Kiddie Tax Planning: Minor Child Investment Income

Imagine setting up investments for your child's future, a college fund perhaps, only to be surprised by a tax bill that feels unfairly large. It's a scenario that many parents face, often unexpectedly, and it can take a chunk out of the very savings you were hoping to grow.

Navigating the world of taxes is already complex, but when it involves your children's investments, things can get even trickier. The rules around taxing a minor's investment income can be confusing, leading to potential overpayment or even unintentional errors in your tax filings. Understanding these regulations is key to maximizing the benefits of your child's investments while staying compliant with the law.

The purpose of Kiddie Tax Planning is to navigate the tax rules governing the investment income of children under a certain age. It aims to minimize the tax burden on those earnings, ensuring more of the money goes towards its intended purpose, such as education or long-term savings. By understanding the regulations and employing effective planning strategies, families can optimize their child's financial future.

This article dives into the complexities of kiddie tax, offering clarity on who it affects, how it works, and strategies for minimizing its impact. We'll explore the history, common misconceptions, and practical tips for navigating this often-overlooked aspect of financial planning. Whether you're just starting to invest for your child or already have established accounts, understanding the kiddie tax is crucial for responsible financial stewardship.

Understanding the Basics of Kiddie Tax

The purpose of understanding the basics of kiddie tax is to lay a foundation for navigating the complexities of taxing a child's investment income. It's about grasping the key concepts, such as the age limits, income thresholds, and applicable tax rates, so you can determine if the kiddie tax applies to your family and begin to strategize effectively. Without this foundational knowledge, it's easy to get lost in the details and make costly mistakes.

I remember the first time I encountered the kiddie tax. I had set up a custodial account for my niece, excited to help her start saving for college. I diligently invested, carefully selecting what I thought were sound long-term options. Then, tax season rolled around, and I was hit with a tax bill much higher than anticipated. It turned out I was completely unaware of the kiddie tax rules! I spent hours researching, trying to understand why her investment income was being taxed at my tax rate. It was a frustrating experience, to say the least. From that moment on, I vowed to learn everything I could about this aspect of tax law.

The kiddie tax essentially says that a portion of a child's unearned income (like dividends, interest, and capital gains) may be taxed at their parents' tax rate, which is often higher than the child's own rate. This rule is in place to prevent parents from shifting income-producing assets to their children to avoid paying higher taxes themselves. While it might seem unfair, the intention is to create a more equitable tax system. Key elements to consider include the child's age (generally under 18, or 24 if a full-time student), the source of income (unearned versus earned), and the amount of unearned income. Staying informed and planning proactively can make a significant difference in managing the tax implications of your child's investments.

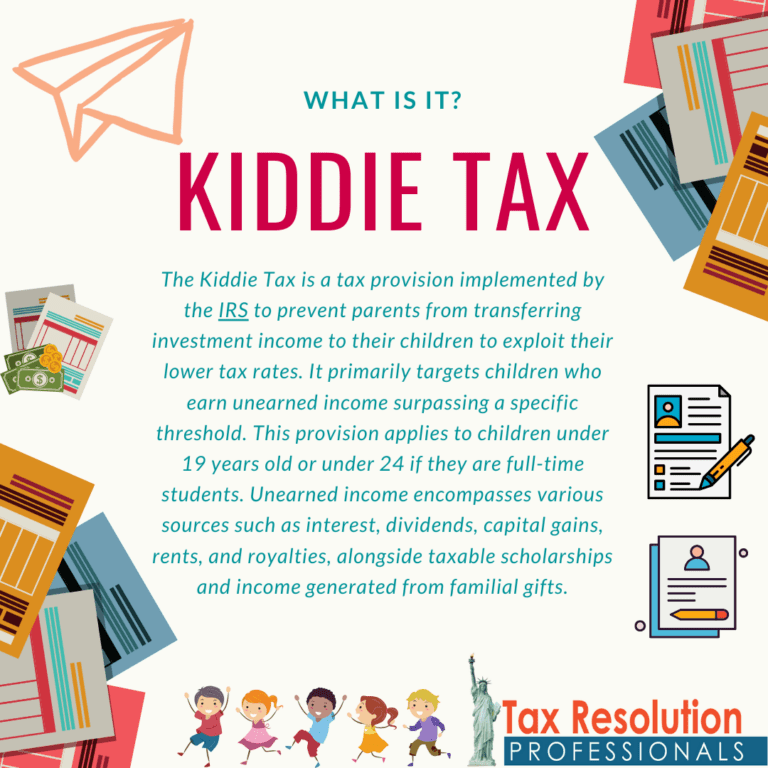

What Exactly is the Kiddie Tax?

The purpose of this is to give a very clear definition of the kiddie tax, going beyond just stating what it is. It's about explaining why it exists, how it functions, and who it impacts. The goal is to remove any ambiguity and ensure that readers have a solid understanding of this tax concept.

The kiddie tax, at its core, is a set of rules within the U.S. tax code designed to prevent high-income individuals from avoiding taxes by transferring income-producing assets to their children. Imagine a wealthy parent giving stocks to their child, who is in a lower tax bracket. Without the kiddie tax, the dividends and capital gains from those stocks would be taxed at the child's lower rate, resulting in significant tax savings for the family. The kiddie tax steps in to prevent this scenario.

In essence, the kiddie tax dictates that a portion of a child's unearned income (income that isn't earned through work, like investment income) may be taxed at their parents' tax rate, rather than the child's rate. This only applies if the child's unearned income exceeds a certain threshold, which is adjusted annually for inflation. The rules typically apply to children under the age of 18, or those who are 18 but younger than 24 and are full-time students, provided they don't earn more than half of their own support. Understanding these specific criteria is crucial for determining whether the kiddie tax will affect your family's financial planning.

The History and Myths of the Kiddie Tax

The purpose of this is to trace the origins of the kiddie tax and debunk some of the common misconceptions that surround it. It's about providing context to the rules and addressing the lingering doubts and misunderstandings that often lead to confusion and anxiety.

The kiddie tax wasn't always around. It was first introduced in 1986 as part of the Tax Reform Act. Before then, it was relatively easy for wealthy families to shift assets to their children and significantly reduce their overall tax burden. The original intent was to close this loophole and create a fairer tax system. Over the years, the rules have been modified and adjusted, leading to the complex regulations we see today.

One of the biggest myths surrounding the kiddie tax is that it applies to all income a child receives. This is simply not true. The kiddie tax only applies to unearned income, such as dividends, interest, capital gains, royalties, and trust income. Earned income, like wages from a summer job, is taxed at the child's own tax rate, regardless of the amount. Another common misconception is that the kiddie tax always results in higher taxes. While it can, it's also possible that the child's tax rate is higher than the parents', especially if the parents are in a lower tax bracket. Understanding these distinctions is essential for accurate tax planning.

The Hidden Secret of Kiddie Tax Planning

The purpose of this is to reveal the core strategy behind effective kiddie tax planning: proactive management. It's about moving beyond simply understanding the rules and embracing a mindset of planning ahead to optimize your child's investment income and minimize tax liabilities.

The "hidden secret" of kiddie tax planning isn't really a secret at all, but rather a proactive approach to managing your child's investment income. It's about understanding the rules, knowing the thresholds, and strategically planning to minimize the impact of the kiddie tax before it hits you. Many parents only start thinking about the kiddie tax when they receive a tax bill they weren't expecting. The key is to anticipate this and plan accordingly.

This proactive approach involves several steps. First, it's about understanding the current kiddie tax rules and how they apply to your specific situation. This includes knowing the annual unearned income thresholds, which dictate how much of your child's income will be taxed at their rate versus your rate. Next, it involves considering different investment strategies that can minimize taxable income. For example, investing in tax-advantaged accounts like 529 plans or Coverdell ESAs can shield investment growth from taxes. Finally, it's about regularly reviewing your child's investment portfolio and adjusting your strategy as needed to stay within the optimal tax range.

Recommendations for Kiddie Tax Planning

The purpose of this section is to offer practical, actionable advice for families looking to navigate the kiddie tax effectively. It's about providing concrete strategies and recommendations that can be implemented to minimize tax burdens and maximize the benefits of children's investments.

When it comes to kiddie tax planning, the first and foremost recommendation is to seek professional advice. A qualified tax advisor or financial planner can assess your specific situation and provide tailored strategies to minimize your tax liability. Every family's financial circumstances are unique, and a one-size-fits-all approach simply won't cut it.

Beyond seeking professional guidance, there are several practical steps you can take. One strategy is to prioritize tax-advantaged accounts, such as 529 plans or Coverdell ESAs. These accounts offer tax benefits that can significantly reduce the impact of the kiddie tax. Another recommendation is to consider gifting appreciated assets to your child strategically. For example, gifting assets with unrealized gains to your child when they are subject to the kiddie tax can allow them to realize those gains at a potentially lower tax rate. Remember to stay informed about the annual kiddie tax rules and thresholds, as these can change from year to year. Also, consider the long-term implications of any investment decisions you make for your child, and ensure they align with your overall financial goals.

Understanding the Unearned Income Thresholds

The purpose of this section is to break down the specific income thresholds that trigger the kiddie tax and explain how those thresholds affect the amount of taxes owed. It's about providing a clear, concise explanation of these key numbers so readers can easily determine if the kiddie tax applies to their situation.

The unearned income thresholds are the cornerstone of the kiddie tax rules. These thresholds determine how much of your child's unearned income will be taxed at their rate versus your rate. For example, let's say the first $1,200 of unearned income is tax-free, the next $1,200 is taxed at the child's rate, and any amount above that is taxed at the parents' rate. These numbers are adjusted annually for inflation, so it's essential to stay up-to-date on the current thresholds.

Understanding these thresholds is crucial for planning purposes. If you know that your child's unearned income will fall below the tax-free threshold, you don't need to worry about the kiddie tax. If their income will exceed that threshold, you can start exploring strategies to minimize the impact of the tax. This might involve shifting investments to tax-advantaged accounts or making strategic gifts of appreciated assets. Regularly monitoring your child's investment income and comparing it to the current thresholds will help you stay ahead of the game and make informed financial decisions. This is especially important as your child gets older and their investments grow, as the likelihood of exceeding the thresholds increases.

Actionable Tips for Kiddie Tax Planning

The purpose of this is to distill the complex rules and strategies of kiddie tax planning into a set of practical tips that families can implement right away. It's about providing concrete steps that can be taken to minimize tax liabilities and maximize the benefits of children's investments.

One of the most actionable tips for kiddie tax planning is to maximize contributions to tax-advantaged accounts like 529 plans and Coverdell ESAs. These accounts offer tax-free growth and withdrawals for qualified education expenses, making them an excellent way to save for your child's future while minimizing the impact of the kiddie tax. Another tip is to consider investing in tax-efficient investments, such as municipal bonds, which generate income that is exempt from federal income tax.

Another strategy is to be mindful of the timing of investment transactions. If you're planning to sell an investment that has appreciated significantly, consider doing so when your child is in a lower tax bracket or when their unearned income is below the kiddie tax thresholds. This can help you minimize the capital gains taxes owed. Finally, don't underestimate the power of gifting appreciated assets to your child strategically. By gifting assets with unrealized gains, you can allow them to realize those gains at a potentially lower tax rate, while also reducing your own tax liability. Remember to consult with a tax advisor to ensure that any gifting strategies comply with gift tax rules and regulations.

Diversify Investments

The purpose of this section is to highlight the importance of diversification as a key strategy for managing risk and optimizing returns within the context of kiddie tax planning. It's about explaining how a well-diversified portfolio can help minimize tax liabilities and ensure that children's investments are positioned for long-term growth.

Diversifying your child's investment portfolio is a fundamental principle of sound financial planning. By spreading investments across different asset classes, such as stocks, bonds, and real estate, you can reduce the risk of losing money due to market fluctuations. Diversification can also help you minimize the impact of taxes on your child's investment income. For example, if you invest in a mix of taxable and tax-advantaged assets, you can strategically allocate investments to minimize your overall tax burden.

When it comes to kiddie tax planning, diversification can be particularly beneficial. By investing in a variety of assets with different tax characteristics, you can potentially reduce the amount of unearned income that is subject to the kiddie tax. For example, consider allocating a portion of your child's portfolio to tax-exempt municipal bonds, which generate income that is exempt from federal income tax. You can also diversify your investments across different geographic regions to reduce your exposure to country-specific risks and taxes. Remember to consult with a financial advisor to determine the optimal asset allocation for your child's portfolio, based on their age, risk tolerance, and financial goals.

Fun Facts About the Kiddie Tax

The purpose of this is to add a touch of levity to a potentially dry topic and share some interesting and lesser-known details about the kiddie tax. It's about making the subject more engaging and memorable, while still reinforcing key concepts and principles.

Did you know that the term "kiddie tax" isn't actually an official term used by the IRS? It's more of a colloquial term that has become widely adopted to refer to the rules governing the taxation of a child's unearned income. Another fun fact is that the kiddie tax rules have been revised and updated several times since they were first introduced in 1986, reflecting the ever-changing landscape of tax law.

Here's another interesting tidbit: the age at which the kiddie tax applies has changed over time. Originally, it applied to children under the age of 14, but it was later extended to children under the age of 18. There have even been proposals to extend the kiddie tax to children up to age 24 in certain circumstances. It's also interesting to note that the kiddie tax rules don't apply if both parents are deceased. In that case, the child's unearned income is taxed at their own tax rate, regardless of their age or the amount of income. These fun facts illustrate the dynamic nature of tax law and the importance of staying informed about the latest changes and updates.

How to Avoid the Kiddie Tax

The purpose of this section is to provide a comprehensive guide to strategies that families can use to legally avoid the kiddie tax. It's about empowering readers with the knowledge and tools they need to minimize their tax liabilities and maximize the benefits of their children's investments.

While you can't completely eliminate the kiddie tax in all situations, there are several strategies you can use to minimize its impact. One of the most effective ways to avoid the kiddie tax is to maximize contributions to tax-advantaged accounts, such as 529 plans and Coverdell ESAs. These accounts offer tax-free growth and withdrawals for qualified education expenses, shielding your child's investment income from taxation.

Another strategy is to invest in assets that generate little or no taxable income, such as growth stocks that don't pay dividends or tax-exempt municipal bonds. You can also consider delaying the realization of capital gains by holding onto appreciated assets until your child is no longer subject to the kiddie tax. If your child is earning income from a part-time job or other sources, you can encourage them to contribute to a Roth IRA, which offers tax-free growth and withdrawals in retirement. Remember to consult with a tax advisor to determine the best strategies for avoiding the kiddie tax based on your specific financial situation.

What if the Kiddie Tax Applies to You?

The purpose of this is to provide guidance and reassurance to families who find themselves subject to the kiddie tax. It's about explaining what to expect, how to navigate the filing process, and how to minimize the impact of the tax on their overall financial picture.

If you determine that the kiddie tax applies to your child's unearned income, the first step is to gather all the necessary documentation, including your child's Social Security number, income statements (such as Form 1099-DIV or Form 1099-INT), and your own tax return information. You'll need to complete Form 8615, Tax for Certain Children Who Have Unearned Income, and attach it to your child's tax return.

The process of completing Form 8615 can be somewhat complex, so it's important to carefully follow the instructions and seek professional assistance if needed. Once you've completed the form, you'll need to calculate the amount of tax owed based on your child's unearned income and your own tax rate. While the kiddie tax can result in a higher tax bill, there are still steps you can take to minimize its impact. Consider adjusting your investment strategy to reduce taxable income in the future, or exploring opportunities to increase your child's earned income, which is not subject to the kiddie tax. Also, remember to review your tax withholding or estimated tax payments to ensure that you're adequately covering your tax liability.

Listicle of Kiddie Tax Planning

The purpose of this is to present the key takeaways from the article in a concise, easily digestible format. It's about summarizing the essential information in a way that is both informative and engaging.

1. Understand the Kiddie Tax Rules: Know the age limits, income thresholds, and applicable tax rates.

2. Maximize Tax-Advantaged Accounts: Utilize 529 plans and Coverdell ESAs to shield investment growth from taxes.

3. Invest in Tax-Efficient Assets: Consider municipal bonds and growth stocks to minimize taxable income.

4. Time Investment Transactions Strategically: Sell appreciated assets when your child is in a lower tax bracket.

5. Gift Appreciated Assets Wisely: Transfer assets with unrealized gains to your child to potentially lower their tax rate.

6. Diversify Your Portfolio: Spread investments across different asset classes to reduce risk and optimize returns.

7. Stay Informed: Keep up-to-date on the latest kiddie tax rules and thresholds.

8. Seek Professional Advice: Consult with a tax advisor or financial planner for personalized guidance.

This listicle provides a quick and easy reference guide to the key strategies for kiddie tax planning. By following these tips, you can minimize your tax liabilities and maximize the benefits of your child's investments.

Question and Answer

Q: Who is subject to the kiddie tax?

A: Generally, children under the age of 18, or those who are 18 but younger than 24 and are full-time students, provided they don't earn more than half of their own support, are subject to the kiddie tax if their unearned income exceeds a certain threshold.

Q: What type of income is subject to the kiddie tax?

A: The kiddie tax applies to unearned income, such as dividends, interest, capital gains, royalties, and trust income. Earned income, like wages from a summer job, is not subject to the kiddie tax.

Q: How is the kiddie tax calculated?

A: The first portion of a child's unearned income is tax-free, the next portion is taxed at the child's rate, and any amount above that is taxed at the parents' tax rate. The specific thresholds and tax rates are adjusted annually for inflation.

Q: What are some strategies for minimizing the kiddie tax?

A: Strategies for minimizing the kiddie tax include maximizing contributions to tax-advantaged accounts, investing in tax-efficient assets, timing investment transactions strategically, and gifting appreciated assets wisely.

Conclusion of Kiddie Tax Planning: Minor Child Investment Income

Navigating the kiddie tax can seem daunting, but with a solid understanding of the rules and proactive planning, you can minimize its impact and maximize the benefits of your child's investments. Remember to stay informed, seek professional advice, and implement strategies that align with your family's financial goals. By taking these steps, you can ensure that your child's financial future is secure and prosperous.

Post a Comment