Tax Loss Harvesting: Advanced Investment Tax Strategy Guide

Imagine being able to turn your investment losses into tax savings. It sounds like financial wizardry, right? Well, it's not magic, but rather a smart investment strategy called tax-loss harvesting. It's a way to potentially lower your tax bill by strategically selling investments at a loss.

Navigating the world of investments can feel like walking through a minefield, especially when taxes enter the equation. Juggling market volatility, keeping up with complex tax rules, and trying to make the most of your portfolio can be incredibly daunting. It's easy to feel overwhelmed and miss out on opportunities to optimize your investment strategy.

This guide is designed to provide a clear and comprehensive understanding of tax-loss harvesting, an advanced investment tax strategy. It's for investors who want to take a more proactive approach to managing their portfolios and minimizing their tax liabilities. We'll break down the complexities of tax-loss harvesting into easy-to-understand concepts, helping you determine if it's the right strategy for you.

In this guide, we'll cover the fundamentals of tax-loss harvesting, including how it works, the potential benefits, and the important rules and regulations to keep in mind. We'll explore how to identify opportunities for tax-loss harvesting within your portfolio, avoid common pitfalls like the wash-sale rule, and integrate this strategy into your overall investment plan. The key concepts you'll learn about are capital gains, capital losses, tax deductions, and investment management. Ultimately, the goal is to empower you to make informed decisions and potentially improve your after-tax investment returns.

Understanding Capital Gains and Losses

My first real foray into investing was a bit of a rollercoaster. I bought a stock based on a tip from a friend, and for a while, it soared. I felt like a genius! But then, the market took a turn, and my "winning" stock started to plummet. I held on, hoping it would rebound, but it just kept falling. Eventually, I sold it, taking a significant loss. It stung, but it also taught me a valuable lesson about risk and the importance of having a well-defined investment strategy.

That experience, while painful at the time, opened my eyes to the concept of capital gains and losses. A capital gain is the profit you make when you sell an asset, like a stock or bond, for more than you bought it for. Conversely, a capital loss is what happens when you sell an asset for less than you bought it for. These gains and losses have a direct impact on your taxes. Capital gains are taxed, while capital losses can be used to offset those gains, potentially lowering your overall tax bill. This is where tax-loss harvesting comes into play.

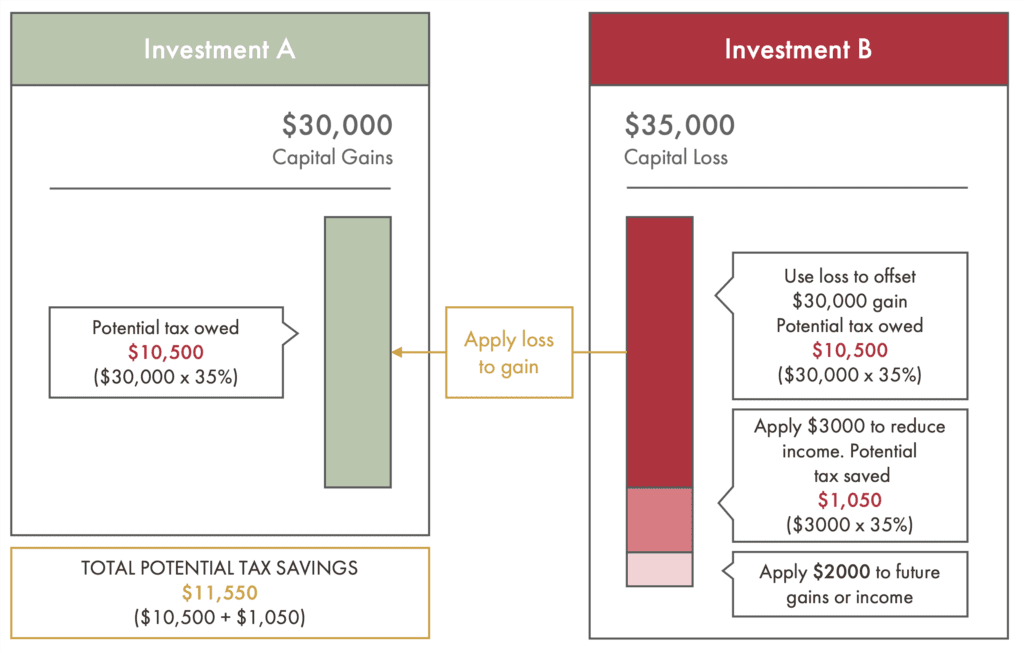

Tax-loss harvesting is a strategy that involves selling investments that have lost value to realize those losses. You can then use these losses to offset capital gains, reducing the amount of taxes you owe. In some cases, if your capital losses exceed your capital gains, you can even deduct up to $3,000 of those losses from your ordinary income each year. The excess loss can be carried forward to future years to offset future gains or income. This is particularly advantageous for investors in high tax brackets, as it can significantly reduce their tax burden.

The Mechanics of Tax-Loss Harvesting

Tax-loss harvesting is a strategic technique used by investors to minimize their tax burden by strategically selling losing investments to offset capital gains. This strategy involves selling investments that have decreased in value to realize a capital loss. These losses can then be used to offset capital gains, which are profits made from selling investments at a higher price than their purchase price. By offsetting gains with losses, investors can reduce the amount of taxes they owe on their investment profits.

The fundamental principle behind tax-loss harvesting lies in the tax code's allowance for using capital losses to offset capital gains. For instance, if an investor has realized $5,000 in capital gains from selling a profitable stock, they can use up to $5,000 in capital losses from selling a losing investment to completely offset those gains. This results in no tax liability on the capital gains. Furthermore, if an investor's capital losses exceed their capital gains, they can deduct up to $3,000 of the excess loss from their ordinary income. Any remaining losses can be carried forward to future tax years, providing ongoing tax benefits.

However, there's a crucial rule to be aware of: the "wash-sale" rule. This rule prevents investors from immediately repurchasing the same or a "substantially identical" investment within 30 days before or after the sale. If the wash-sale rule is triggered, the capital loss is disallowed for that tax year, and it's added to the cost basis of the newly purchased investment. To avoid triggering the wash-sale rule, investors can purchase similar but not identical investments, such as a different ETF tracking the same index or a stock in the same industry but from a different company. Proper planning and record-keeping are essential for successful tax-loss harvesting. Consult with a tax professional to ensure compliance with all relevant regulations and to determine the most appropriate strategies for your individual financial situation.

History and Myths of Tax-Loss Harvesting

The concept of tax-loss harvesting has been around for quite some time, evolving alongside changes in tax laws and investment strategies. While the exact origins are difficult to pinpoint, the underlying principle of offsetting gains with losses has likely been practiced informally for decades. As tax codes became more complex and investment options expanded, the need for a more systematic approach to tax management grew, leading to the formalization of tax-loss harvesting strategies.

One common myth is that tax-loss harvesting is only for the wealthy. While high-net-worth individuals certainly benefit from this strategy, it can be valuable for any investor with taxable investment accounts. Another misconception is that it's a complex and time-consuming process. While it does require some understanding of tax rules and investment options, it can be streamlined with the help of financial advisors or automated tools. Finally, some believe that tax-loss harvesting is a guaranteed way to reduce taxes. While it can be an effective strategy, its success depends on market conditions, individual investment choices, and the specific tax situation.

Throughout history, tax-loss harvesting has adapted to various economic climates and market conditions. In periods of market volatility, the opportunities for tax-loss harvesting often increase, as investors are more likely to experience losses in their portfolios. However, it's important to remember that tax-loss harvesting is not a market-timing strategy. It's a long-term approach to managing taxes within a well-diversified investment portfolio. The key is to remain disciplined, avoid emotional decision-making, and focus on the overall financial goals. By understanding the history and dispelling the myths surrounding tax-loss harvesting, investors can make informed decisions and potentially improve their after-tax investment returns.

Hidden Secrets of Tax-Loss Harvesting

One often overlooked aspect of tax-loss harvesting is its potential to improve portfolio diversification. When you sell a losing investment to realize a tax loss, you have the opportunity to reallocate those funds into a different asset class or investment strategy. This can help to reduce overall portfolio risk and potentially increase long-term returns. For example, if you sell a losing technology stock, you could reinvest the proceeds into a more diversified index fund or a bond fund.

Another hidden secret is the power of "tax-gain harvesting." While the focus is usually on losses, there may be times when it makes sense to intentionally realize gains. For example, if you anticipate being in a lower tax bracket in the future, you could strategically sell some appreciated assets to pay taxes at a lower rate. This can be particularly beneficial for retirees or individuals who expect a significant decrease in income. However, it's crucial to carefully consider the potential tax implications and consult with a financial advisor before implementing tax-gain harvesting.

Furthermore, understanding the "substantially identical" rule is paramount. While you can't immediately repurchase the same investment you sold for a loss, you can invest in similar but not identical assets. For example, you could sell an S&P 500 ETF and buy a different S&P 500 ETF from a different provider. Or, you could sell a stock in a particular industry and buy a stock in a similar but different company within the same industry. By strategically navigating these nuances, investors can maximize the benefits of tax-loss harvesting while minimizing the risk of violating the wash-sale rule. It's about finding the right balance between tax efficiency and maintaining a well-diversified portfolio that aligns with your long-term investment goals.

Recommendation of Tax-Loss Harvesting

Tax-loss harvesting isn't a one-size-fits-all solution, and it's crucial to determine if it aligns with your specific financial situation and investment goals. For investors in high tax brackets with taxable investment accounts, it can be a highly effective strategy for reducing their tax burden. However, for those with primarily tax-advantaged accounts, such as 401(k)s or IRAs, the benefits may be limited.

Before implementing tax-loss harvesting, it's essential to carefully assess your portfolio and identify any potential opportunities for realizing losses. Consider your risk tolerance, investment time horizon, and overall financial plan. If you're unsure whether tax-loss harvesting is right for you, consult with a qualified financial advisor or tax professional. They can help you analyze your individual circumstances and develop a customized strategy that meets your needs.

Furthermore, it's important to remember that tax-loss harvesting is just one piece of the puzzle. It should be integrated into a comprehensive investment plan that includes diversification, asset allocation, and regular portfolio rebalancing. Don't let tax considerations drive your investment decisions entirely. The primary goal should always be to achieve your long-term financial goals, while minimizing taxes along the way. By taking a holistic approach to investment management and seeking professional guidance when needed, you can make informed decisions and potentially improve your after-tax investment returns. Tax-loss harvesting can be a valuable tool in your arsenal, but it's most effective when used strategically and in conjunction with other sound investment practices.

Automated Tax-Loss Harvesting

Automated tax-loss harvesting is becoming increasingly popular, offering investors a more efficient and hands-off approach to managing their taxes. These automated systems continuously monitor your portfolio for opportunities to realize losses and automatically execute trades to harvest those losses. This can save you time and effort, while also ensuring that you don't miss out on potential tax benefits. However, it's important to carefully evaluate the fees and features of these automated systems before signing up. Some may charge a percentage of assets under management, while others may have a flat fee. Additionally, consider the level of customization and control you have over the process.

One of the key advantages of automated tax-loss harvesting is its ability to identify and execute trades in a timely manner. Market conditions can change rapidly, and opportunities for tax-loss harvesting may be fleeting. Automated systems can react quickly to these changes, ensuring that you capture as many losses as possible. However, it's crucial to understand how these systems work and to monitor their performance regularly. Make sure they are aligned with your overall investment goals and risk tolerance.

Another important consideration is the potential for "drift" in your portfolio. When you sell an investment to realize a loss, you'll need to replace it with a similar but not identical asset. Over time, these substitutions can cause your portfolio to deviate from its original asset allocation. Automated tax-loss harvesting systems should have mechanisms in place to prevent excessive drift and to rebalance your portfolio back to its target allocation. By carefully selecting an automated system and monitoring its performance, you can potentially simplify the tax-loss harvesting process and improve your after-tax investment returns.

Tips for Successful Tax-Loss Harvesting

Successful tax-loss harvesting requires careful planning, diligent record-keeping, and a thorough understanding of the relevant tax rules. One of the most important tips is to maintain accurate records of all your investment transactions, including purchase dates, sale dates, and cost basis. This will make it easier to identify opportunities for tax-loss harvesting and to accurately calculate your capital gains and losses.

Another crucial tip is to be mindful of the wash-sale rule. As mentioned earlier, this rule prevents you from immediately repurchasing the same or a substantially identical investment within 30 days before or after the sale. To avoid triggering the wash-sale rule, consider investing in similar but not identical assets, such as a different ETF tracking the same index or a stock in the same industry but from a different company. You can also wait more than 30 days before repurchasing the original investment.

Furthermore, it's important to be strategic about which investments you choose to sell for a loss. Consider the potential for future growth and the overall role of the investment in your portfolio. Don't simply sell investments based solely on their current losses. Evaluate the long-term outlook and make sure the sale aligns with your overall investment goals. By following these tips and seeking professional guidance when needed, you can maximize the benefits of tax-loss harvesting and improve your after-tax investment returns. Remember, it's a long-term strategy that requires patience, discipline, and a thorough understanding of your own financial situation.

The Importance of Cost Basis

Accurate cost basis tracking is fundamental to successful tax-loss harvesting. Cost basis is the original price you paid for an investment, and it's used to calculate your capital gains and losses when you sell that investment. Without accurate cost basis records, it's difficult to determine the actual amount of your gains or losses, which can lead to errors on your tax return. Fortunately, many brokerage firms now track cost basis automatically, but it's always a good idea to double-check and ensure the information is accurate.

There are several methods for calculating cost basis, including first-in, first-out (FIFO), last-in, first-out (LIFO), and specific identification. FIFO assumes that the first shares you purchased are the first shares you sell, while LIFO assumes the opposite. Specific identification allows you to choose which shares you want to sell, which can be beneficial for tax planning purposes. The IRS generally allows you to choose the cost basis method you want to use, but you must be consistent from year to year.

If you've inherited investments or received them as a gift, the cost basis may be different from the original purchase price. In the case of inherited investments, the cost basis is typically the fair market value of the investment on the date of the decedent's death. For gifts, the cost basis is generally the same as the donor's cost basis, unless the fair market value of the investment on the date of the gift is less than the donor's cost basis, in which case the recipient's cost basis is the fair market value. By understanding the importance of cost basis and accurately tracking your investment transactions, you can ensure that you're maximizing the benefits of tax-loss harvesting and minimizing your tax liabilities.

Fun Facts of Tax-Loss Harvesting

Did you know that tax-loss harvesting can be done year-round, not just at the end of the year? While many investors focus on tax planning in December, opportunities for tax-loss harvesting can arise throughout the year, especially during periods of market volatility. By staying vigilant and monitoring your portfolio regularly, you can potentially capture more losses and reduce your tax burden.

Another fun fact is that tax-loss harvesting can be combined with other tax-saving strategies, such as donating appreciated assets to charity. By donating assets that have increased in value, you can avoid paying capital gains taxes on those assets and also receive a charitable deduction. This can be a particularly effective strategy for high-net-worth individuals who are charitably inclined.

Furthermore, tax-loss harvesting can be a family affair. If you have multiple investment accounts, including accounts for your children or other family members, you can coordinate your tax-loss harvesting strategies to maximize the overall tax benefits for your family. However, it's important to be aware of the related-party rules, which may limit the ability to deduct losses on transactions with certain family members. By understanding these fun facts and strategically planning your tax-loss harvesting efforts, you can potentially unlock even greater tax savings and improve your overall financial well-being. Remember, it's about thinking creatively and taking a holistic approach to tax planning.

How to Tax-Loss Harvesting

The process of tax-loss harvesting involves several key steps. First, you need to identify investments in your taxable accounts that have unrealized losses, meaning they are currently worth less than what you paid for them. Review your portfolio statements and look for investments that have declined in value.

Next, determine if selling these investments and realizing the losses makes sense in your overall investment strategy. Consider the potential for future growth, the role of the investment in your portfolio, and your risk tolerance. Don't simply sell investments based solely on their current losses. Evaluate the long-term outlook and make sure the sale aligns with your overall investment goals.

Once you've identified suitable investments to sell, execute the trades through your brokerage account. Be sure to keep accurate records of the sale date, sale price, and cost basis. After selling the investments, you'll need to decide how to reinvest the proceeds. To avoid triggering the wash-sale rule, you can't immediately repurchase the same or a substantially identical investment within 30 days. Consider investing in similar but not identical assets, such as a different ETF tracking the same index or a stock in the same industry but from a different company. Finally, at the end of the tax year, you'll need to report your capital gains and losses on your tax return. Use Form 8949, Sales and Other Dispositions of Capital Assets, to report each transaction and Schedule D (Form 1040), Capital Gains and Losses, to calculate your overall capital gains and losses. By following these steps and seeking professional guidance when needed, you can effectively implement tax-loss harvesting and potentially reduce your tax liabilities.

What if Tax-Loss Harvesting?

What if you fail to implement tax-loss harvesting? The primary consequence is that you may end up paying more in taxes than necessary. By not strategically selling losing investments to offset capital gains, you're missing out on an opportunity to reduce your tax burden. This can be particularly significant for investors in high tax brackets with substantial capital gains.

Furthermore, by not actively managing your portfolio for tax efficiency, you may be hindering your long-term investment returns. Taxes can eat into your profits and reduce the amount of money you have available to reinvest. Over time, this can have a significant impact on your overall wealth accumulation.

However, it's also important to consider the potential risks of tax-loss harvesting. If you're not careful, you could trigger the wash-sale rule and invalidate your losses. Additionally, if you're constantly selling and repurchasing investments, you may incur transaction costs that offset the tax benefits. Therefore, it's crucial to weigh the potential benefits and risks of tax-loss harvesting carefully and to seek professional guidance when needed. A financial advisor can help you assess your individual circumstances and develop a customized tax-loss harvesting strategy that aligns with your overall investment goals. Don't be afraid to ask for help and to take a proactive approach to managing your taxes.

Listicle of Tax-Loss Harvesting

1.Understand Capital Gains and Losses: Learn the basics of how capital gains and losses are taxed.

2.Identify Losing Investments: Regularly review your portfolio for opportunities to harvest losses.

3.Consider Your Investment Strategy: Ensure that selling losing investments aligns with your long-term goals.

4.Be Mindful of the Wash-Sale Rule: Avoid repurchasing the same or a substantially identical investment within 30 days.

5.Reinvest Strategically: Replace the sold investments with similar but not identical assets.

6.Keep Accurate Records: Maintain detailed records of all your investment transactions.

7.Consider Automated Tax-Loss Harvesting: Explore automated systems for a more efficient approach.

8.Consult with a Professional: Seek guidance from a financial advisor or tax professional.

9.Integrate with Your Overall Plan: Incorporate tax-loss harvesting into your comprehensive investment strategy.

10.Stay Vigilant: Monitor your portfolio regularly and adjust your strategy as needed.

Question and Answer

Q: What happens if I accidentally violate the wash-sale rule?

A: If you violate the wash-sale rule, the IRS will disallow the capital loss you claimed on your tax return. However, the disallowed loss is not permanently lost. Instead, it's added to the cost basis of the replacement investment, which will affect your capital gain or loss when you eventually sell that replacement investment.

Q: Can I use tax-loss harvesting in my retirement accounts?

A: No, tax-loss harvesting is generally not applicable in tax-advantaged retirement accounts like 401(k)s or IRAs. This is because the gains and losses within these accounts are not taxed in the same way as in taxable investment accounts.

Q: How often should I perform tax-loss harvesting?

A: The frequency of tax-loss harvesting depends on market conditions and your individual investment strategy. Some investors may do it regularly throughout the year, while others may only do it during periods of market volatility.

Q: What are some alternatives to investing in a "substantially identical" asset after selling for a loss?

A: You can invest in a similar but not identical asset, such as a different ETF tracking the same index, a stock in the same industry but from a different company, or a broader market index fund. You can also invest in a different asset class altogether, such as bonds or real estate.

Conclusion of Tax Loss Harvesting: Advanced Investment Tax Strategy Guide

Tax-loss harvesting is a powerful tool that can help investors minimize their tax liabilities and potentially improve their after-tax investment returns. However, it's not a magic bullet and requires careful planning, diligent record-keeping, and a thorough understanding of the relevant tax rules. By understanding the fundamentals of tax-loss harvesting, avoiding common pitfalls, and seeking professional guidance when needed, you can make informed decisions and potentially unlock significant tax savings. Remember, it's a long-term strategy that should be integrated into a comprehensive investment plan that aligns with your overall financial goals.

Post a Comment