Saver's Credit: Retirement Contribution Tax Benefits

Saving for retirement can feel like climbing a never-ending staircase, especially when you're also juggling everyday expenses. But what if I told you there's a tax credit designed to help make that climb a little easier? It's called the Saver's Credit, and it could be the key to unlocking significant tax savings while securing your future.

Many people struggle with the misconception that saving for retirement is only for the wealthy. Some might feel overwhelmed by the complexity of tax laws or simply believe that they don't earn enough to make a meaningful impact on their retirement savings. This often leads to missed opportunities for tax advantages and a less secure financial future.

The Saver's Credit is specifically targeted towards low-to-moderate income taxpayers who are actively saving for retirement. It's designed to incentivize and reward those who are making an effort to build a nest egg, even when money is tight. It's a way for the government to say, "We see you, and we want to help."

This article explores the ins and outs of the Saver's Credit, a valuable tax benefit for eligible taxpayers contributing to retirement accounts. We'll delve into eligibility requirements, contribution limits, how to claim the credit, common myths, and tips for maximizing your savings. Understanding this credit can significantly reduce your tax burden and boost your retirement savings. Key terms include retirement contributions, tax credit, eligibility, AGI, Form 8880, and retirement planning.

Who is the Saver's Credit For?

I remember the first time I heard about the Saver's Credit. I was volunteering at a tax clinic, and a woman came in, clearly stressed about her finances. She was working two part-time jobs and barely making ends meet. When we started reviewing her tax information, we realized she qualified for the Saver's Credit. The look of relief on her face was incredible. It was a reminder that even small amounts can make a big difference in someone's life. The Saver's Credit is specifically for individuals and families with modest incomes who are actively saving for retirement. It's not just for those who are already comfortable; it's a helping hand for those who are working hard to build a secure future. The credit is designed to offset some of the costs of saving, making it more accessible for those who might otherwise struggle to do so. Income limits are a key factor in determining eligibility. For example, a single filer might have a different income threshold than a married couple filing jointly. These limits are adjusted annually, so it's important to check the current guidelines. The type of retirement account also matters. Contributions to traditional IRAs, Roth IRAs, 401(k)s, and certain other retirement plans can qualify for the credit. The Saver's Credit is a nonrefundable credit, meaning it can reduce your tax liability to zero, but you won't receive any of it back as a refund. It’s a powerful tool for lower and middle income earners who are proactively planning for their financial future.

What is the Saver's Credit?

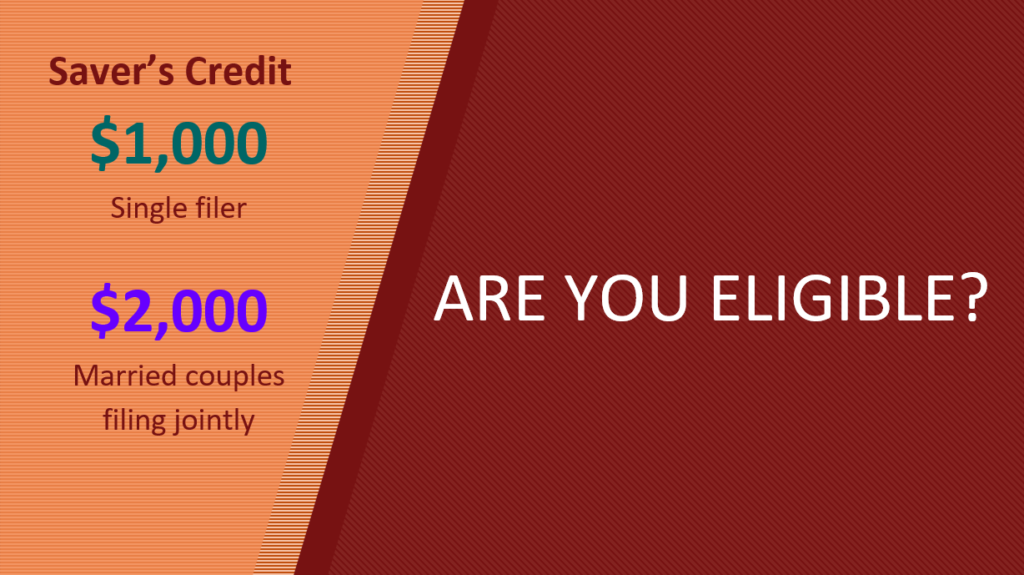

The Saver's Credit, officially known as the Retirement Savings Contributions Credit, is a tax credit designed to encourage low-to-moderate income taxpayers to save for retirement. It essentially reduces your tax bill based on the amount you contribute to qualifying retirement accounts. Think of it as a financial pat on the back for being proactive about your future. It directly lowers the amount of taxes you owe, dollar for dollar. This is different from a tax deduction, which only reduces your taxable income. The credit can be worth up to $1,000 for single filers and up to $2,000 for married couples filing jointly. However, the exact amount of the credit depends on your adjusted gross income (AGI) and your contribution amount. The AGI thresholds are updated annually, so it's important to check the IRS guidelines for the current year. There are different credit rates available: 50%, 20%, and 10%. The lower your AGI, the higher the potential credit rate. For instance, someone with a very low income might qualify for the 50% credit, meaning they could receive a credit equal to half of their retirement contributions, up to the maximum limits. To claim the Saver's Credit, you'll need to file Form 8880, Credit for Qualified Retirement Savings Contributions, along with your tax return. This form requires you to provide information about your retirement contributions and your AGI. It's a relatively straightforward form, but it's always a good idea to double-check your entries to ensure accuracy. Keep in mind that certain distributions from retirement accounts can affect your eligibility for the credit. For example, if you take a distribution from your IRA during the year, it could reduce the amount of your contribution that qualifies for the credit.

History and Myths of the Saver's Credit

The Saver's Credit was established to address the challenge of low retirement savings rates among low-to-moderate income individuals. Lawmakers recognized that many people in this income bracket were struggling to save for retirement due to competing financial priorities. The credit was designed to provide an incentive to encourage saving, even in the face of these challenges. One common myth about the Saver's Credit is that it's only for people who are already wealthy. This is simply not true. The credit is specifically targeted towards those with modest incomes who might not otherwise have the resources to save for retirement. Another myth is that the credit is too complicated to claim. While tax forms can sometimes seem daunting, Form 8880, which is used to claim the Saver's Credit, is relatively straightforward. The IRS also provides resources and assistance to help taxpayers understand and claim the credit. A third myth is that the credit isn't worth the effort. While the maximum credit amount might not seem like a huge sum, it can still make a significant difference, especially for those with limited financial resources. Even a small tax break can free up cash for other essential expenses or further boost retirement savings. It's important to dispel these myths and spread awareness about the Saver's Credit so that more eligible taxpayers can take advantage of this valuable benefit. By understanding the true purpose and mechanics of the credit, more people can be empowered to save for a secure retirement.

Hidden Secrets of the Saver's Credit

One of the lesser-known aspects of the Saver's Credit is that it can be claimed in addition to other tax benefits, such as the IRA deduction. This means that you can potentially reduce your taxable income and receive a tax credit for the same retirement contributions. This stacking of benefits can significantly amplify your tax savings. Another hidden secret is that the Saver's Credit can be claimed even if you're contributing to a retirement account through your employer. As long as you meet the income requirements and contribute to a qualifying plan, such as a 401(k) or 403(b), you can still be eligible for the credit. It's also worth noting that the Saver's Credit can be claimed for contributions made to a spouse's retirement account. This can be particularly beneficial for married couples where one spouse has a lower income and is not able to contribute as much to their own retirement account. By contributing to the spouse's account, the couple can potentially maximize their Saver's Credit. To truly unlock the hidden secrets of the Saver's Credit, it's crucial to understand the interplay between income limits, contribution amounts, and credit rates. By carefully planning your retirement contributions, you can strategically position yourself to receive the maximum credit amount. Consult with a tax professional to develop a personalized savings strategy that takes full advantage of the Saver's Credit and other available tax benefits.

Recommendations of the Saver's Credit

My top recommendation for anyone who thinks they might be eligible for the Saver's Credit is to explore whether it can help make saving easier. Don't assume that you don't qualify. It's worth taking the time to research the income limits and eligibility requirements to see if you can benefit. Start by gathering your tax information, including your adjusted gross income (AGI), and reviewing the IRS guidelines for the current tax year. Several online resources and tax preparation software programs can help you determine your eligibility for the Saver's Credit. If you're still unsure, consider seeking advice from a qualified tax professional. They can assess your specific situation and provide personalized guidance on whether you qualify for the credit and how to claim it properly. Another recommendation is to prioritize retirement savings, even if it's just a small amount. Every dollar you contribute can make a difference, both in terms of your retirement nest egg and your potential tax savings. Even if you can only afford to contribute a small amount each month, it's better than nothing. Consider setting up automatic contributions to your retirement account to make saving easier and more consistent. Finally, don't forget to file Form 8880, Credit for Qualified Retirement Savings Contributions, with your tax return. This form is required to claim the Saver's Credit, and it's important to complete it accurately and thoroughly. By following these recommendations, you can maximize your chances of receiving the Saver's Credit and building a more secure financial future.

Understanding Adjusted Gross Income (AGI)

Adjusted Gross Income (AGI) is a crucial factor in determining your eligibility for the Saver's Credit. It's essentially your gross income (total income before deductions) minus certain deductions, such as contributions to traditional IRAs, student loan interest payments, and self-employment taxes. Your AGI is listed on line 11 of Form 1040. The IRS uses AGI to determine your eligibility for various tax credits and deductions, including the Saver's Credit. The AGI thresholds for the Saver's Credit vary depending on your filing status. For example, a single filer will have a different AGI limit than a married couple filing jointly. These limits are adjusted annually, so it's essential to check the latest IRS guidelines. It's important to note that certain types of income are not included in AGI, such as Social Security benefits (unless a portion of them is taxable) and tax-exempt interest. However, most forms of income, including wages, salaries, tips, and investment income, are included in AGI. To calculate your AGI accurately, it's best to gather all of your income and deduction information and use a tax preparation software program or consult with a tax professional. By understanding your AGI and how it affects your eligibility for the Saver's Credit, you can make informed decisions about your retirement savings and tax planning.

Tips for Maximizing the Saver's Credit

To maximize your Saver's Credit, one key strategy is to contribute the maximum amount allowed to your retirement accounts while staying within the AGI limits. This will ensure that you're receiving the largest possible credit. Another tip is to coordinate your retirement contributions with your overall tax planning strategy. Consider factors such as your estimated income, deductions, and other tax credits when deciding how much to contribute to your retirement accounts. If you're married, discuss your retirement savings plans with your spouse to determine the best way to maximize your joint tax benefits. If one spouse has a lower income, it might make sense for the higher-earning spouse to contribute to the lower-earning spouse's retirement account. Consider tax-advantaged retirement accounts, such as traditional IRAs, Roth IRAs, and 401(k)s. These accounts offer different tax benefits, and the best choice for you will depend on your individual circumstances. Contributing to a Roth IRA might be more beneficial if you expect to be in a higher tax bracket in retirement, while contributing to a traditional IRA might be more beneficial if you're in a lower tax bracket now. Keep accurate records of your retirement contributions. This will make it easier to file Form 8880 and claim the Saver's Credit when you file your taxes. Review your retirement savings and tax plan regularly. As your income and financial situation change, you might need to adjust your savings strategy to continue maximizing your tax benefits. It's always a good idea to consult with a tax professional or financial advisor to ensure that you're making the best decisions for your individual circumstances.

Understanding Credit Rates

The Saver's Credit offers different credit rates based on your adjusted gross income (AGI). The higher your AGI, the lower the credit rate. The available credit rates are 50%, 20%, and 10%. To qualify for the 50% credit rate, your AGI must be below a certain threshold, which varies depending on your filing status. For example, a single filer might need to have an AGI below $21,750 to qualify for the 50% credit rate in 2023. The 20% credit rate is available to those with slightly higher AGIs, while the 10% credit rate is available to those with the highest AGIs who still meet the eligibility requirements. It's important to understand that the credit rate applies to the amount of your retirement contributions, up to a certain limit. For example, if you're eligible for the 50% credit rate and you contribute $2,000 to your retirement account, you could receive a credit of $1,000. However, the maximum contribution that qualifies for the Saver's Credit is $2,000 for single filers and $4,000 for married couples filing jointly. Even if you contribute more than these amounts, you'll only receive the credit on the first $2,000 or $4,000, respectively. To determine which credit rate you qualify for, consult the IRS guidelines for the current tax year. These guidelines provide the specific AGI thresholds for each credit rate, based on your filing status. By understanding the credit rates and how they apply to your retirement contributions, you can make informed decisions about your savings and tax planning.

Fun Facts About the Saver's Credit

Did you know that the Saver's Credit can be claimed even if you're receiving Social Security benefits? As long as you meet the income requirements and contribute to a qualifying retirement account, you can still be eligible for the credit, regardless of your Social Security status. Another fun fact is that the Saver's Credit is a nonrefundable credit. This means that it can reduce your tax liability to zero, but you won't receive any of it back as a refund. For example, if your tax liability is $500 and you qualify for a $1,000 Saver's Credit, your tax liability will be reduced to zero, but you won't receive the remaining $500 as a refund. It's also interesting to note that the Saver's Credit has been around for quite some time. It was first enacted as part of the Economic Growth and Tax Relief Reconciliation Act of 2001, and it has been helping low-to-moderate income taxpayers save for retirement ever since. A lesser-known fact is that certain distributions from retirement accounts can disqualify you from claiming the Saver's Credit. For example, if you take a distribution from your IRA during the year, it could reduce the amount of your contribution that qualifies for the credit. To ensure that you're maximizing your chances of receiving the Saver's Credit, it's essential to avoid taking unnecessary distributions from your retirement accounts. Another fun fact is that the IRS provides various resources and assistance to help taxpayers understand and claim the Saver's Credit. These resources include publications, online tools, and toll-free phone support. By taking advantage of these resources, you can increase your knowledge of the Saver's Credit and ensure that you're claiming it correctly.

How to Claim the Saver's Credit

Claiming the Saver's Credit is a relatively straightforward process, but it does require you to take a few specific steps. First, you'll need to determine your eligibility for the credit. This involves assessing your adjusted gross income (AGI) and ensuring that you meet the income requirements for your filing status. You'll also need to make sure that you've contributed to a qualifying retirement account, such as a traditional IRA, Roth IRA, 401(k), or 403(b). Once you've confirmed your eligibility, the next step is to complete Form 8880, Credit for Qualified Retirement Savings Contributions. This form requires you to provide information about your retirement contributions and your AGI. You'll also need to indicate the type of retirement account you contributed to and the amount of your contribution. Be sure to complete Form 8880 accurately and thoroughly. Double-check your entries before submitting it to ensure that you haven't made any mistakes. You'll need to attach Form 8880 to your tax return when you file. You can file your tax return electronically or by mail. If you're filing electronically, most tax preparation software programs will guide you through the process of completing Form 8880 and attaching it to your return. If you're filing by mail, you'll need to print out Form 8880 and include it with your paper tax return. Remember to keep a copy of Form 8880 and your tax return for your records. This will be helpful if you need to refer to it in the future. If you have any questions about claiming the Saver's Credit, consult with a tax professional or contact the IRS for assistance.

What if You Don't Qualify for the Saver's Credit?

Even if you don't qualify for the Saver's Credit, there are still plenty of other ways to save for retirement and reduce your tax burden. One option is to contribute to a traditional IRA. Contributions to a traditional IRA are typically tax-deductible, which means they can reduce your taxable income. The amount you can deduct depends on your income and whether you're covered by a retirement plan at work. Another option is to contribute to a 401(k) or 403(b) plan through your employer. Contributions to these plans are typically made on a pre-tax basis, which means they can also reduce your taxable income. Many employers also offer matching contributions to these plans, which can significantly boost your retirement savings. If you're self-employed, you have even more retirement savings options, such as a SEP IRA or a SIMPLE IRA. These plans allow you to contribute a portion of your self-employment income to a retirement account, and the contributions are typically tax-deductible. Regardless of your income or employment status, it's always a good idea to consult with a financial advisor to develop a personalized retirement savings plan. A financial advisor can help you assess your financial goals, determine the best retirement savings strategies for your situation, and choose the right investment options. Even if you can't take advantage of the Saver's Credit, there are still many ways to save for retirement and secure your financial future. The key is to start early, save consistently, and seek professional advice when needed.

Listicle of Saver's Credit

Here's a quick list of the key things you need to know about the Saver's Credit:

- It's a tax credit for low-to-moderate income taxpayers who save for retirement.

- It can be worth up to $1,000 for single filers and $2,000 for married couples filing jointly.

- The exact amount of the credit depends on your adjusted gross income (AGI) and your contribution amount.

- To claim the credit, you'll need to file Form 8880, Credit for Qualified Retirement Savings Contributions, with your tax return.

- Contributions to traditional IRAs, Roth IRAs, 401(k)s, and certain other retirement plans can qualify for the credit.

- The credit rates are 50%, 20%, and 10%, depending on your AGI.

- The higher your AGI, the lower the credit rate.

- The AGI thresholds for the credit vary depending on your filing status.

- The credit is nonrefundable, meaning it can reduce your tax liability to zero, but you won't receive any of it back as a refund.

- Certain distributions from retirement accounts can affect your eligibility for the credit.

- You can claim the credit in addition to other tax benefits, such as the IRA deduction.

- Even if you don't qualify for the credit, there are still other ways to save for retirement and reduce your tax burden.

- Consult with a tax professional to develop a personalized savings strategy that takes full advantage of the Saver's Credit and other available tax benefits.

- Don't assume that you don't qualify for the credit. It's worth taking the time to research the eligibility requirements to see if you can benefit.

- Prioritize retirement savings, even if it's just a small amount. Every dollar you contribute can make a difference.

Question and Answer about Saver's Credit

Here are some common questions and answers about the Saver's Credit:

Q: What is the Saver's Credit?

A: The Saver's Credit, also known as the Retirement Savings Contributions Credit, is a tax credit designed to encourage low-to-moderate income taxpayers to save for retirement. It reduces your tax bill based on the amount you contribute to qualifying retirement accounts.

Q: Who is eligible for the Saver's Credit?

A: To be eligible for the Saver's Credit, you must be at least 18 years old, not a student, and not claimed as a dependent on someone else's return. You must also meet certain income requirements, which vary depending on your filing status.

Q: How much is the Saver's Credit worth?

A: The Saver's Credit can be worth up to $1,000 for single filers and $2,000 for married couples filing jointly. The exact amount of the credit depends on your adjusted gross income (AGI) and your contribution amount.

Q: How do I claim the Saver's Credit?

A: To claim the Saver's Credit, you'll need to file Form 8880, Credit for Qualified Retirement Savings Contributions, with your tax return. This form requires you to provide information about your retirement contributions and your AGI.

Conclusion of Saver's Credit

The Saver's Credit is a valuable tax benefit for low-to-moderate income taxpayers who are actively saving for retirement. By understanding the eligibility requirements, contribution limits, and claiming procedures, you can potentially reduce your tax burden and boost your retirement savings. Don't miss out on this opportunity to secure your financial future. Take the time to explore whether you qualify for the Saver's Credit and start saving for retirement today.

Post a Comment