsure about anything, consult with a tax professional.

Cooperate with the IRS and provide them with the information they request in a timely manner. Be honest and transparent in your responses.

If you disagree with the auditor's findings, you have the right to appeal. Consult with a tax professional to determine the best course of action.

Remember, being organized and having accurate records can help you navigate an audit with confidence. The best defense against an audit is to file accurate and complete tax returns from the start.

Top 5 Tax Tips for Independent Consultants (Listicle)

Here's a quick rundown of the top 5 tax tips for independent consultants:

1. Track all your income and expenses meticulously.

2. Claim all eligible deductions, including home office expenses, business travel, and professional development.

3. Pay estimated taxes quarterly to avoid penalties.

4. Contribute to a retirement plan to save for the future and reduce your taxable income.

5. Seek professional tax advice to ensure you're optimizing your tax strategy and staying compliant with the law.

Question and Answer about Consultant Tax Optimization

Q: What's the biggest tax mistake consultants make?

A: Not keeping accurate records of income and expenses. This makes it difficult to claim deductions and accurately report income.

Q: Can I deduct expenses for meals with clients?

A: Yes, you can generally deduct 50% of the cost of business-related meals and entertainment, provided they are directly related to your business.

Q: How often should I review my tax situation?

A: It's a good idea to review your tax situation at least quarterly, especially if your income fluctuates. This helps you adjust your estimated tax payments and plan for any tax liabilities.

Q: What's the best way to prepare for an audit?

A: The best way to prepare for an audit is to keep accurate and organized records of all your income and expenses. This makes it easier to substantiate your tax return if you're ever audited.

Conclusion of Consultant Tax Optimization: Independent Contractor Guide

Navigating taxes as an independent consultant can feel overwhelming, but with the right knowledge and strategies, you can optimize your tax situation and keep more of your hard-earned money. By understanding deductible expenses, planning for self-employment tax, and implementing effective record-keeping practices, you can confidently manage your taxes and achieve your financial goals. Remember to stay informed, seek professional advice when needed, and take a proactive approach to tax planning. Ultimately, mastering consultant tax optimization will empower you to thrive in your independent career and build a secure financial future.

Post a Comment