Gig Worker Tax Planning: Independent Contractor Guide

So, you're navigating the exciting world of the gig economy! You're your own boss, setting your own hours, and pursuing your passions. But with great freedom comes great responsibility, especially when tax season rolls around. Are you prepared?

The allure of being an independent contractor can quickly fade when faced with the complexities of self-employment taxes. It's easy to feel overwhelmed by unfamiliar forms, confusing deductions, and the constant need to track every penny. Many find themselves scrambling to gather information at the last minute, unsure if they're taking advantage of all available tax breaks or, even worse, facing unexpected penalties.

This guide is designed to empower you, the independent contractor, with the knowledge and strategies needed to navigate the world of taxes with confidence. We'll break down the essential aspects of gig worker tax planning, providing clear and actionable advice to help you minimize your tax burden and maximize your financial well-being.

This comprehensive guide covers everything from understanding your tax obligations as a 1099 contractor to maximizing deductions, making estimated tax payments, and planning for retirement. We'll also explore common myths and mistakes to avoid, ensuring you're well-equipped to handle your taxes like a pro. By understanding the nuances of self-employment taxes, you can confidently manage your finances and focus on growing your business.

Understanding Your 1099 Tax Obligations

The core of being a gig worker is often signified by receiving a 1099-NEC form. This form is sent to you by companies that have paid you $600 or more during the tax year. It's a crucial piece of the tax puzzle. I remember the first time I received a stack of 1099s; it felt like a badge of honor, signifying my growing freelance career. But that feeling quickly turned to mild panic when I realized I was solely responsible for calculating and paying my taxes.

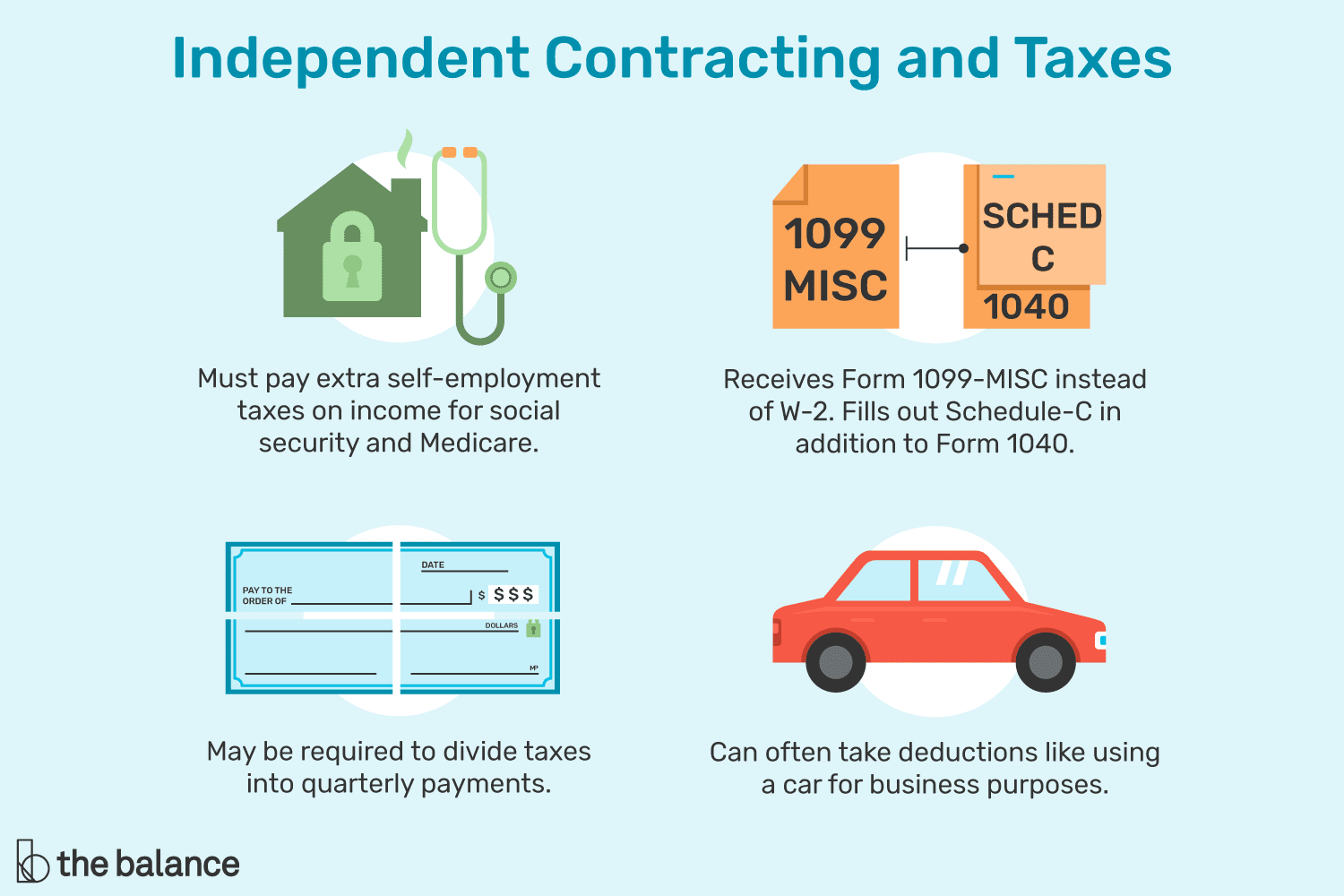

Understanding your 1099 tax obligations begins with accurately tracking your income and expenses throughout the year. Unlike traditional employees, no taxes are automatically withheld from your payments, meaning you're responsible for paying both income tax and self-employment tax (which covers Social Security and Medicare). Self-employment tax is generally 15.3% of your net earnings, so it's essential to factor this into your financial planning. You'll need to file Schedule C (Profit or Loss from Business) with your Form 1040 to report your business income and expenses. This form is where you calculate your net profit or loss, which then flows onto your individual tax return.

Remember to keep meticulous records of all income received and expenses incurred. This includes invoices, receipts, bank statements, and any other documentation that supports your business transactions. Cloud-based accounting software or even a simple spreadsheet can be invaluable for staying organized. Missing a deduction or misreporting income can lead to audits, penalties, and unnecessary stress. Consulting with a tax professional can provide personalized guidance and ensure you're taking advantage of all available deductions and credits.

Maximizing Your Tax Deductions

What is maximizing tax deductions? It means reducing your taxable income as much as possible by claiming all eligible business expenses. This is one of the biggest advantages of being an independent contractor. Think of it as finding hidden treasures that lower your tax bill.

As a gig worker, you're entitled to deduct various business expenses that can significantly reduce your taxable income. Common deductions include home office expenses (if you use a portion of your home exclusively for business), supplies, software, internet and phone costs, vehicle expenses (either actual expenses or the standard mileage rate), education, and professional development costs. For example, if you use a room in your home exclusively as an office, you can deduct a portion of your mortgage interest, rent, utilities, and homeowners insurance based on the percentage of your home used for business.

Another valuable deduction is the self-employment tax deduction. You can deduct one-half of your self-employment tax from your gross income, which further reduces your taxable income. It's crucial to keep detailed records of all your expenses, as you'll need to substantiate them if you're audited. Consider using accounting software or a dedicated spreadsheet to track your income and expenses throughout the year. It will help you stay organized and ensure you don't miss any potential deductions. Consult with a tax professional to identify all the deductions applicable to your specific situation and to ensure you're complying with all tax laws and regulations. Don't leave money on the table – take advantage of every legitimate deduction you're entitled to.

The History and Myths of Gig Worker Tax Planning

Let's debunk some common myths about gig worker taxes. Many believe that if they don't receive a 1099, they don't have to report the income. That's absolutely false! All income, regardless of whether you receive a 1099, is taxable and must be reported to the IRS.

The history of gig worker tax planning is relatively recent, as the gig economy itself has only exploded in the last couple of decades. Before the rise of platforms like Uber, Airbnb, and Upwork, independent contracting was less prevalent and often viewed as a side hustle rather than a primary source of income. As the gig economy grew, so did the need for specialized tax guidance for these workers. Historically, many independent contractors were unaware of their tax obligations, leading to underreporting of income and penalties from the IRS.

One persistent myth is that you can only deduct expenses if you make a profit. While you can't deduct more than your business income (you can't create a loss to offset other income unless certain conditions are met), you can still deduct expenses even if your business is not yet profitable. Another myth is that you don't need to pay estimated taxes if you don't owe a lot. However, if you expect to owe $1,000 or more in taxes, you're generally required to make estimated tax payments throughout the year to avoid penalties. Staying informed about the realities of gig worker tax planning is crucial for avoiding costly mistakes and ensuring compliance with tax laws.

Hidden Secrets of Gig Worker Tax Planning

The biggest secret? Proactive planning! Don't wait until April 15th to think about your taxes. Regular reviews of your income and expenses can prevent surprises and allow you to make informed financial decisions throughout the year.

One of the most overlooked aspects of gig worker tax planning is understanding the power of retirement savings. As an independent contractor, you have access to retirement plans like SEP IRAs and solo 401(k)s, which allow you to contribute a significant portion of your income and defer taxes until retirement. These plans not only provide valuable tax benefits but also help you secure your financial future. Another hidden secret is the Qualified Business Income (QBI) deduction, which allows eligible self-employed individuals to deduct up to 20% of their qualified business income. This deduction can significantly lower your tax liability, but it's often overlooked due to its complexity.

Another key secret is the importance of keeping personal and business finances separate. Mixing personal and business expenses can create a nightmare during tax season and make it difficult to track your deductible expenses accurately. Open a separate bank account and credit card for your business to simplify your bookkeeping and ensure you're properly tracking your income and expenses. Finally, don't underestimate the value of professional guidance. A qualified tax advisor can provide personalized advice tailored to your specific situation and help you navigate the complexities of self-employment taxes. They can identify deductions and credits you might have missed and ensure you're complying with all tax laws and regulations. Investing in professional tax advice can save you time, money, and a lot of stress in the long run.

Recommendations for Effective Gig Worker Tax Planning

My top recommendation? Invest in good accounting software. It simplifies tracking income and expenses, generates reports, and can even help you estimate your quarterly tax payments. There are many user-friendly options available at affordable prices.

For effective gig worker tax planning, it's crucial to stay organized and proactive. Start by establishing a system for tracking your income and expenses from day one. Whether you use accounting software, a spreadsheet, or a simple notebook, consistency is key. Make it a habit to record all your income and expenses regularly, noting the date, amount, and purpose of each transaction. Next, familiarize yourself with the common tax deductions available to independent contractors. Research the requirements for claiming these deductions and gather the necessary documentation to support your claims. This will not only help you reduce your tax liability but also protect you in case of an audit.

Consider consulting with a tax professional specializing in self-employment taxes. They can provide personalized guidance based on your specific situation and help you identify deductions and credits you might have missed. They can also help you navigate the complexities of estimated tax payments and ensure you're complying with all tax laws and regulations. Finally, stay informed about changes to tax laws and regulations that could affect your business. Subscribe to tax newsletters, follow reputable tax blogs, and attend webinars or seminars on self-employment taxes. Staying up-to-date will help you make informed financial decisions and avoid costly mistakes. Effective tax planning is an ongoing process, so make it a priority to stay organized, informed, and proactive.

Staying Organized: The Key to Stress-Free Taxes

Organization is paramount. Keep all receipts, invoices, and bank statements in one place. Whether you prefer digital or physical files, a well-organized system will save you countless hours and headaches when tax time arrives.

Staying organized is the cornerstone of stress-free tax preparation for gig workers. Without a systematic approach to tracking income and expenses, it's easy to miss deductions, misreport income, and face potential penalties from the IRS. Start by creating a dedicated filing system for all your tax-related documents. This can be a physical filing cabinet, a digital folder on your computer, or a cloud-based storage solution. The key is to choose a system that works for you and stick to it consistently. Within your filing system, create separate folders for each type of income and expense. For example, you might have folders for invoices, receipts, bank statements, and tax forms.

Next, establish a regular schedule for recording your income and expenses. Whether you do it daily, weekly, or monthly, make it a habit to update your records regularly. This will prevent you from falling behind and having to scramble to gather information at the last minute. Use accounting software or a spreadsheet to track your income and expenses electronically. This will not only simplify your bookkeeping but also make it easier to generate reports and analyze your financial performance. Finally, back up your data regularly to protect against loss or damage. Whether you use an external hard drive, a cloud-based backup service, or both, make sure your data is safe and secure. Staying organized will not only make tax preparation easier but also give you greater control over your finances and help you make informed business decisions.

Tips for Managing Estimated Taxes

My best tip? Don't underestimate your tax liability! It's always better to overestimate and pay a little extra than to underpay and face penalties. Use the IRS's online tools to estimate your taxes and adjust your payments accordingly.

Managing estimated taxes is a critical aspect of gig worker tax planning. Unlike traditional employees who have taxes withheld from their paychecks, independent contractors are responsible for paying their income tax and self-employment tax throughout the year. The IRS requires you to pay estimated taxes if you expect to owe $1,000 or more when you file your return. The best way to avoid penalties is to make timely estimated tax payments each quarter. The due dates for estimated tax payments are typically April 15, June 15, September 15, and January 15 of the following year. However, these dates can vary depending on weekends and holidays, so it's essential to check the IRS website for the most up-to-date information.

To calculate your estimated taxes, start by estimating your total income for the year. Then, subtract any deductions and credits you expect to claim to arrive at your taxable income. Use the current tax rates and self-employment tax rate to calculate your estimated income tax and self-employment tax liability. Divide your total tax liability by four to determine the amount of each quarterly payment. The IRS offers several methods for paying estimated taxes, including online payments, electronic funds withdrawal, and mail. Choose the method that works best for you and make sure to keep a record of all your payments. If your income fluctuates throughout the year, you may need to adjust your estimated tax payments accordingly. You can use the IRS's Estimated Tax Worksheet (Form 1040-ES) to help you calculate your estimated tax liability and adjust your payments as needed. Managing estimated taxes effectively requires careful planning and attention to detail, but it's essential for avoiding penalties and staying in good standing with the IRS.

Understanding the Self-Employment Tax

Self-employment tax covers Social Security and Medicare taxes, typically paid by both employers and employees. As an independent contractor, you're responsible for paying both halves, which can come as a shock if you're not prepared.

Understanding the self-employment tax is crucial for gig workers, as it represents a significant portion of their overall tax liability. Unlike traditional employees, who have Social Security and Medicare taxes withheld from their paychecks, self-employed individuals are responsible for paying both the employer and employee portions of these taxes. The self-employment tax rate is currently 15.3% of your net earnings, with

12.4% allocated to Social Security and

2.9% allocated to Medicare. This tax applies to the first $160,200 (for 2023) of your net earnings for Social Security, while the Medicare tax applies to all of your net earnings.

To calculate your self-employment tax, you'll need to complete Schedule SE (Self-Employment Tax) and file it with your Form 1040. The first step is to calculate your net earnings from self-employment by subtracting your business expenses from your business income. You can deduct one-half of your self-employment tax from your gross income, which reduces your taxable income. This deduction helps offset the impact of the self-employment tax and lowers your overall tax liability. It's important to note that you're only subject to self-employment tax if your net earnings from self-employment are $400 or more. If your net earnings are below this threshold, you don't need to file Schedule SE or pay self-employment tax. Understanding the self-employment tax and how to calculate it is essential for accurate tax planning and compliance. Make sure to factor this tax into your estimated tax payments and plan accordingly to avoid surprises at tax time.

Fun Facts About Gig Worker Tax Planning

Did you know that the IRS has a specific publication dedicated to self-employment taxes? It's Publication 334, Tax Guide for Small Business, and it's a wealth of information for independent contractors. While it might not be the most thrilling read, it's definitely worth checking out.

One fun fact about gig worker tax planning is that the term "gig economy" is relatively new, but the concept of independent contracting has been around for centuries. From freelance writers to traveling musicians, people have been earning income through short-term or project-based work for a long time. However, the rise of technology and online platforms has made it easier than ever for individuals to connect with clients and find gig work, leading to the explosion of the gig economy in recent years. Another fun fact is that the IRS has a dedicated team of experts who specialize in self-employment taxes. These experts are responsible for developing tax guidance, conducting audits, and providing assistance to self-employed individuals. They also work to combat tax fraud and ensure that everyone is paying their fair share of taxes.

One more interesting tidbit is that many famous entrepreneurs and business leaders started out as independent contractors. From Steve Jobs, who started Apple in his garage, to Oprah Winfrey, who began her career as a news anchor, many successful individuals have honed their skills and built their businesses through self-employment. Tax planning for gig workers can be complex and challenging, but it's also an opportunity to take control of your finances and build a successful business. By staying organized, informed, and proactive, you can minimize your tax liability and maximize your financial well-being. So, embrace the freedom and flexibility of the gig economy, but don't forget to take care of your taxes!

How to Plan for Retirement as a Gig Worker

Retirement planning is crucial, even if you're self-employed. Consider opening a SEP IRA or solo 401(k) to save for the future while also reducing your current tax liability. These plans offer significant tax advantages and can help you build a comfortable retirement nest egg.

Planning for retirement as a gig worker requires a proactive and strategic approach. Unlike traditional employees who have access to employer-sponsored retirement plans like 401(k)s, independent contractors are responsible for setting up and managing their own retirement savings. Fortunately, there are several retirement plans available to self-employed individuals that offer tax advantages and help you build a secure financial future. One popular option is the Simplified Employee Pension (SEP) IRA, which allows you to contribute up to 20% of your net self-employment income, with a maximum contribution of $66,000 for 2023. The contributions are tax-deductible, and the earnings grow tax-deferred until retirement. Another option is the solo 401(k), which comes in two forms: traditional and Roth. The traditional solo 401(k) allows you to contribute both as an employee and as an employer, with contributions being tax-deductible. The Roth solo 401(k) allows you to contribute after-tax dollars, but the earnings grow tax-free and withdrawals in retirement are also tax-free.

You can also consider a SIMPLE IRA, which is easier to set up and administer than a solo 401(k), but it has lower contribution limits. In addition to choosing the right retirement plan, it's essential to develop a savings strategy that aligns with your financial goals and risk tolerance. Determine how much you need to save each year to reach your retirement goals, and automate your contributions to ensure you stay on track. Consider diversifying your investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk and maximize returns. Consulting with a financial advisor can provide personalized guidance and help you develop a retirement plan that meets your specific needs. Planning for retirement as a gig worker requires discipline and foresight, but it's an investment in your future that will pay off in the long run.

What If You Make a Mistake on Your Taxes?

Don't panic! Mistakes happen. If you realize you've made an error on your tax return, file an amended return (Form 1040-X) as soon as possible. The IRS is generally understanding of honest mistakes, especially if you take prompt action to correct them.

Making a mistake on your taxes can be a stressful experience, but it's important to remember that the IRS is generally understanding of honest errors. If you discover a mistake on your tax return after you've already filed it, don't panic. The first step is to determine the nature and extent of the error. Did you omit income, claim a deduction you weren't entitled to, or make a calculation error? Once you've identified the mistake, gather the necessary documentation to correct it. Next, file an amended tax return (Form 1040-X) to correct the error. Form 1040-X allows you to explain the mistake you made and provide the corrected information. Be sure to include any supporting documentation that substantiates your corrections.

File your amended return as soon as possible after discovering the mistake. The IRS has a statute of limitations for assessing additional taxes, so it's important to correct the error promptly to avoid penalties and interest. If the mistake resulted in an underpayment of taxes, you may owe penalties and interest. However, the IRS may waive penalties if you can demonstrate that you had reasonable cause for the mistake and that you acted in good faith. To request a penalty waiver, include a written statement with your amended return explaining the circumstances that led to the mistake. If the mistake resulted in an overpayment of taxes, you'll receive a refund or credit to your account. The IRS typically processes amended returns within 8 to 12 weeks, but it can take longer depending on the complexity of the return. Making a mistake on your taxes is not the end of the world. By taking prompt action to correct the error and filing an amended return, you can minimize the potential consequences and stay in good standing with the IRS.

Listicle: Top 5 Tax Mistakes Gig Workers Make (and How to Avoid Them)

1. Failing to Track Expenses: This is the most common mistake. Keep meticulous records of all business-related expenses to maximize your deductions.

2. Not Paying Estimated Taxes: Avoid penalties by making timely quarterly payments.

3. Mixing Personal and Business Finances: Keep separate bank accounts and credit cards for your business.

4. Ignoring the Home Office Deduction: If you use a portion of your home exclusively for business, you may be eligible for this deduction.

5. Not Seeking Professional Advice: A tax advisor can provide personalized guidance and help you avoid costly mistakes.

Gig workers often face unique tax challenges, and it's easy to make mistakes if you're not careful. Here are the top 5 tax mistakes gig workers make and how to avoid them: 1. Failing to Track Expenses: Many gig workers underestimate the importance of tracking their business expenses. Without accurate records, you'll miss out on valuable deductions that can significantly reduce your tax liability. Keep detailed records of all your business-related expenses, including receipts, invoices, and bank statements.

2. Not Paying Estimated Taxes: As an independent contractor, you're responsible for paying estimated taxes throughout the year. Failing to do so can result in penalties and interest. Make sure to calculate your estimated tax liability and make timely quarterly payments to avoid penalties.

3. Mixing Personal and Business Finances: Mixing personal and business finances can create a bookkeeping nightmare and make it difficult to track your deductible expenses. Open separate bank accounts and credit cards for your business to simplify your bookkeeping and ensure you're properly tracking your income and expenses.

4. Ignoring the Home Office Deduction: If you use a portion of your home exclusively for business, you may be eligible for the home office deduction. This deduction can help you reduce your taxable income, but it's important to meet the requirements for claiming it.

5. Not Seeking Professional Advice: Navigating the complexities of self-employment taxes can be challenging, especially if you're new to the gig economy. Consulting with a tax advisor can provide personalized guidance and help you avoid costly mistakes. By avoiding these common tax mistakes, you can minimize your tax liability and maximize your financial well-being as a gig worker.

Question and Answer Section

Q: What's the difference between a 1099-NEC and a W-2?

A: A 1099-NEC is for independent contractors, while a W-2 is for traditional employees. If you receive a 1099-NEC, you're responsible for paying self-employment taxes.

Q: What is the Qualified Business Income (QBI) deduction?

A: It allows eligible self-employed individuals to deduct up to 20% of their qualified business income, potentially lowering their tax liability.

Q: Can I deduct expenses even if my business isn't profitable?

A: Yes, you can deduct expenses up to the amount of your business income. You can't create a loss to offset other income unless certain conditions are met.

Q: How often should I review my tax situation?

A: Ideally, you should review your tax situation regularly throughout the year, especially before each quarterly estimated tax payment is due.

Conclusion of Gig Worker Tax Planning: Independent Contractor Guide

Navigating the world of gig worker taxes can feel daunting, but with the right knowledge and strategies, it's entirely manageable. By understanding your tax obligations, maximizing your deductions, planning for retirement, and staying organized, you can confidently manage your finances and thrive in the gig economy. Remember to stay informed, seek professional advice when needed, and make tax planning an ongoing process. Your financial success as an independent contractor depends on it!

Post a Comment