Latvian Tax Optimization: Latvia Tax Planning Strategies

Imagine keeping more of your hard-earned money, legally and ethically, all while operating within a vibrant European economy. Latvia offers a compelling landscape for businesses and individuals seeking to optimize their tax burden, but navigating its nuances can feel like traversing a maze.

Many entrepreneurs and investors find themselves facing challenges in understanding the Latvian tax system. Concerns about high tax rates, complex regulations, and the constant threat of non-compliance often create stress and uncertainty. The fear of making costly mistakes and the administrative burden can overshadow the potential benefits of doing business in Latvia.

This blog post aims to shed light on Latvian tax optimization strategies, providing a clear and practical guide to help you navigate the Latvian tax system effectively. We'll explore various planning techniques and insights that can help you minimize your tax liabilities while remaining fully compliant with local laws. Our goal is to empower you with the knowledge and strategies needed to make informed decisions and maximize your financial success in Latvia.

In the following sections, we will delve into the specifics of Latvian tax planning, from understanding the corporate income tax regime and VAT regulations to exploring opportunities for international tax structuring. We will discuss legal methods for minimizing your tax burden, highlighting key considerations for businesses and individuals. By understanding these strategies, you can unlock the full potential of Latvia's favorable tax environment and achieve your financial goals.

Understanding the Latvian Corporate Income Tax (CIT) Regime

The primary target of the Latvian Corporate Income Tax (CIT) regime is to tax distributed profits rather than retained earnings. I remember when I first started exploring the Latvian tax system for my own business; I was initially confused by this concept. In most countries, you pay taxes on your profits as you earn them, regardless of whether you reinvest them or distribute them to shareholders. Latvia’s system flips this on its head. The CIT rate is 20% applied to distributed profits. This includes dividends, deemed dividends, expenses unrelated to business activities, and certain loans to related parties. However, retained profits and reinvestments are not taxed. This encourages businesses to invest in their growth and expansion within Latvia. This is a significant advantage for companies looking to grow. For example, if a company earns €100,000 in profit and reinvests the entire amount back into the business, no CIT is due. If the company distributes €50,000 as dividends, the CIT would be €10,000 (20% of €50,000). This unique approach fosters a business-friendly environment by allowing companies to retain more capital for future development. Furthermore, the CIT regime includes various exemptions and incentives for specific sectors and activities, making Latvia an attractive destination for foreign investment. This tax system encourages long-term growth and stability within the Latvian economy. Understanding these nuances is crucial for effective tax planning and optimization.

Exploring VAT Optimization Strategies in Latvia

VAT (Value Added Tax) in Latvia is a consumption tax applied to most goods and services. VAT optimization strategies in Latvia revolve around legally minimizing the VAT burden on your business. The standard VAT rate in Latvia is 21%, but reduced rates of 12% and 5% apply to certain goods and services, such as books, pharmaceuticals, and passenger transportation. One key optimization strategy is to ensure you are correctly classifying your goods and services to take advantage of any applicable reduced rates. Another important aspect is understanding the rules for VAT registration. Businesses are required to register for VAT if their taxable turnover exceeds €40,000 per year. However, voluntary registration can be beneficial for businesses with lower turnover, especially if they make a lot of purchases subject to VAT. By registering voluntarily, you can claim back the VAT you pay on your business expenses, effectively reducing your overall tax burden. Furthermore, understanding the rules for intra-community supplies and acquisitions is crucial for businesses engaged in cross-border trade within the EU. Properly accounting for these transactions can help you avoid potential VAT liabilities and penalties. Also, consider utilizing special schemes like the VAT refund scheme for foreign businesses. Effective VAT management and optimization require careful planning and attention to detail, but the potential benefits can be substantial. Seek expert advice to tailor a strategy that aligns with your specific business needs and objectives.

The History and Myths Surrounding Latvian Tax Planning

The history of Latvian tax planning is intertwined with its journey from Soviet control to independence and integration into the European Union. In the past, tax regulations were often opaque and subject to frequent changes, leading to uncertainty and complexity for businesses. After regaining independence in 1991, Latvia embarked on a path of economic reform, including the development of a modern and transparent tax system. One of the biggest myths surrounding Latvian tax planning is that it's all about tax evasion. This is simply not true. Effective tax planning is about legally minimizing your tax liabilities by taking advantage of available incentives, exemptions, and deductions. It's about structuring your business and transactions in a way that optimizes your tax position while remaining fully compliant with the law. Another common misconception is that only large corporations can benefit from tax planning. In reality, small and medium-sized businesses can also reap significant rewards by implementing effective tax strategies. Latvian tax law offers various opportunities for businesses of all sizes to reduce their tax burden and improve their bottom line. The key is to seek professional advice and develop a customized tax plan that aligns with your specific business needs and objectives. By dispelling these myths and understanding the history of tax reform in Latvia, businesses can approach tax planning with confidence and clarity.

Unveiling the Hidden Secrets of Latvian Tax Optimization

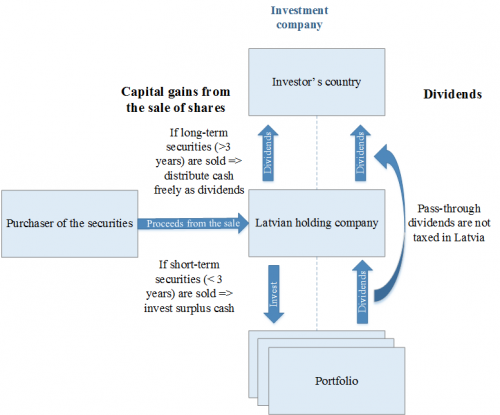

Latvian tax optimization, like any sophisticated financial strategy, holds some "hidden secrets," although they are more accurately described as less commonly known techniques. One key area often overlooked is the strategic use of holding companies. Establishing a Latvian holding company can provide significant tax advantages for businesses with international operations. Latvian holding companies benefit from participation exemption, meaning that dividends received from subsidiaries are often exempt from CIT. Additionally, capital gains from the sale of shares in subsidiaries may also be exempt from tax under certain conditions. Another hidden secret lies in the effective utilization of double taxation treaties. Latvia has signed double taxation treaties with numerous countries, which can help to avoid or minimize the tax burden on cross-border transactions. By understanding the provisions of these treaties, businesses can structure their operations to take advantage of favorable tax rates and exemptions. Furthermore, exploring the benefits of special economic zones (SEZs) can unlock significant tax incentives. SEZs in Latvia offer reduced CIT rates, property tax exemptions, and other benefits to businesses that invest in these areas. However, it's crucial to carefully evaluate the eligibility criteria and compliance requirements before investing in an SEZ. Another strategy involves optimizing transfer pricing policies for transactions between related parties. Ensure that transfer prices are arm's length to avoid potential scrutiny from tax authorities. By uncovering these hidden secrets and implementing them strategically, businesses can significantly enhance their tax optimization efforts in Latvia.

Recommendations for Effective Latvian Tax Planning

When it comes to Latvian tax planning, there are a few key recommendations I always emphasize. Firstly, seek professional advice. Navigating the Latvian tax system can be complex, and a qualified tax advisor can provide tailored guidance based on your specific circumstances. They can help you identify potential tax optimization opportunities, ensure compliance with local regulations, and avoid costly mistakes. Secondly, prioritize proper record-keeping. Accurate and complete records are essential for supporting your tax filings and demonstrating compliance. Maintain detailed records of all income, expenses, assets, and liabilities. Invest in accounting software or hire a bookkeeper to help you manage your finances effectively. Thirdly, stay informed about changes in tax law. Latvian tax laws are subject to change, so it's crucial to stay up-to-date on the latest developments. Subscribe to tax newsletters, attend seminars, and consult with your tax advisor regularly to ensure that your tax planning strategies remain compliant and effective. Fourthly, consider the long-term implications of your tax decisions. Don't focus solely on minimizing your tax liability in the short term. Think about the long-term impact of your tax strategies on your business and personal finances. Finally, be proactive rather than reactive. Don't wait until the last minute to start planning your taxes. Engage in tax planning throughout the year to identify opportunities and address potential issues early on. By following these recommendations, you can optimize your tax position in Latvia and achieve your financial goals.

Specific Tax Incentives for Businesses in Latvia

Latvia offers several specific tax incentives designed to attract investment and stimulate economic growth. One notable incentive is the support for investments in eligible projects, which can significantly reduce the corporate income tax burden. The Investment Support Programme allows companies to deduct a certain percentage of their investment costs from their taxable profit. This incentive is particularly attractive for businesses planning to expand their operations or invest in new equipment or technologies. Another key incentive is the support for research and development (R&D) activities. Companies conducting eligible R&D projects can benefit from a double deduction of R&D expenses, further reducing their taxable income. This incentive aims to encourage innovation and technological advancements within Latvia. Additionally, there are specific tax incentives available for companies operating in special economic zones (SEZs). SEZs offer reduced corporate income tax rates, property tax exemptions, and other benefits to businesses that invest in these designated areas. To qualify for these incentives, businesses typically need to meet certain criteria, such as investing a minimum amount, creating new jobs, or engaging in specific types of activities. Before making any investment decisions, it's crucial to conduct a thorough assessment of your eligibility for these incentives and carefully evaluate the compliance requirements. It is possible to combine several incentives to maximize benefits. Seeking professional advice can help you navigate the application process and ensure you meet all the necessary conditions.

Practical Tips for Maximizing Tax Efficiency in Latvia

Maximizing tax efficiency in Latvia requires a proactive and strategic approach. One practical tip is to carefully structure your business operations to take advantage of available tax incentives and deductions. For example, if you're planning to invest in new equipment, consider utilizing the Investment Support Programme to reduce your corporate income tax liability. Another tip is to optimize your salary and dividend payments. By strategically balancing your salary and dividend payments, you can minimize your personal income tax and social security contributions. Consult with a tax advisor to determine the most tax-efficient way to structure your compensation. Furthermore, consider the timing of your income and expenses. By strategically timing your income and expenses, you can defer tax liabilities to future periods. For example, you might consider delaying certain income recognition or accelerating certain deductions to reduce your tax liability in the current year. Another practical tip is to utilize tax-efficient investment vehicles. Consider investing in tax-advantaged investment accounts or funds to minimize your capital gains tax and dividend income tax. Additionally, ensure that you are claiming all eligible deductions and credits. Carefully review your expenses and identify any deductions or credits that you may be entitled to claim. Consult with a tax advisor to ensure that you are taking full advantage of all available tax benefits. By following these practical tips, you can significantly improve your tax efficiency in Latvia and maximize your financial resources.

Understanding the Micro-Enterprise Tax Regime

The Micro-Enterprise Tax (MET) regime in Latvia is designed to simplify taxation for small businesses and self-employed individuals. It offers a simplified tax system with a single tax rate on turnover, making it easier for entrepreneurs to manage their tax obligations. The MET rate varies depending on the turnover and can range from 25% to 40% on turnovers up to EUR 40,000. One of the key benefits of the MET regime is its simplicity. Businesses operating under the MET regime are not required to pay corporate income tax, personal income tax, or social security contributions separately. Instead, they pay a single tax on their turnover, which covers all these taxes. However, there are certain limitations and conditions that businesses need to consider before opting for the MET regime. For example, businesses can only operate under the MET regime if their annual turnover does not exceed EUR 40,000. Additionally, there are restrictions on the types of activities that can be carried out under the MET regime. Certain activities, such as financial services and real estate transactions, are not eligible. Before choosing the MET regime, businesses should carefully evaluate their eligibility and assess whether it is the most tax-efficient option for their specific circumstances. Consult with a tax advisor to determine whether the MET regime is the right choice for your business and to ensure that you comply with all the relevant requirements. While it offers simplicity, it's not always the most advantageous option, especially for businesses with high expenses.

Fun Facts About the Latvian Tax System

Did you know that Latvia has a relatively modern and competitive tax system compared to many other European countries? One fun fact is that Latvia was one of the first countries in the world to introduce a flat tax rate on personal income, which simplifies the tax system and promotes transparency. Another interesting fact is that Latvia's corporate income tax system is unique in that it only taxes distributed profits. This encourages companies to reinvest their earnings and grow their businesses within Latvia. Latvia also has a relatively low VAT rate compared to some other EU member states, making it an attractive destination for businesses and consumers. The Latvian tax system is constantly evolving to adapt to the changing needs of the economy and the global business environment. The government is committed to creating a fair and efficient tax system that promotes economic growth and attracts foreign investment. Furthermore, Latvia's tax authorities are known for being relatively approachable and helpful, providing guidance and support to businesses and individuals navigating the tax system. Overall, the Latvian tax system is a dynamic and evolving landscape that offers both challenges and opportunities for businesses and individuals. By understanding the key features of the system and staying informed about the latest developments, you can optimize your tax position and achieve your financial goals in Latvia.

How to Choose the Right Tax Structure in Latvia

Choosing the right tax structure in Latvia is crucial for maximizing your tax efficiency and achieving your business objectives. There are several options available, each with its own advantages and disadvantages. One common structure is a limited liability company (SIA), which offers limited liability protection and is suitable for a wide range of businesses. Another option is a joint-stock company (AS), which is typically used for larger businesses with more complex ownership structures. For small businesses and self-employed individuals, the Micro-Enterprise Tax (MET) regime can be an attractive option, offering a simplified tax system with a single tax rate on turnover. However, the MET regime has certain limitations and conditions that businesses need to consider before opting for it. Another option is to operate as a sole proprietor, which is the simplest form of business structure but offers limited liability protection. When choosing the right tax structure, consider factors such as the size and nature of your business, your liability exposure, your tax planning objectives, and your administrative capabilities. It's also important to consult with a tax advisor to determine the most tax-efficient structure for your specific circumstances. A tax advisor can help you evaluate the various options, assess the potential tax implications, and make informed decisions that align with your business goals. By carefully considering your options and seeking professional advice, you can choose a tax structure that maximizes your tax efficiency and supports the long-term success of your business.

What if You Don't Optimize Your Taxes in Latvia?

Failing to optimize your taxes in Latvia can have significant financial consequences. You could end up paying more taxes than necessary, reducing your profitability and hindering your business growth. Overpaying taxes can also limit your ability to invest in your business, hire new employees, or expand into new markets. Additionally, failing to optimize your taxes can increase your risk of non-compliance. The Latvian tax authorities have the power to audit businesses and impose penalties for non-compliance. If you're found to be in violation of tax laws, you could face fines, interest charges, and even legal action. Furthermore, failing to optimize your taxes can create a competitive disadvantage. Businesses that effectively manage their tax obligations can free up more capital to invest in their operations, giving them a competitive edge over those that don't. Ignoring tax optimization can also lead to missed opportunities. There are various tax incentives, deductions, and exemptions available in Latvia that businesses can utilize to reduce their tax burden. By failing to take advantage of these opportunities, you could be leaving money on the table. The key message is that tax optimization is not just about minimizing your tax liability; it's about maximizing your financial resources and creating a sustainable business. By prioritizing tax planning and seeking professional advice, you can avoid the pitfalls of non-optimization and unlock the full potential of your business in Latvia.

A Listicle of Key Tax Planning Strategies in Latvia

Here are a few key tax planning strategies that can help you optimize your tax burden in Latvia:

- Leverage the CIT regime: Reinvest your profits rather than distributing them to avoid immediate taxation.

- Optimize VAT management: Ensure correct classification of goods/services for reduced rates and consider voluntary VAT registration.

- Utilize holding companies: Establish a Latvian holding company to benefit from participation exemption on dividends.

- Maximize double taxation treaties: Structure your transactions to take advantage of favorable tax rates.

- Explore special economic zones (SEZs): Consider investing in SEZs to benefit from reduced CIT rates.

- Optimize transfer pricing: Ensure arm's length pricing for transactions between related parties.

- Claim eligible R&D deductions: Utilize the double deduction for eligible R&D expenses.

- Participate in the Investment Support Programme: Deduct a percentage of investment costs from taxable profit.

- Choose the right business structure: Select a tax-efficient business structure such as SIA or MET.

- Seek professional tax advice: Consult with a tax advisor to develop a customized tax plan.

Question and Answer Section About Latvian Tax Optimization

Q: What is the main advantage of the Latvian corporate income tax (CIT) system?

A: The main advantage is that CIT is only levied on distributed profits, while retained earnings and reinvestments are not taxed.

Q: What is the standard VAT rate in Latvia?

A: The standard VAT rate is 21%, but reduced rates of 12% and 5% apply to certain goods and services.

Q: What is a Latvian holding company and why is it beneficial?

A: A Latvian holding company is a company established in Latvia to hold shares in other companies. It is beneficial because dividends received and capital gains from the sale of shares may be exempt from CIT.

Q: Is it worth seeking professional advice for tax planning in Latvia?

A: Yes, it is highly recommended. A qualified tax advisor can provide tailored guidance based on your specific circumstances, ensure compliance with local regulations, and identify potential tax optimization opportunities.

Conclusion of Latvian Tax Optimization

Navigating the Latvian tax landscape effectively requires a blend of understanding local regulations, strategic planning, and proactive management. By leveraging the unique aspects of the Latvian tax system, such as the CIT regime on distributed profits, VAT optimization strategies, and the benefits of holding companies, businesses and individuals can significantly reduce their tax burden and enhance their financial success. Remember that seeking professional advice is crucial for developing a customized tax plan that aligns with your specific needs and objectives. Tax optimization in Latvia is not just about minimizing your tax liability; it's about maximizing your resources and creating a sustainable future.

Post a Comment