Growth Investment Tax Planning: Capital Appreciation Strategy

Imagine a world where your investments not only grow but also do so in a way that minimizes your tax burden. It sounds like a dream, right? But with strategic planning, it's entirely achievable. Let's explore how you can make this a reality.

Many investors find themselves in a difficult situation. They pour their resources into promising growth opportunities, only to see a significant portion of their returns eaten away by taxes when they eventually decide to sell. This can create hesitation, make it difficult to plan effectively for the future, and ultimately diminish the long-term benefits of their investment strategy. Navigating the complexities of tax regulations can also feel overwhelming.

The primary goal of growth investment tax planning with a capital appreciation strategy is to maximize after-tax returns. By carefully considering the tax implications of investment decisions, investors can minimize their tax liability and keep more of their hard-earned profits. This involves strategically choosing investments, managing holding periods, and utilizing tax-advantaged accounts to optimize overall financial outcomes.

This article dives into the world of Growth Investment Tax Planning, specifically focusing on the Capital Appreciation Strategy. We'll explore how to strategically manage your investments to minimize your tax liability while maximizing your long-term growth potential. Key concepts we'll cover include tax-advantaged accounts, strategic asset allocation, and the importance of long-term investing. Our goal is to equip you with the knowledge and tools you need to navigate the complex world of investment taxes and build a more secure financial future. Get ready to unlock the power of tax-efficient growth investing!

Understanding Capital Appreciation

The core target of capital appreciation is to increase the value of an investment over time. It's all about buying assets that are expected to rise in price, such as stocks, real estate, or even certain collectibles. The beauty of this strategy is that you only pay taxes when you actually sell the asset, which gives you control over the timing of your tax liability.

I remember when I first started investing, I was so focused on the potential gains that I completely overlooked the tax implications. I bought a stock that I thought was a sure thing, and it did indeed appreciate significantly. However, when I sold it a year later, I was shocked at how much I owed in taxes! That experience taught me a valuable lesson about the importance of tax planning. Now, I always consider the tax consequences of my investment decisions, and I actively seek out ways to minimize my tax liability.

Capital appreciation focuses on investments that are expected to increase in value over time. Common examples include stocks, particularly those of companies with high growth potential, real estate in rapidly developing areas, and certain types of collectibles. The key is to identify assets with strong fundamentals and the potential for significant price appreciation. This strategy often involves a longer investment horizon, as it takes time for assets to realize their full potential. Proper tax planning allows investors to strategically manage when they realize these gains, potentially deferring or minimizing their tax obligations.

Tax-Advantaged Accounts

Tax-advantaged accounts are specifically designed to help you save for retirement or other long-term goals while minimizing your tax burden. These accounts come in various forms, each with its own unique set of rules and benefits. Think of them as powerful tools that can help you grow your wealth more efficiently.

What exactly are tax-advantaged accounts? They are investment accounts that offer special tax benefits, such as tax-deferred growth or tax-free withdrawals. Common examples include 401(k)s, traditional IRAs, Roth IRAs, and 529 plans. The specific tax advantages vary depending on the type of account. For instance, with a traditional IRA, you typically get a tax deduction for your contributions, and your investments grow tax-deferred until retirement. With a Roth IRA, you don't get a tax deduction upfront, but your withdrawals in retirement are tax-free.

The beauty of tax-advantaged accounts is that they allow your investments to grow without being eroded by taxes each year. This can make a significant difference in the long run, especially if you have a long investment horizon. By strategically utilizing these accounts, you can potentially accumulate a much larger nest egg for retirement or other financial goals. Careful consideration should be given to contribution limits, income restrictions, and withdrawal rules to maximize the benefits of these accounts.

The History and Myths of Capital Appreciation Strategy

The idea of capital appreciation has been around for centuries, although the specific investment vehicles and tax regulations have evolved considerably over time. Understanding the historical context and debunking common myths can help you make more informed investment decisions.

The concept of investing for capital appreciation dates back to the earliest days of organized markets. Historically, land was a primary source of capital appreciation, followed by precious metals and commodities. As financial markets developed, stocks and bonds became increasingly popular investment vehicles. The rise of modern portfolio theory and efficient market hypothesis in the 20th century further solidified the importance of capital appreciation as a key investment goal. However, the understanding of tax implications has often lagged behind investment strategies.

One common myth is that capital appreciation is only for the wealthy. While it's true that high-net-worth individuals often have access to sophisticated investment strategies, the basic principles of capital appreciation are applicable to investors of all income levels. Another myth is that capital appreciation is a guaranteed way to make money. In reality, all investments carry some degree of risk, and there's no guarantee that an asset will appreciate in value. Understanding these realities is crucial for building a realistic and sustainable investment strategy. Tax planning, often overlooked, can significantly impact the actual returns realized from capital appreciation, regardless of the initial investment amount.

Hidden Secrets of Growth Investment Tax Planning

While the fundamentals of growth investment tax planning are relatively straightforward, there are several lesser-known strategies that can significantly boost your after-tax returns. These "hidden secrets" often involve taking advantage of specific tax loopholes or utilizing advanced planning techniques.

One often-overlooked secret is the power of tax-loss harvesting. This involves selling investments that have lost value to offset capital gains. By strategically realizing these losses, you can reduce your overall tax liability and potentially reinvest the proceeds into similar assets. Another hidden gem is the use of qualified opportunity zones. These are designated economically distressed communities where investments can receive preferential tax treatment.

Another secret is to be mindful of the "wash sale" rule. This rule prevents you from claiming a tax loss if you repurchase substantially identical securities within 30 days before or after the sale. Avoiding this pitfall requires careful planning and a clear understanding of the regulations. These "hidden secrets" can be complex, and it's often best to consult with a qualified tax advisor to ensure you're taking full advantage of all available opportunities. Furthermore, staying informed about changes in tax laws and regulations is crucial for effective tax planning.

Recommendations for Capital Appreciation Strategy

Based on the principles we've discussed, here are some practical recommendations for implementing a capital appreciation strategy while minimizing your tax liability. These recommendations are designed to be a starting point for your own personalized financial plan.

First, prioritize tax-advantaged accounts like 401(k)s and Roth IRAs. Maximize your contributions to these accounts to take full advantage of the tax benefits they offer. Second, consider holding your long-term growth investments in taxable accounts to benefit from lower capital gains tax rates. Third, utilize tax-loss harvesting to offset capital gains and reduce your overall tax burden. Fourth, rebalance your portfolio regularly to maintain your desired asset allocation.

Finally, consult with a qualified financial advisor and tax professional to develop a personalized investment plan that aligns with your specific goals and circumstances. They can help you navigate the complexities of tax laws and regulations and ensure you're making the most tax-efficient investment decisions. Remember, effective tax planning is an ongoing process, not a one-time event. Regular reviews and adjustments are essential to staying on track and maximizing your after-tax returns.

Strategic Asset Allocation

Strategic asset allocation is at the heart of long-term investment success. It involves determining the optimal mix of asset classes, such as stocks, bonds, and real estate, to achieve your desired risk and return objectives. A well-diversified portfolio can help you weather market volatility and maximize your long-term growth potential.

Diversification is key to managing risk. By spreading your investments across different asset classes, you can reduce the impact of any single investment on your overall portfolio. For example, stocks tend to offer higher potential returns but also carry higher risk, while bonds are generally more stable but offer lower returns. A balanced portfolio that includes both stocks and bonds can help you achieve a more consistent and predictable investment experience. Furthermore, the specific allocation should be tailored to your individual risk tolerance, time horizon, and financial goals. Regular rebalancing is crucial to maintain your desired asset allocation and ensure that your portfolio remains aligned with your long-term objectives.

When considering tax implications, strategic asset allocation becomes even more critical. Different asset classes are taxed differently. For instance, dividends and interest income are typically taxed at ordinary income tax rates, while capital gains are taxed at lower rates. By strategically allocating your assets across different accounts, you can minimize your overall tax liability. For example, you might consider holding your high-dividend-paying stocks in a tax-advantaged account to avoid paying taxes on the dividends each year. Effective asset allocation requires a deep understanding of both investment principles and tax regulations. The goal is to create a portfolio that not only maximizes your returns but also minimizes your tax burden.

Tips for Minimizing Taxes

Minimizing taxes is an ongoing process that requires careful planning and attention to detail. Here are some practical tips that can help you reduce your tax liability and keep more of your investment profits.

One simple tip is to hold your investments for longer than one year to qualify for long-term capital gains tax rates, which are typically lower than short-term rates. Another tip is to be strategic about when you sell your investments. If you anticipate being in a lower tax bracket in the future, you might consider deferring the sale until then. You can also donate appreciated securities to charity. This allows you to avoid paying capital gains taxes on the appreciation while also receiving a tax deduction for the fair market value of the securities.

Another effective strategy is to use a qualified charitable distribution (QCD) from your IRA to satisfy your required minimum distribution (RMD). This allows you to avoid paying taxes on the distribution while also supporting a worthy cause. Always consult with a tax professional before implementing any of these strategies to ensure they are appropriate for your individual circumstances. Staying informed about changes in tax laws and regulations is also essential for effective tax planning. Remember, even small tax savings can add up over time and make a significant difference in your overall financial well-being. Consider all options available when deciding what strategies work for you.

The Importance of Long-Term Investing

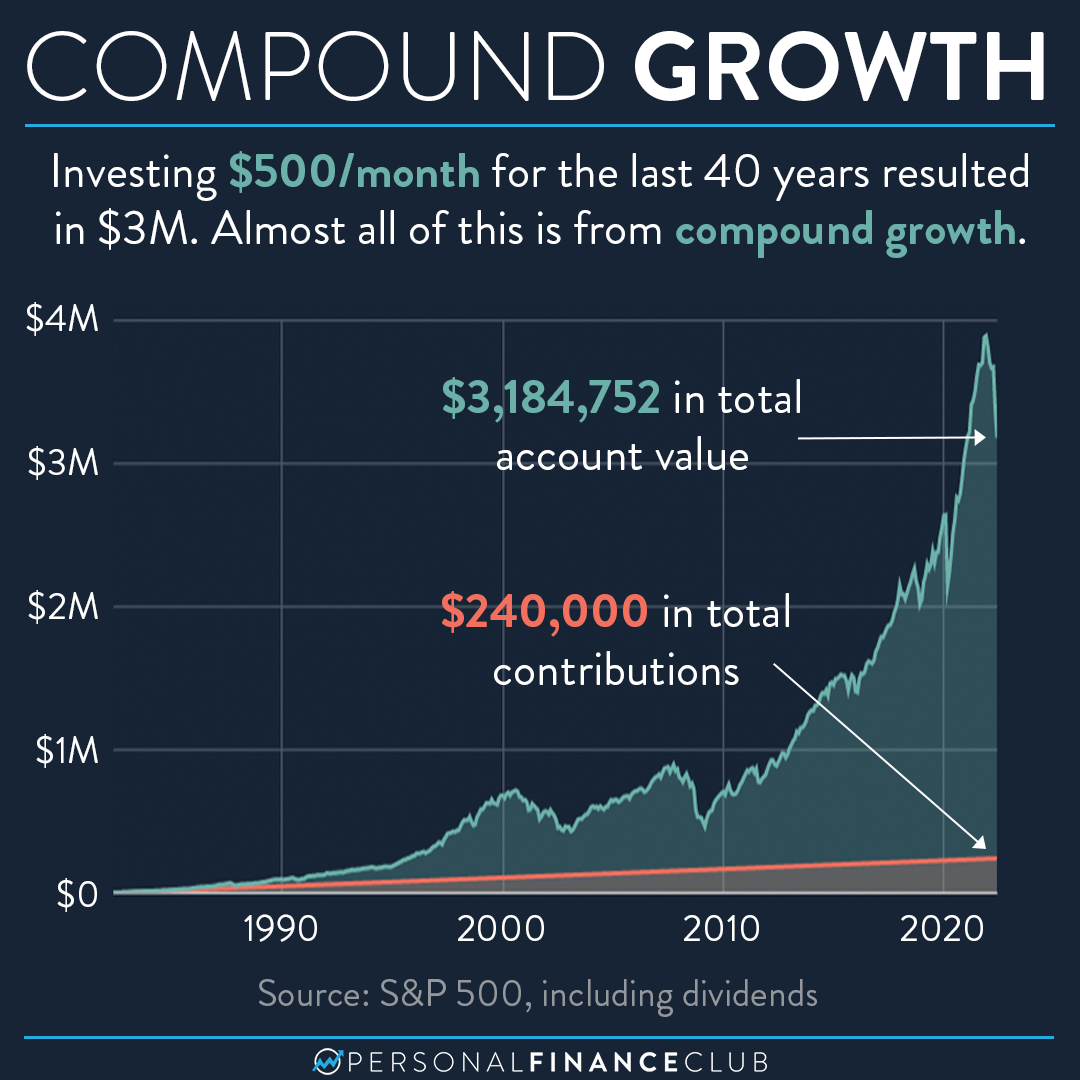

Long-term investing is a cornerstone of successful wealth building. It allows you to take advantage of the power of compounding and ride out market volatility. When it comes to tax planning, long-term investing offers several advantages, including lower capital gains tax rates and the ability to defer taxes for extended periods.

One of the biggest benefits of long-term investing is the potential for lower capital gains tax rates. If you hold an investment for more than one year, any profits you realize upon selling it are taxed at the long-term capital gains rate, which is typically lower than the short-term rate. This can save you a significant amount of money, especially if you have substantial gains.

Another advantage of long-term investing is that it allows you to defer taxes for extended periods. By holding onto your investments for longer, you can avoid paying taxes on the gains each year. This can be particularly beneficial if you anticipate being in a higher tax bracket in the future. Furthermore, long-term investing allows you to take advantage of tax-advantaged accounts like 401(k)s and Roth IRAs, which offer additional tax benefits. The combination of long-term investing and strategic tax planning can be a powerful tool for building wealth.

Fun Facts About Growth Investment Tax Planning

Believe it or not, tax planning can be fascinating! Here are some fun facts about growth investment tax planning and capital appreciation strategies that you might find interesting.

Did you know that the concept of capital gains taxes dates back to ancient Rome? While the specific regulations have changed dramatically over time, the idea of taxing profits from investments has been around for centuries. Another fun fact is that the highest capital gains tax rate in the United States was 39.875% in

1977. Today, the top rate is significantly lower, but it's still an important consideration for investors.

Another interesting tidbit is that the term "capital appreciation" wasn't widely used until the mid-20th century. Before that, investors often focused primarily on income-generating assets like bonds and dividend-paying stocks. The rise of growth stocks and the increasing importance of capital gains have led to the widespread adoption of the term. These fun facts highlight the evolution of tax planning and investment strategies over time. Understanding the historical context can provide valuable insights into the challenges and opportunities that investors face today. Furthermore, staying informed about the latest developments in tax law and investment strategies is essential for success.

How to Implement a Capital Appreciation Strategy

Implementing a capital appreciation strategy requires careful planning and a systematic approach. Here's a step-by-step guide to help you get started.

First, define your investment goals and risk tolerance. How much risk are you willing to take to achieve your desired returns? What is your time horizon? Answering these questions will help you determine the appropriate asset allocation for your portfolio. Second, research potential investments. Look for companies with strong fundamentals, high growth potential, and a history of generating returns. Consider diversifying your portfolio across different sectors and industries to reduce your overall risk.

Third, develop a tax-efficient investment plan. Utilize tax-advantaged accounts like 401(k)s and Roth IRAs to minimize your tax liability. Consider holding your long-term growth investments in taxable accounts to benefit from lower capital gains tax rates. Fourth, monitor your portfolio regularly and make adjustments as needed. Rebalance your portfolio to maintain your desired asset allocation. Consider tax-loss harvesting to offset capital gains and reduce your overall tax burden. Remember, investing is a long-term game, and it's important to stay disciplined and patient.

What If Things Go Wrong?

Despite your best efforts, investments can sometimes go south. It's important to have a plan in place for dealing with losses and managing your tax liability in these situations.

One of the most effective strategies for mitigating losses is to diversify your portfolio. By spreading your investments across different asset classes, you can reduce the impact of any single investment on your overall portfolio. Another important strategy is to set stop-loss orders. These orders automatically sell your investments if they fall below a certain price, helping to limit your losses.

When it comes to tax planning, remember that you can use capital losses to offset capital gains. If you have capital losses that exceed your capital gains, you can deduct up to $3,000 of those losses against your ordinary income each year. Any excess losses can be carried forward to future years. This can help to reduce your overall tax burden and provide some relief during challenging times. Consulting with a financial advisor and tax professional can help you navigate these complex situations and develop a plan that is tailored to your individual needs.

Listicle: Growth Investment Tax Planning

Here is a listicle summarizing key aspects of Growth Investment Tax Planning:

1. Tax-Advantaged Accounts: Utilize 401(k)s, Roth IRAs, and other tax-advantaged accounts to minimize your tax liability.

2. Long-Term Investing: Hold your investments for longer than one year to qualify for lower capital gains tax rates.

3. Strategic Asset Allocation: Diversify your portfolio across different asset classes to manage risk and maximize returns.

4. Tax-Loss Harvesting: Sell investments that have lost value to offset capital gains.

5. Regular Rebalancing: Rebalance your portfolio regularly to maintain your desired asset allocation.

6. Professional Advice: Consult with a financial advisor and tax professional to develop a personalized investment plan.

7. Qualified Opportunity Zones: Consider investing in qualified opportunity zones to receive preferential tax treatment.

8. Charitable Giving: Donate appreciated securities to charity to avoid paying capital gains taxes.

9. Qualified Charitable Distributions: Use QCDs from your IRA to satisfy your RMD and avoid paying taxes on the distribution.

10. Stay Informed: Stay informed about changes in tax laws and regulations to ensure you're making the most tax-efficient investment decisions.

Question and Answer

Here are some common questions about Growth Investment Tax Planning with a Capital Appreciation Strategy:

Q: What is the difference between short-term and long-term capital gains?

A: Short-term capital gains are profits from investments held for one year or less, while long-term capital gains are profits from investments held for more than one year. Long-term capital gains are typically taxed at lower rates than short-term gains.

Q: What is tax-loss harvesting?

A: Tax-loss harvesting involves selling investments that have lost value to offset capital gains. This can help to reduce your overall tax liability.

Q: What are qualified opportunity zones?

A: Qualified opportunity zones are designated economically distressed communities where investments can receive preferential tax treatment.

Q: How often should I rebalance my portfolio?

A: You should rebalance your portfolio regularly, typically at least once a year, to maintain your desired asset allocation.

Conclusion of Growth Investment Tax Planning: Capital Appreciation Strategy

By implementing a well-thought-out growth investment strategy and understanding the tax implications of your investment decisions, you can significantly improve your long-term financial outcomes. Remember, tax planning is not just about minimizing taxes; it's about maximizing your after-tax returns and achieving your financial goals. So, take the time to educate yourself, seek professional advice, and develop a plan that is tailored to your individual needs and circumstances. Your financial future depends on it!

Post a Comment