ETF Tax Loss Harvesting: Index Fund Tax Efficiency

Imagine a world where you could legally shrink your tax bill simply by being a smart investor. Sound too good to be true? It's not! Welcome to the world of tax-loss harvesting with ETFs and index funds, a powerful strategy that can help you keep more of your investment gains.

Many investors find themselves frustrated by the inevitable tax implications of successful investing. Selling assets for a profit means paying capital gains taxes, which can eat into returns. On the other hand, selling losing investments can feel like adding insult to injury, especially when you're trying to build long-term wealth.

The goal of ETF tax-loss harvesting with index funds is to strategically sell losing investments to offset capital gains taxes, ultimately improving your after-tax investment returns. It's about making the tax code work for you, rather than against you.

In this article, we'll delve into the details of how tax-loss harvesting works with ETFs and index funds, exploring its benefits, potential pitfalls, and practical strategies for implementation. We'll cover the basics of capital gains and losses, the wash-sale rule, and how to select appropriate replacement investments. By understanding these concepts, you can leverage the tax efficiency of index funds and ETFs to potentially boost your investment performance. We'll explore everything from its definition, the history and myths surrounding it, hidden secrets, recommendations, tips, fun facts, and what-ifs scenarios.

Understanding Tax-Loss Harvesting

My own journey into tax-loss harvesting began a few years ago when I realized how much of my investment gains were being siphoned off by taxes. It felt like I was working hard to grow my portfolio, only to hand over a significant chunk of it to the government each year. I knew there had to be a better way. That's when I stumbled upon the concept of tax-loss harvesting. It sounded a bit intimidating at first, but the more I researched, the more I realized it was a powerful tool that could help me keep more of my hard-earned money.

Tax-loss harvesting is a strategy that involves selling investments that have lost value in order to offset capital gains taxes. Capital gains taxes are taxes you pay on profits you make when you sell an asset for more than you bought it for. By selling losing investments, you can generate capital losses, which can then be used to reduce your taxable gains. For example, if you have $5,000 in capital gains and $3,000 in capital losses, you can use the losses to reduce your taxable gains to $2,000. This can significantly lower your tax bill.

The main target of tax-loss harvesting is to minimize your tax liability and maximize your after-tax investment returns. It's a way to turn lemons into lemonade, so to speak. By strategically selling losing investments, you can create a tax benefit that can help you grow your wealth more efficiently. Tax-loss harvesting is most effective when done in taxable accounts. It’s important to remember, however, that losses can only offset gains, and if the losses exceed the gains, you can only deduct up to $3,000 of net losses per year, while carrying forward any remaining losses to future years.

What is ETF Tax-Loss Harvesting?

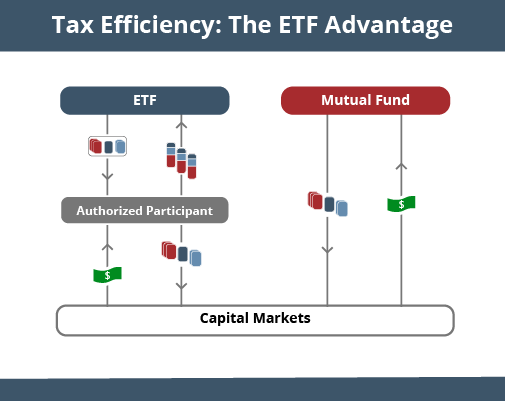

ETF tax-loss harvesting is a specific application of the general tax-loss harvesting strategy, tailored to exchange-traded funds (ETFs). ETFs are baskets of securities that track a particular index or investment strategy. They offer diversification and are generally considered tax-efficient due to their structure. However, even with ETFs, opportunities for tax-loss harvesting can arise when the ETF's value declines.

The process involves identifying ETFs in your portfolio that have unrealized losses (meaning you would incur a loss if you sold them). You then sell these losing ETFs and immediately purchase similar, but not "substantially identical," ETFs. This allows you to maintain your exposure to the same asset class or investment strategy while generating a tax-deductible loss. The IRS has specific rules around what constitutes a "substantially identical" security, and violating these rules can trigger the "wash-sale rule," which disallows the tax loss.

The goal is to capture the tax benefit without significantly altering your investment allocation. For instance, if you hold an S&P 500 ETF that has declined in value, you might sell it and immediately buy a different S&P 500 ETF from a different provider. The key is to ensure that the replacement ETF is not considered "substantially identical" to the one you sold. Some investors will sell an ETF tracking the S&P 500 and then purchase an ETF tracking a similar index, such as the Russell 500. As these are technically different indexes, they are not considered “substantially identical.” These strategies can be implemented manually, or increasingly through automated services provided by wealth management platforms. The beauty of using ETFs for tax-loss harvesting lies in their liquidity, low cost, and wide variety of options, making it easier to find suitable replacement investments.

History and Myth of ETF Tax-Loss Harvesting

The concept of tax-loss harvesting has been around for as long as there have been capital gains taxes. However, its application to ETFs is a relatively recent phenomenon, driven by the increasing popularity and accessibility of these investment vehicles. Before ETFs, tax-loss harvesting was primarily employed with individual stocks or mutual funds. ETFs, with their lower costs and greater flexibility, have made the strategy more accessible to a wider range of investors.

One common myth surrounding tax-loss harvesting is that it's only beneficial for high-net-worth individuals. While it's true that those in higher tax brackets can potentially reap greater benefits, tax-loss harvesting can be valuable for anyone with a taxable investment account. Even small tax savings can add up over time, especially when compounded.

Another myth is that tax-loss harvesting is a complex and time-consuming process. While it's important to understand the rules and potential pitfalls, the actual execution can be quite simple, especially with the help of automated tools and platforms. Many brokerage firms now offer tax-loss harvesting services that automatically monitor your portfolio for opportunities and execute trades on your behalf.

A more nuanced myth is that tax-loss harvesting guarantees higher returns. It's important to remember that tax-loss harvesting is a tax-management strategy, not an investment strategy. It can help you keep more of your returns, but it doesn't guarantee that your investments will increase in value. The effectiveness of tax-loss harvesting depends on market volatility and the availability of losses to harvest. Furthermore, the wash-sale rule, which prevents investors from immediately repurchasing the same or a substantially identical security, can sometimes make finding suitable replacement investments challenging, which could increase transaction costs and create tracking error.

Hidden Secrets of ETF Tax-Loss Harvesting

One of the hidden secrets of ETF tax-loss harvesting is the power of "tax alpha." Tax alpha refers to the additional return generated by actively managing your investments to minimize taxes. By strategically harvesting losses, you can effectively increase your after-tax returns without necessarily taking on more investment risk. This is particularly valuable in taxable accounts where taxes can significantly erode your gains.

Another secret is the importance of considering state taxes. While the federal tax code allows you to deduct capital losses against capital gains, some states may have different rules. It's important to understand the specific tax laws in your state to ensure that you're maximizing your tax benefits. Some states may not allow the same deductions as the federal government, which could reduce the overall effectiveness of tax-loss harvesting.

Furthermore, many investors underestimate the impact of the "wash-sale rule." This rule prevents you from claiming a tax loss if you repurchase the same or a "substantially identical" security within 30 days before or after the sale. While the rule seems straightforward, determining what constitutes a "substantially identical" security can be tricky. For example, selling an S&P 500 ETF and immediately buying another S&P 500 ETF from a different provider would likely violate the wash-sale rule.

A less obvious secret is the timing of tax-loss harvesting. The end of the year is often a popular time to engage in tax-loss harvesting, as investors review their portfolios and look for ways to reduce their tax liability. However, opportunities for tax-loss harvesting can arise throughout the year, especially during periods of market volatility. Being proactive and monitoring your portfolio regularly can help you identify and capitalize on these opportunities as they arise.

Recommendation of ETF Tax-Loss Harvesting

My recommendation for ETF tax-loss harvesting is to approach it as a strategic and ongoing part of your overall investment plan. It's not a one-time fix, but rather a consistent practice that can help you improve your after-tax returns over the long term.

First, it's essential to have a clear understanding of your investment goals and risk tolerance. Tax-loss harvesting should not drive your investment decisions. Instead, it should be a tool you use to enhance your existing investment strategy. Don't let the potential tax benefits lead you to make investments that are inconsistent with your risk profile or long-term objectives.

Second, consider using technology to automate the process. There are numerous robo-advisors and brokerage platforms that offer automated tax-loss harvesting services. These tools can monitor your portfolio for opportunities, execute trades, and ensure compliance with the wash-sale rule. Automating the process can save you time and effort, and reduce the risk of errors.

Third, be mindful of transaction costs. While ETFs generally have low expense ratios, trading them still incurs transaction costs, such as brokerage commissions. These costs can eat into the tax benefits of tax-loss harvesting, especially if you're making frequent trades. Look for brokerage platforms that offer commission-free ETF trading to minimize these costs.

Finally, remember that tax-loss harvesting is not a substitute for sound investment advice. Consider consulting with a qualified financial advisor to develop a comprehensive investment plan that incorporates tax-loss harvesting and other tax-efficient strategies. A financial advisor can help you navigate the complexities of the tax code and make informed decisions that align with your financial goals.

The Wash-Sale Rule in Depth

The wash-sale rule is a critical aspect of tax-loss harvesting that investors must understand thoroughly. It exists to prevent taxpayers from artificially generating tax losses by selling a security and then quickly repurchasing it. The IRS defines a wash sale as occurring when you sell a security at a loss and then, within 30 days before or after the sale, you buy "substantially identical" securities.

If a wash sale occurs, the tax loss is disallowed, meaning you cannot deduct it from your taxable income. Instead, the disallowed loss is added to the cost basis of the newly acquired security. This effectively defers the tax benefit until you eventually sell the replacement security. The 30-day window surrounding the sale is crucial and extends both backward and forward from the date of the sale.

Defining "substantially identical" can be complex and is often the source of confusion. The IRS does not provide a definitive list of what constitutes a substantially identical security, but it generally considers factors such as the issuer, coupon rate, maturity date (for bonds), and voting rights (for stocks). As a general rule, selling an S&P 500 ETF and immediately buying another S&P 500 ETF from a different provider would likely violate the wash-sale rule. However, selling an S&P 500 ETF and buying a Russell 500 ETF, while similar, is generally considered acceptable because they track different indexes.

The wash-sale rule also applies to options contracts. If you sell a stock at a loss and then buy a call option on that same stock within the 30-day window, the wash-sale rule would be triggered. Understanding the nuances of the wash-sale rule is essential for effective tax-loss harvesting. Failing to comply with the rule can result in unexpected tax liabilities and negate the intended benefits of the strategy.

Tips for Effective ETF Tax-Loss Harvesting

To maximize the benefits of ETF tax-loss harvesting, consider these tips:

1.Be Proactive: Don't wait until the end of the year to start looking for opportunities. Monitor your portfolio regularly throughout the year and be ready to act when losses arise. Market volatility can create opportunities for tax-loss harvesting that you might miss if you only review your portfolio annually.

2.Diversify Your ETFs: Holding a variety of ETFs that track different indexes or sectors can make it easier to find suitable replacement investments without violating the wash-sale rule. For example, you might hold ETFs that track the S&P 500, the Russell 2000, and international markets.

3.Use a Tax-Loss Harvesting Tool: Consider using a robo-advisor or brokerage platform that offers automated tax-loss harvesting. These tools can monitor your portfolio, identify opportunities, and execute trades on your behalf, saving you time and effort.

4.Document Everything: Keep detailed records of all your trades, including the date, price, and number of shares sold and purchased. This documentation will be essential when you file your taxes.

5.Consider the Long-Term Impact: While tax-loss harvesting can provide immediate tax benefits, it's important to consider the long-term impact on your portfolio. Selling assets can trigger capital gains taxes in the future, so it's important to weigh the potential benefits against the potential costs.

6.Understand the "Substantially Identical" Rule: It's crucial to understand what constitutes a "substantially identical" security under the wash-sale rule. When in doubt, consult with a tax professional.

7.Coordinate with Other Tax Strategies: Tax-loss harvesting should be part of a broader tax planning strategy. Consider how it fits in with other strategies, such as tax-deferred accounts and charitable giving.

By following these tips, you can effectively implement tax-loss harvesting and potentially improve your after-tax investment returns.

Selecting Replacement Investments

Choosing the right replacement investments is crucial for successful tax-loss harvesting. The goal is to maintain your desired asset allocation while avoiding the wash-sale rule. Here are some key considerations:

1.Avoid "Substantially Identical" Securities: As mentioned earlier, the wash-sale rule prohibits you from repurchasing the same or a "substantially identical" security within 30 days. This means you cannot simply sell an S&P 500 ETF and immediately buy the same S&P 500 ETF from a different provider.

2.Consider Similar ETFs: One strategy is to replace the losing ETF with a similar ETF that tracks a different, but related, index. For example, you could sell an S&P 500 ETF and buy a Russell 500 ETF. While both indexes track large-cap U.S. stocks, they have slightly different compositions, which may be sufficient to avoid the wash-sale rule.

3.Explore Different Share Classes: Some ETFs may have different share classes that track the same underlying index but have different fee structures or trading volumes. Switching between these share classes could be an option, but it's important to ensure that the IRS does not consider them "substantially identical."

4.Use Tax-Managed Funds: Some fund companies offer "tax-managed" ETFs that are specifically designed to minimize capital gains distributions. These funds may be a good option for replacement investments, as they are already managed with tax efficiency in mind.

5.Consult with a Tax Professional: If you're unsure about whether a particular replacement investment would violate the wash-sale rule, consult with a tax professional. They can provide personalized guidance based on your specific circumstances. Remember, the goal is to capture the tax benefit without significantly altering your investment strategy or taking on undue risk.

Fun Facts of this ETF Tax-Loss Harvesting

Did you know that the wash-sale rule was originally enacted in 1921 to prevent taxpayers from artificially generating losses on stock sales to avoid taxes? It's a century-old rule that's still relevant today!

Another fun fact is that the IRS doesn't explicitly define what constitutes a "substantially identical" security. This ambiguity can make tax-loss harvesting a bit of an art, as investors must make judgments based on the available guidance and their own interpretations.

Here's a surprising fact: tax-loss harvesting can actually increase your long-term returns, even though it involves selling losing investments. By reducing your tax liability, you can keep more of your investment gains, which can then compound over time.

And finally, did you know that some robo-advisors and brokerage platforms offer automated tax-loss harvesting services that can save you time and effort? These tools can monitor your portfolio for opportunities, execute trades, and ensure compliance with the wash-sale rule, making tax-loss harvesting more accessible to the average investor. Tax-loss harvesting, while potentially beneficial, can also trigger unintended consequences if not carefully planned and executed. It is important to consult with a qualified financial advisor or tax professional to determine if tax-loss harvesting is appropriate for your individual circumstances.

How to ETF Tax-Loss Harvesting

Here's a step-by-step guide on how to implement ETF tax-loss harvesting:

1.Review Your Portfolio: Start by reviewing your taxable investment accounts and identifying any ETFs that have unrealized losses. These are ETFs that are currently worth less than what you paid for them.

2.Calculate Potential Tax Savings: Estimate the potential tax savings you could realize by selling these losing ETFs. This will depend on your tax bracket and the amount of your capital gains.

3.Identify Replacement Investments: Research and identify suitable replacement ETFs that track similar, but not "substantially identical," indexes or sectors. Consider factors such as expense ratios, tracking error, and liquidity.

4.Sell the Losing ETFs: Execute the trades to sell the losing ETFs. Be sure to keep detailed records of the date, price, and number of shares sold.

5.Purchase Replacement ETFs: Immediately purchase the replacement ETFs. Again, keep detailed records of the date, price, and number of shares purchased.

6.Monitor Your Portfolio: Continue to monitor your portfolio regularly for additional tax-loss harvesting opportunities.

7.Consult with a Tax Professional: If you're unsure about any aspect of the process, consult with a tax professional. They can provide personalized guidance and help you avoid costly mistakes.

Remember, tax-loss harvesting is a strategic and ongoing process that can help you improve your after-tax investment returns. By following these steps and staying informed, you can effectively implement tax-loss harvesting in your own portfolio.

What if ETF Tax-Loss Harvesting?

What if you could significantly reduce your tax bill simply by being a strategic investor? What if you could keep more of your hard-earned money and put it towards your financial goals? That's the promise of ETF tax-loss harvesting.

But what if you don't take advantage of this strategy? You could be leaving money on the table, paying more in taxes than you need to, and potentially hindering your long-term investment growth.

What if you make a mistake and violate the wash-sale rule? You could lose the tax benefit you were hoping to achieve, and potentially complicate your tax filing.

What if you're not sure whether tax-loss harvesting is right for you? Consulting with a qualified financial advisor can help you assess your situation and determine whether this strategy is appropriate for your needs.

What if you embrace tax-loss harvesting and make it a regular part of your investment plan? You could potentially improve your after-tax returns, accelerate your progress towards your financial goals, and gain a greater sense of control over your financial future. The key is to be informed, strategic, and proactive.

Listicle of ETF Tax-Loss Harvesting

Here's a list of key takeaways about ETF tax-loss harvesting:

1.What it is: A strategy to sell losing investments to offset capital gains taxes.

2.Why it matters: Can improve after-tax investment returns.

3.ETFs are ideal: Their liquidity and variety make tax-loss harvesting easier.

4.The Wash-Sale Rule: Avoid repurchasing "substantially identical" securities within 30 days.

5.Replacement Investments: Choose similar, but not identical, ETFs.

6.Automate: Use robo-advisors or brokerage platforms for efficiency.

7.Be Proactive: Monitor your portfolio throughout the year.

8.Diversify: Hold a variety of ETFs.

9.Document: Keep detailed records of all trades.

10.Consult a Pro: Seek advice from a tax professional or financial advisor.

11.Timing: Be proactive, not just at year-end.

12.Benefits*Minimize your tax liability, maximizing investment returns.

13.Tax Alpha*Achieve additional return by actively managing your investments to minimize taxes.

14.Remember*losses can only offset gains.

15.TimingTiming is key for effective tax-loss harvesting to reap the most benefit.

Question and Answer

Q:What is the main benefit of tax-loss harvesting?

A: The main benefit is to reduce your tax liability by offsetting capital gains with capital losses, ultimately improving your after-tax investment returns.

Q: What is the wash-sale rule, and how does it affect tax-loss harvesting?

A: The wash-sale rule prevents you from claiming a tax loss if you repurchase the same or a "substantially identical" security within 30 days before or after the sale. It's important to avoid violating this rule when tax-loss harvesting.

Q: Can tax-loss harvesting guarantee higher investment returns?

A: No, tax-loss harvesting is a tax-management strategy, not an investment strategy. It can help you keep more of your returns, but it doesn't guarantee that your investments will increase in value.

Q: Should I do tax-loss harvesting myself, or should I use a professional?

A: It depends on your knowledge and comfort level. If you understand the rules and are comfortable making investment decisions, you can do it yourself. However, if you're unsure, consulting with a financial advisor or using a robo-advisor with automated tax-loss harvesting is a good option.

Conclusion of ETF Tax Loss Harvesting

ETF tax-loss harvesting is a powerful tool for enhancing after-tax investment returns. By strategically selling losing investments to offset capital gains, investors can potentially reduce their tax liability and keep more of their hard-earned money. While it requires careful planning and attention to the wash-sale rule, the benefits can be significant, especially when compounded over time. Whether you choose to implement the strategy yourself or rely on automated tools and professional guidance, understanding the principles of ETF tax-loss harvesting is essential for any tax-conscious investor. Incorporating tax-loss harvesting into your investment strategy can potentially lead to improved long-term financial outcomes.

Post a Comment