Hungarian Tax Optimization: Hungary Tax Planning Guide

Navigating the Hungarian tax system can feel like wandering through a maze, especially for those unfamiliar with its intricacies. Are you leaving money on the table, or worse, inadvertently running afoul of regulations? There's a better way to approach your finances in Hungary.

Many businesses and individuals struggle to keep up with the ever-changing tax landscape in Hungary. Complex regulations, language barriers, and a lack of readily available, easily digestible information can lead to missed opportunities for savings and increased stress about compliance.

This guide is designed to provide a clear and concise overview of tax optimization strategies in Hungary. We aim to empower you with the knowledge necessary to make informed financial decisions, minimize your tax burden legally and ethically, and navigate the Hungarian tax system with confidence. We want to help you achieve financial clarity and control.

In this article, we will explore various aspects of Hungarian tax planning, from understanding the basics of the Hungarian tax system to implementing effective optimization strategies. We'll cover topics like corporate tax, personal income tax, VAT, and available tax incentives. We'll also discuss common mistakes to avoid and provide actionable advice for optimizing your tax position in Hungary. We want to show you how you can take control of your finances.

Understanding the Hungarian Tax System

The first step toward effective tax optimization is gaining a solid understanding of the Hungarian tax system. This isn't just about memorizing rates; it's about understanding the philosophy behind the taxes, how they're applied, and the potential for legitimate optimization. I remember when I first arrived in Hungary. I was overwhelmed by the sheer amount of information and the feeling that I was missing something crucial. It took time, research, and consultations with local experts to truly grasp the nuances of the system. It was like learning a new language, but in financial terms.

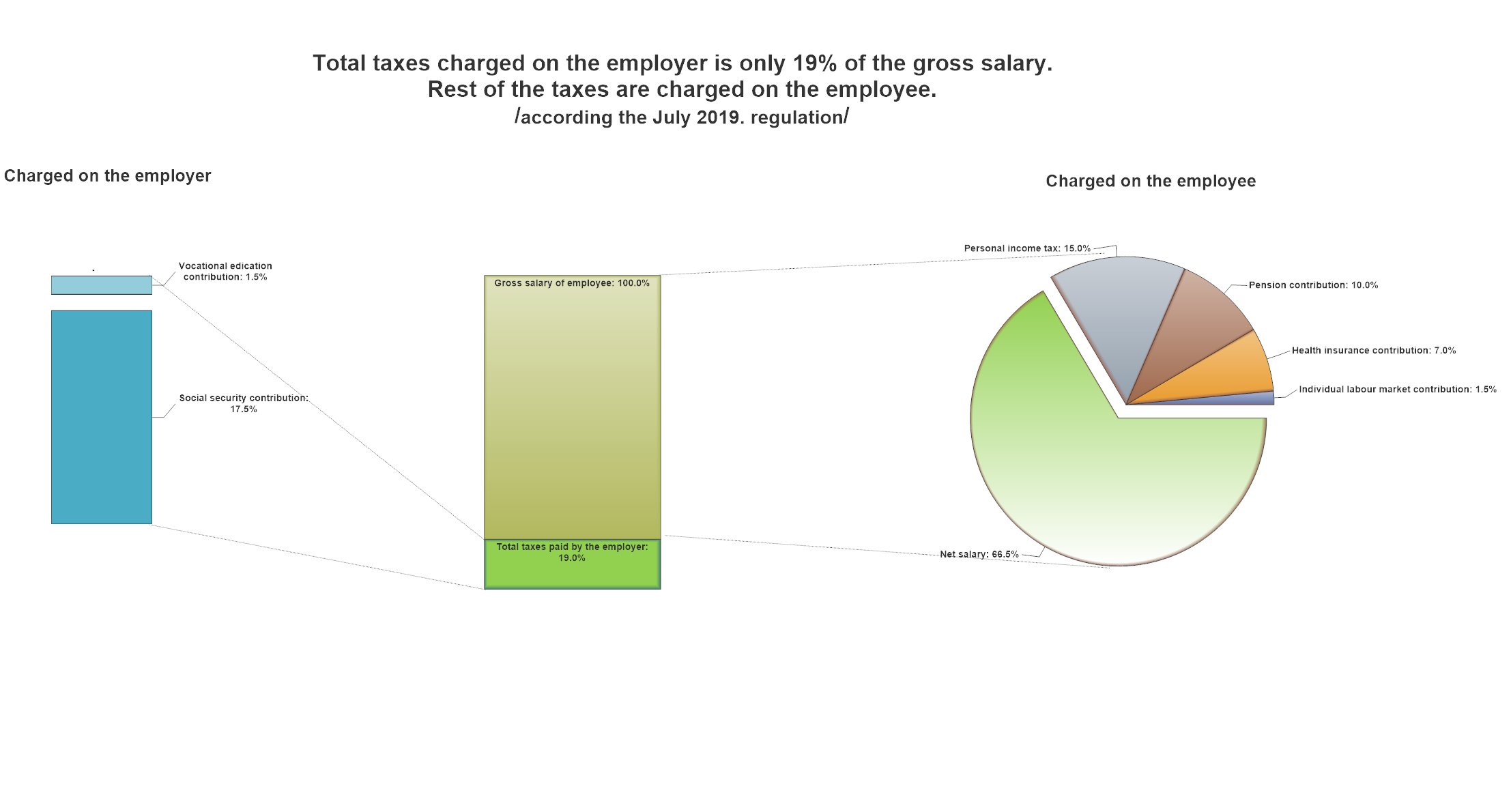

The Hungarian tax system is based on a progressive income tax system, but in reality, it is a flat tax of 15% for income up to a certain threshold. Corporate income tax is also relatively low, at 9%. VAT is a standard rate of 27%, but there are exceptions. A crucial aspect is to understand how these taxes apply to your specific situation, be it as an entrepreneur, a freelancer, or a corporation. Knowing the rules of the game allows you to play it strategically. Tax planning is a continuous process that requires proactive effort. As the Hungarian economy evolves and laws adapt, staying informed is vital for optimal tax management.

Key Tax Types in Hungary

So, what exactly are the key taxes you'll encounter in Hungary? Let's break them down. First, there's Corporate Income Tax (CIT), levied on the profits of companies registered in Hungary. The current rate is a rather appealing 9%, making Hungary a potentially attractive location for businesses. Second, Personal Income Tax (PIT) applies to the income of individuals, including salaries, wages, and self-employment income. The PIT rate is a flat 15%. Third, Value Added Tax (VAT) is charged on most goods and services. The standard VAT rate is a hefty 27%, but reduced rates apply to certain items.

Understanding these key taxes is not just about compliance; it's about identifying opportunities. For instance, businesses can strategically manage their expenses to minimize their CIT liability. Individuals can explore available deductions and exemptions to reduce their PIT burden. VAT can be complex, especially for businesses engaged in international trade, but proper planning can help optimize cash flow and minimize compliance risks. Hungarian tax optimization relies heavily on understanding these different aspects of taxation and their effect on individual and corporate entities.

The History and Myths of Hungarian Tax Optimization

The concept of "tax optimization" often conjures images of complex schemes and loopholes, but the truth is far more nuanced. Historically, Hungary has been a region of shifting empires and evolving economic policies. This turbulent past has contributed to a unique approach to taxation. One common myth is that tax optimization is about avoiding taxes altogether. In reality, it's about structuring your financial affairs in a way that minimizes your tax liability within the bounds of the law. It's about taking advantage of legitimate deductions, exemptions, and incentives offered by the Hungarian government.

Another myth is that tax optimization is only for large corporations or wealthy individuals. While they certainly benefit from sophisticated strategies, even small businesses and individuals can achieve meaningful savings through careful planning. The key is to understand the rules of the game and apply them intelligently to your specific circumstances. Remember, knowledge is power. By educating yourself about Hungarian tax laws and seeking professional advice, you can dispel the myths and unlock the potential for legitimate tax optimization.

Unveiling the Secrets of Hungarian Tax Optimization

So, what are the hidden secrets to successful Hungarian tax optimization? Well, they're not exactly "secrets," but rather strategic approaches that are often overlooked. One key lies in understanding the available tax incentives and subsidies. The Hungarian government offers various programs to encourage investment, innovation, and job creation. By taking advantage of these incentives, businesses can significantly reduce their tax burden.

Another important aspect is transfer pricing. For multinational companies operating in Hungary, it's crucial to establish appropriate transfer prices for transactions between related entities. This ensures compliance with international tax regulations and minimizes the risk of disputes with tax authorities. Proper documentation and a well-defined transfer pricing policy are essential. In conclusion, the "secrets" of Hungarian tax optimization are not about finding loopholes or engaging in shady practices. They're about being proactive, informed, and strategic in your approach to tax planning. By taking the time to understand the rules and seeking expert advice, you can unlock the potential for significant tax savings.

Recommendations for Effective Hungarian Tax Planning

If you are looking for the best way to approach Hungarian tax planning, consider several important factors. Firstly, seek professional advice. Navigating the complexities of Hungarian tax law can be challenging, especially for foreigners. A qualified tax advisor can provide tailored guidance based on your specific circumstances. They can help you identify potential tax savings opportunities and ensure compliance with all applicable regulations.

Secondly, maintain accurate and detailed records. Proper documentation is essential for substantiating your tax deductions and claims. Keep records of all income, expenses, and assets. This will make it easier to prepare your tax returns and respond to any inquiries from the tax authorities. Thirdly, stay informed about changes in tax law. The Hungarian tax system is constantly evolving. It's important to stay up-to-date on the latest changes and how they might affect your tax position. Following these recommendations can make sure that you approach tax planning in Hungary with a proactive and informed approach.

Understanding VAT in Hungary

Hungary's Value Added Tax (VAT) system can be quite intricate, particularly for businesses involved in international trade. The standard VAT rate is 27%, which is among the highest in the European Union. However, reduced rates of 5% and 18% apply to certain goods and services, such as books, pharmaceuticals, and specific food products. Businesses are required to register for VAT if their annual turnover exceeds a certain threshold. Once registered, they must collect VAT on their sales and remit it to the tax authorities.

One of the key challenges for businesses is understanding the rules for VAT refunds. If a business incurs VAT on its purchases but its output VAT is lower, it can claim a refund from the tax authorities. However, the refund process can be complex and time-consuming. It's important to maintain accurate records of all VAT transactions and comply with the strict deadlines for filing VAT returns. Failure to comply with VAT regulations can result in penalties and interest charges. Therefore, businesses operating in Hungary should seek professional advice to ensure they are managing their VAT obligations effectively.

Practical Tips for Hungarian Tax Optimization

Let's talk about some concrete steps you can take to optimize your tax situation in Hungary. A key one is expense tracking. Meticulously track all business-related expenses, no matter how small they seem. Many expenses are deductible, reducing your taxable income. This includes everything from office supplies and travel costs to professional development and marketing expenses.

Another tip is to take advantage of available tax allowances. The Hungarian government offers various allowances for specific situations, such as family allowances or allowances for investments in certain industries. Make sure you understand the eligibility requirements for these allowances and claim them if you qualify. Finally, consider the timing of your income and expenses. By strategically timing when you receive income or incur expenses, you can potentially shift your tax liability from one year to the next, taking advantage of lower tax rates or changing tax laws. Remember, small actions can add up to significant tax savings over time.

Strategies for Small Businesses

Small businesses in Hungary have unique opportunities for tax optimization. One strategy is to consider the optimal legal structure for your business. Sole proprietorships, partnerships, and limited liability companies (Kft.) have different tax implications. Consult with a tax advisor to determine which structure is most advantageous for your specific circumstances. Another strategy is to take advantage of available tax credits for research and development (R&D) activities. If your business is involved in innovation or technological development, you may be eligible for significant tax credits.

In conclusion, small businesses in Hungary have a variety of tools at their disposal to optimize their tax position. By carefully considering their legal structure, utilizing available tax credits, and managing their income and expenses strategically, they can minimize their tax burden and improve their profitability. Seeking professional advice is essential to navigating the complexities of the Hungarian tax system and ensuring compliance with all applicable regulations. A good tax advisor can provide tailored guidance based on your specific business needs and help you develop a long-term tax optimization plan.

Fun Facts About Hungarian Tax Optimization

Did you know that Hungary has one of the lowest corporate tax rates in Europe, at just 9%? This makes it an attractive location for businesses looking to minimize their tax burden. Here's another interesting fact: Hungary's tax system has undergone significant reforms in recent years, making it more competitive and business-friendly.

And finally, here's a fun fact about Hungarian tax optimization: while it's crucial to minimize your tax liability, it's equally important to comply with all applicable regulations. Tax evasion is a serious offense that can result in hefty penalties and even imprisonment. So, always prioritize compliance and seek professional advice to ensure you're staying on the right side of the law. Remember, tax optimization is about smart planning, not about breaking the rules.

How to Implement Hungarian Tax Optimization Strategies

Implementing effective tax optimization strategies in Hungary requires a proactive and strategic approach. Start by conducting a thorough review of your current financial situation. This includes analyzing your income, expenses, assets, and liabilities. Identify areas where you may be overpaying taxes or missing out on potential deductions or credits. Next, seek professional advice from a qualified tax advisor. They can help you develop a personalized tax optimization plan tailored to your specific needs and circumstances.

It is also vital to maintain accurate and detailed records of all financial transactions. This will make it easier to prepare your tax returns and substantiate your claims. Keep copies of all invoices, receipts, bank statements, and other relevant documents. In conclusion, implementing effective tax optimization strategies in Hungary requires a combination of careful planning, professional advice, and diligent record-keeping. By taking a proactive and strategic approach, you can minimize your tax liability and improve your overall financial well-being.

What If You Don't Engage in Hungarian Tax Optimization?

Ignoring tax optimization in Hungary can have significant consequences for both individuals and businesses. You could be paying more taxes than necessary, which reduces your disposable income or business profits. Over time, this can have a substantial impact on your financial well-being. You could also be missing out on valuable tax incentives and credits that could save you money.

Another consequence of not engaging in tax optimization is an increased risk of non-compliance. Tax laws are complex and constantly changing. Without proper planning and advice, you could inadvertently violate tax regulations, resulting in penalties, interest charges, or even legal action. Ultimately, neglecting tax optimization can lead to financial losses, increased stress, and potential legal problems. Taking a proactive approach to tax planning is essential for protecting your financial interests and ensuring compliance with the law.

Listicle of Hungarian Tax Optimization Strategies

Here are some actionable steps to take on your Hungarian tax journey:

1.Claim all eligible deductions: From business expenses to charitable donations, ensure you're claiming every deduction you're entitled to.

2.Optimize your business structure: Choosing the right legal form for your business can have significant tax implications.

3.Take advantage of tax incentives: Hungary offers various incentives for investments, innovation, and job creation.

4.Plan your income and expenses: Timing your income and expenses strategically can minimize your tax burden.

5.Seek professional advice: A tax advisor can provide personalized guidance and help you navigate the complexities of the Hungarian tax system.

Question and Answer

Here are some commonly asked questions about Hungarian tax optimization:Q: Is tax optimization the same as tax evasion?

A: No. Tax optimization is about legally minimizing your tax liability, while tax evasion is an illegal attempt to avoid paying taxes.

Q: Can individuals benefit from tax optimization?

A: Yes, individuals can benefit from tax optimization through strategies like claiming deductions and taking advantage of tax allowances.

Q: How often should I review my tax optimization plan?

A: You should review your tax optimization plan at least annually, or more frequently if there are significant changes in your financial situation or tax laws.

Q: Is it necessary to hire a tax advisor for tax optimization?

A: While it's not always necessary, hiring a tax advisor can be beneficial, especially if you have a complex financial situation or are unfamiliar with Hungarian tax laws.

Conclusion of Hungarian Tax Optimization: Hungary Tax Planning Guide

Navigating the Hungarian tax landscape doesn't have to be a daunting task. By understanding the key tax types, implementing effective optimization strategies, and seeking professional advice when needed, you can take control of your finances and minimize your tax burden legally and ethically. Remember, tax planning is an ongoing process, so stay informed, stay proactive, and reap the rewards of smart financial management in Hungary.

Post a Comment